U.S. Natural Gas Exports to Mexico Surge 11% in First Nine Months of 2018

Natural gas exports via pipeline from the United States into Mexico grew 11.2% year/year during the first nine months of 2018 to reach 1.25 Tcf, or 4.6 Bcf/d, according to a report from the U.S. Department of Energy (DOE).

Natural gas prices fetched at the Mexican border by U.S. gas, however declined, averaging $3.16/MMBtu in the first nine months of 2018, down 2.7% from $3.24/MMBtu a year earlier.

Liquefied natural gas (LNG) shipments from the United States saw average prices of $4.72/MMBtu in the first three-quarters of 2018, a 1.5% improvement from $4.65/MMBtu in the same period of 2017.

Meanwhile, DOE said U.S. exports to Canada shrank by 15.2% to 587.6 Bcf in the same comparison, but LNG shipments and Mexico deliveries more than offset the loss.

Total U.S. exports hit 2.6 Tcf or 9.5 Bcf/d in first three-quarters of last year, up 14% from 2.28 Tcf or 8.4 Bcf/d in the same period of 2017. Total domestic LNG exports jumped 64% to 762.5 Bcf.

In 3Q2018, the United States exported gas to Mexico through a large number of exit points using short-term authorizations, but “over 49% of the gas transited two points” in South Texas, Rio Grande City and Roma. Rio Grande City is the largest point of export to Mexico.

Smaller volumes of gas were exported through longer-term authorizations, according to DOE.

About 70% of total pipeline and truck exports in the third quarter of 2018 went to Mexico.

Rising LNG and Mexico gas exports are part of a longer-term trend that will soon make the United States an energy exporting powerhouse. After more than 60 years as a net energy importer, the country is on track to become a net energy exporter of gas and oil by as early as next year, according to the U.S. Energy Information Administration (EIA).

According to a reference case and all alternative cases in EIA’s Annual Energy Outlook 2019, the United States will be a net energy exporter by 2020 and remain so through at least 2050.

The country became a net exporter of natural gas in 2017 for the first time since 1958. In EIA’s reference case, the U.S. gas trade, which comprises pipeline and truck exports, as well as LNG, to Mexico and Canada, will be increasingly dominated by LNG exports. However, pipeline shipments to Mexico will continue to see steady growth through 2050.

Despite the increase in LNG, gas prices should remain comparatively low during the period, EIA said, leading to increased consumption across end-user sectors and rising exports.

Exports into Mexico also depend on the southern neighbor’s gas pipeline buildout.

Although Mexico has added 4,639 kilometers (2,882 miles) of gas pipelines since 2012, several important projects still face delays, mostly because of local opposition.

One project, Fermaca’s 1.2 Bcf/d La Laguna-Aguascalientes and 0.9 Bcf/d Villa de Reyes-Aguascalientes-Guadalajara (VAG) system, is now set to come online in the second quarter, the head of government affairs, Fernando Alonso, told NGI’s Mexico GPI.

Mexico is also a major destination for U.S. LNG exports.

In the third quarter of last year, Mexico accounted for 52.5 Bcf of U.S. LNG exports, second only to South Korea’s 55.7 Bcf consumption of U.S LNG.

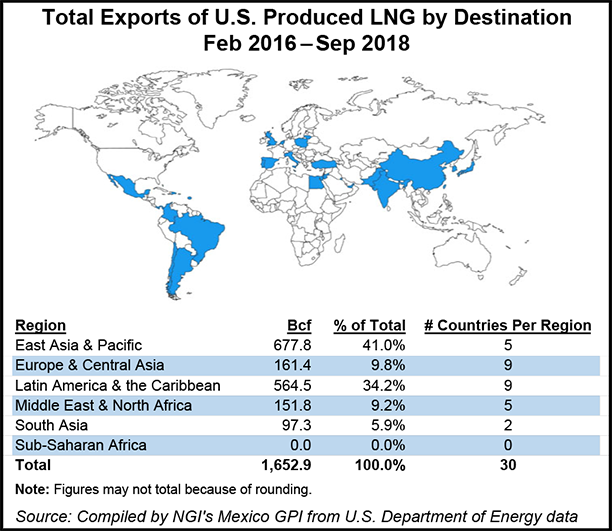

From February 2016 through September 2018, 34.2% of all U.S. LNG exports went to Latin America and the Caribbean, accounting for 564.5 Bcf, second as a region to East Asia and the Pacific, which accounted for 677.8 Bcf, or 41%, according to DOE.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |