NGI All News Access | E&P | Infrastructure

U.S. Natural Gas Rig Count Down One as Fallout Continues in Oil Patch

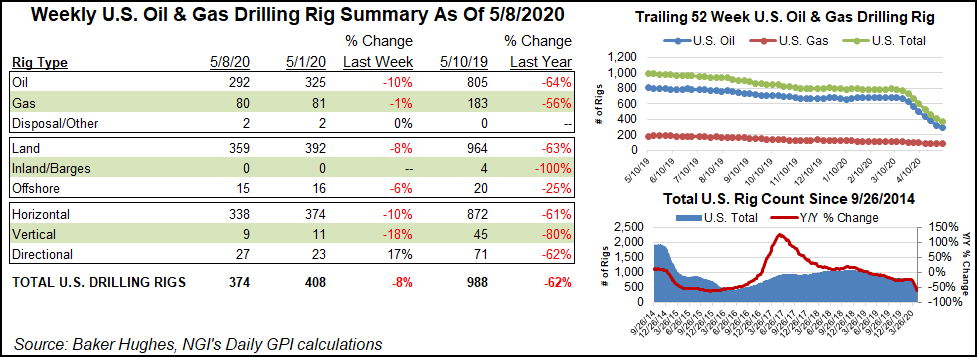

The U.S. natural gas rig count fell one unit to 80 during the week ended Friday (May 8), while another steep decline in oil activity sent the overall U.S. count plummeting once again, according to the latest figures from Baker Hughes Co. (BKR).

The bleeding continued in the U.S. onshore during the week, with a 33-rig drop in oil activity lowering the overall U.S. rig count 34 units to 374. The domestic drilling total finished the week more than 600 units behind the 988 rigs active at this time last year.

The 34-rig week/week drop, while sizable by any measure, reflects a slower rate of decline compared to recent weeks as the economic fallout from the Covid-19 pandemic has forced a swift and severe response from operators. U.S. drilling activity has declined by 418 rigs since March 13, BKR data show.

Most of the departing rigs were working on land; the Gulf of Mexico dropped one rig to fall to 15, down from 20 in the year-ago period. Thirty-six horizontal rigs and two vertical rigs exited the patch, partially offset by the addition of four directional units, according to BKR.

In Canada, one gas-directed unit departed on the week, lowering the Canadian rig count to 26, versus 63 in the year-ago period.

The combined North American rig count fell to 400 for the week, versus 1,051 at this time last year.

Among plays, the Permian Basin again shed the largest number of rigs on the week, dropping 21 units to fall to 198, down from 457 at the same time last year. The Williston Basin dropped six rigs on the week, while the Eagle Ford Shale dropped three.The Ardmore Woodford and the Utica Shale each dropped one rig on the week.

Among states, the Texas count fell 28 units to finish at 173, more than 300 units behind its year-ago total. North Dakota dropped six rigs, Oklahoma dropped two and Louisiana and Ohio each dropped one. Those losses were partially offset by the addition of four rigs in New Mexico, according to BKR.

Financial results from the first three months of 2020 continue to roll in, and the latest disclosures from Permian-heavy operators point to reduced activity in reaction to plummeting demand.

Among those Permian players cutting spending is Occidental Petroleum Corp. (Oxy). Stung by the untimely and expensive takeover of Anadarko Petroleum Corp. in 2019, the Houston-based company is working to right itself after taking a battering in the first three months.

Permian pure-play Diamondback Energy Inc. CEO Travis Stice said during the first quarter conference call the teams had “reacted quickly to the rapidly changing landscape and adjusted our operating and capital program in almost real time” to prepare for the commodity price weaknesses.

“Crises have a way of revealing character, and we have witnessed this across our organization,” pointing to how employees have responded and are supporting communities where they work and live.

Meanwhile, North Dakota’s Department of Mineral Resources (DMR) has established the Bakken Restart Task force to help the state’s oil and gas industry and supporting sectors recover from the collapse in oil demand and prices caused by the Covid-19 pandemic.

DMR Director Lynn Helms said his state has 6,800 shut-in wells at the moment, equaling 450,000 b/d of production, with 27 rigs and five fracture crews still running.

“These are staggering numbers impacting North Dakota production,” Helms said. “However, it was clear during the first meeting of the Bakken Restart Task Force that many great efforts are already underway across agencies to secure, strengthen and stimulate North Dakota’s energy future.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |