Regulatory | E&P | Infrastructure | NGI All News Access

U.S. Natural Gas Rig Count Down One; Oil Rigs Climb

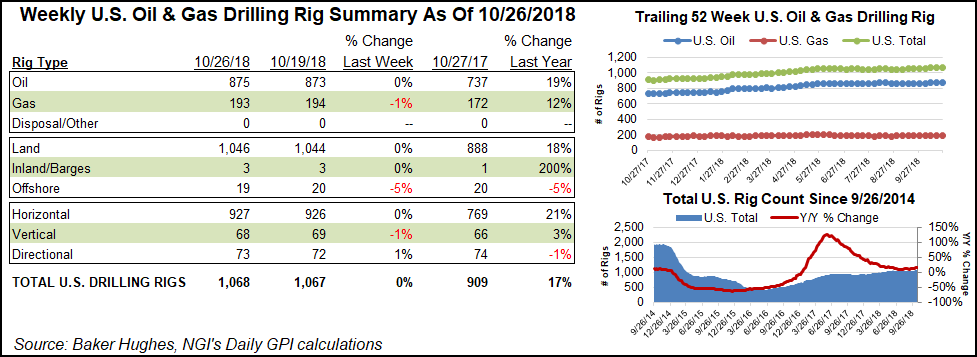

The U.S. natural gas rig count dropped one unit to fall to 193 for the week ended Friday (Oct. 26), and the Gulf of Mexico also lost one rig, according to data from Baker Hughes, a GE Company (BHGE).

The United States added two oil-directed rigs to offset the natural gas declines and grow the domestic count to 1,068, outpacing its year-ago total by 159 rigs.

One directional rig and one horizontal rig returned to action, while one vertical unit packed up shop for the week. Land rigs increased by two overall, while one rig departed in the offshore, according to BHGE.

Canada added nine rigs on the week, eight gas-directed and one oil-directed, to finish at 200, up from 191 a year ago. The combined North American rig count finished the week at 1,268, versus 1,100 in the year-ago period.

The biggest mover for the week among plays was the Williston, home to the Bakken Shale, which added four rigs to finish at 56, besting its year-ago total of 49. Elsewhere, the gas-focused Marcellus and Haynesville shales each added one rig to reach 56 and 51 units, respectively. The Barnett Shale, the Denver Julesburg-Niobrara and the Permian Basin each saw one rig dropped for the week.

Among states, North Dakota, home to a large chunk of the Williston, added two rigs on the week, while Montana also picked up two rigs, according to BHGE data. Elsewhere, Alaska added two rigs, while New Mexico and West Virginia tacked on one rig each.

Louisiana and Texas led declines among states, each dropping three units from their running tallies, while Colorado saw one rig exit.

With 3Q2018 earnings reports underway in the oil and gas industry, oilfield services players have offered differing outlooks on the state of U.S. onshore activity.

Halliburton Co.’s operating income slumped 9% sequentially in the third quarter on a “softening” market for North American completions, but beyond the holidays, as customers reload budgets, the market should improve, CEO Jeff Miller said.

“As it played out, it was a challenging quarter for the services industry in North America,” Miller said. “We didn’t see the typical growth we expect in pressure pumping activity in the third quarter. This negatively impacted pricing and the efficient use of our equipment as customers responded to budget limitations and offtake capacity bottlenecks.”

Striking a similar tone, Houston-based Superior Energy Services Inc. said it’s expecting a contraction in U.S. land operation into 2019 on an overabundance of hydraulic fracturing equipment and withering completions demand.

During a conference call Tuesday to discuss 3Q2018 results, CEO Dave Dunlap laid out the feast-or-famine tale in the U.S. onshore and in particular the Permian, where talent and equipment swarmed to extract huge amounts of oil and natural gas, only now to face a dearth of pipeline capacity.

“There’s definitely a higher degree of uncertainty surrounding U.S. land markets over the coming quarters primarily as it relates to completions activity,” Dunlap said. “Current fracturing supply and demand dynamics have caused spot market pricing to erode rapidly.”

Meanwhile, a proactive attack to defeat an oversupplied North American pressure pumping market and instead lean on advantaged high-tech drilling rigs lifted Patterson-UTI Energy Inc. (PTEN) to a better-than-forecast performance during the third quarter.

The demand outlook for PTEN’s top-of-the line machines, i.e. super spec Apex rigs remains strong, according to CEO Andy Hendricks.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |