NGI Mexico GPI | Markets | NGI All News Access

U.S. Natural Gas Pipe Exports to Mexico Climbed 10% in First Nine Months of 2019

U.S. natural gas exports to Mexico via pipeline continued to surge in the first nine months of 2019, according to the latest trade scorecard of the U.S. Department of Energy (DOE).

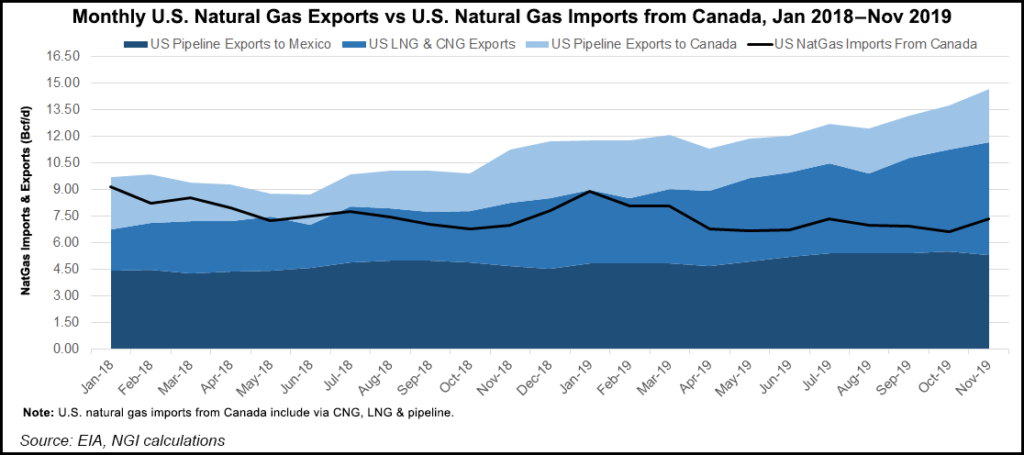

Natural gas exports to Mexico grew by 10.2% to 1.38 Tcf, or 5.1 Bcf/d, up from 1.26 Tcf, or 4.6 Bcf/d, in the same period in 2018, making it the No. 1 export destination for U.S. natural gas.

Total U.S. exports grew by 27.3% to 3.3 Tcf or 12.1 Bcf/d in the first three quarters of 2019, up from 2.6 Tcf, or 9.5 Bcf/d, in the same period of 2018, according to DOE’s gas regulation division.

The growth star was liquefied natural gas (LNG). LNG tankers loaded by five U.S. terminals carried 1.22 Tcf, or 4.5 Bcf/d, to 28 overseas destinations in the first nine months of 2019, up 61.2% year/year from 762.5 Bcf, or 2.8 Bcf/d.

Cross-border U.S. pipeline exports to Canada increased by 19.3% year/year to 693.8 Bcf, or 2.5 Bcf/d, between January and September, up from 581.4 Bcf, or 2.1 Bcf/d.

Prices continued to be attractive for Mexican importers of natural gas in the first nine months of 2019.

The average price of U.S. gas exports to Mexico shrank during the nine-month period, dropping by 16.8% year/year from $3.16/MMBtu to $2.63/MMBtu. Prices for U.S. exports to Canada fell by 7.1% to $2.80/MMBtu from January-September 2019, down from $3.01/MMBtu a year earlier.

Prices fetched by U.S. LNG varied widely across the 28 destinations during the first nine months of the year, from Argentina and Belgium to Thailand and the United Arab Emirates. Average prices ranged from $3.40/MMBtu in the Netherlands to $6.06/MMBtu in Japan.

Since then, global gas prices have plummeted to record lows. Benchmark prices in Northeast Asia have dipped below $4.00/MMBtu in recent days, while European benchmarks are hovering around $3.00. The prices, particularly in Asia, where LNG has fetched steep prices well above $10.00 in recent years, were once unthinkable.

The coronavirus outbreak in China that is spreading across the globe and its potential impacts on demand are weighing heavily on a market that is already swimming in LNG thanks largely to steady production from Australia, Qatar, Russia and the United States.

Mexico energy ministry Sener said this week continued investments in Mexico’s natural gas infrastructure would allow it to take advantage of “the cheapest gas in the world” from the United States.

Last September, the 2.6 Bcf/d Sur de Texas-Tuxpan pipeline came into operation, bolstering Mexico natural gas trade options. Meanwhile Genscape Inc. expects steep increases in U.S. gas flows to Mexico in February and March. February exports are projected to rise to slightly above 5.5 Bcf/d, a roughly 0.2 Bcf/d sequential increase over January volumes.

“The February increase will be driven by normal seasonality and ongoing production declines and demand growth, though all of these factors are rather modest,” Genscape senior natural gas analyst Rick Margolin said.

“In March, we expect another steep increase, with exports averaging more than 5.6 Bcf/d. This is based upon the above factors plus the anticipated startup of the Wahalajara pipeline system. This pipe network will connect West Texas/Permian gas to central Mexico pipelines, creating the opportunity for Mexico to replace” liquefied natural gas volumes from the Manzanillo terminal “and potentially replace South Texas-originated gas with cheaper molecules from Waha.”

In his State of the Union speech on Tuesday, President Trump highlighted the United States-Mexico-Canada-Agreement (USMCA), an updated version of the North American Free Trade Agreement, or NAFTA, signed into law last week. The USMCA will “bring trade with Mexico and Canada to a much higher level, but also to a much greater degree of fairness and reciprocity, we will have that…I say that finally, because it has been many years since we were treated fairly on trade,” Trump said.

Trade policy has been among the main drivers of tension between Trump and Mexico President Andrés Manuel López Obrador, who succeeded Enrique Peña Nieto in December 2018.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |