NGI Mexico GPI | Markets | NGI All News Access

U.S. Natural Gas Price Rally Seen in 2021, with Pipeline Exports to Mexico Set to Rise

While the impact of Covid-19 on U.S. natural gas prices remains a wildcard, supply/demand changes point for the strip to move lower this year before 2021 ushers in “extremely bullish” prices, Raymond James & Associates Inc. said Monday, adding year/year (y/y) pipeline exports to Mexico should increase in 2020 in spite of the pandemic.

In a note to clients led by analyst John Freeman, the Raymond James team said the U.S. gas market is reacting to near-term bearish trends, with a faster-than-expected restart of oil well shut-ins as prices increase and the “terrible” headlines around the drop-off in liquefied natural gas (LNG) demand overseas.

“We expect crude oil production to continue ”driving’ the gas supply ”bus’ for the foreseeable future,” Freeman said. Given the firm’s crude production expectations, “we foresee a sizable decline in gas supply relative to our previous model in 2020/2021,” which is a decrease of 1.8 Bcf/d in 2020 and a decline of 0.5 Bcf/d in 2021.

The demand destruction from the coronavirus this year is expected to reduce U.S. industrial demand, down 0.5 Bcf/d from a previous model, with LNG exports sliding by 0.8 Bcf/d.

“We continue to expect Covid-19 to result in reduced gas exports to Mexico and reduced gas imports from Canada versus our pre-Covid expectations,” analysts said. “With that said, we continue to forecast a y/y uptick in Mexican gas exports as pipeline volumes displace LNG imports as well as crude.”

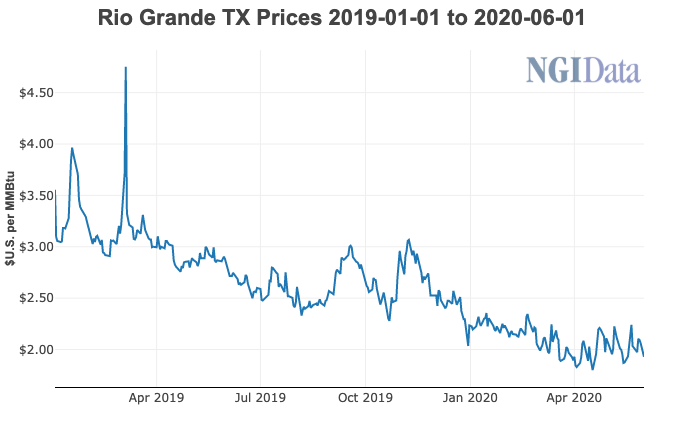

Analysts have reiterated their 2020 price forecast of $1.90/Mcf set in late March. Next year demand is forecast to be near normal levels, but without a rebound in supply, gas prices could average $3.50.

This forecast is in line with projections by Juan Carlos Zepeda, former chairman of Mexico’s Comisión Nacional de Hidrocarburos, who told NGI’s Mexico GPI last week that a rally in U.S. gas prices could make conventional gas production in northern Mexico’s Burgos Basin profitable again.

The market may be underestimating the degree to which U.S. supply may decline in 2021 without a “substantial move in one or both of the U.S. oil or gas strips,” the analysts said.

In addition, the ramp of now shut-in oil wells, and with them associated gas, later this year cannot be discounted.

“All things considered, we remain of the view that the market response to the Covid-19 pandemic is setting up the U.S. natural gas prices market for a massive recovery next year.”

In the short-term, however, shut-ins are likely to reduce supply by 5 Bcf/d-plus, according to Raymond James estimates.

Publicly held exploration and production (E&P) companies collectively have indicated they plan to curtail more than 1.5 million b/d of oil this month. That action is set to have two “contrasting effects” on U.S. supply.

“As all shale wells have a material natural gas component, nearly 6 Bcf/d of natural gas production will be shut-in alongside targeted oil volumes,” said analysts. In addition, the improving gas strip and fewer takeaway constraints should cause a 0.5 Bcf/d reduction in flaring, mostly from the Permian Basin and Bakken Shale.

According to Raymond James, the shut-in gas figure is based on 3 Bcf/d gross, using an assumption of a 66% oil and 33% gas mix by public E&P-disclosed oil curtailments, forecast at 1.4 million b/d, plus an additional 0.6 Bcf/d of estimated curtailments by the private E&Ps.

The “net effects of these two cross currents peak at a 5.5 Bcf/d (nearly 6% of 2019 average production) impact to supply in June before falling sharply in July (down 75%) and becoming negligible by year end at 0.8 Bcf/d (15% of original impact),” said the analysts.

The amount of gas shut-in is “markedly different” from the long-term curtailments that Raymond James analysts predicted in their oil forecast only a few weeks ago because most E&Ps plan to bring back volumes in July as oil prices are rising.

“Our expectation is that oil demand and pricing continues to rebound in the back-half of 2020 and into 2021 when economic re-openings…should be largely completed,” said the analysts. “As such, we think that while a small amount of shut-in production will never be successfully brought back (maybe 5%), said production isn’t enough to move the needle in 2021 or going forward.”

In Raymond James’ view, the sharp decline in drilling activity and capital expenditures is set to have a more lasting impact on gas supply.

For U.S. LNG exports, however, Raymond James has reduced its forecast yet again. A prior update had reduced the U.S. outlook by 20% from January.

“Global natural gas demand is holding up a fair bit better than that of crude oil, primarily because natural gas is not much of a transportation fuel globally — but several industry sources still predict global natural gas demand to be down around 5% in 2020,” said the analysts.

The global market was oversupplied before the pandemic struck, and international storage is nearly full.

U.S. LNG feed gas intake has fallen from 9 Bcf/d in March to 6 Bcf/d in May, according to Raymond James, with exports possibly moving below 5 Bcf/d this summer.

“After 30 June cancellations, industry participants believe 35-45 U.S. LNG export cargoes may have been canceled,” totaling 3.5-4 Bcf/d based on the recent deadline for July nominations.

“This is roughly 50% of the realistic cargo level for the industry nationwide (which ran at 60-70% in February-April),” the Raymond James team said.

There have been some “positive under-currents,” such as the third train starting up at the Cameron LNG facility in Louisiana, and China has begun taking the most U.S. cargoes since 2018. However, “trends through the summer and fall months look bleak.”

Raymond James has adjusted assumptions lower for U.S. LNG utilization rates for the second time this year and now anticipates 5.5 Bcf/d of exports in 2020, an increase of only 0.5 Bcf/d y/y.

“In 2021, we expect another modest increase of just over 0.5 Bcf/d year/year to just above 6 Bcf/d (November to November),” the analysts said. Although it is not a “silver lining,” Covid-19 “is likely to have significantly tightened up the 2023-2025 global LNG landscape given recent project delays.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |