NGI The Weekly Gas Market Report | LNG | Markets | NGI All News Access

U.S. NatGas Bulls’ Hopes Rest on LNG as Heatwave Hits Europe

Summer is here, both for the United States and especially across the pond in sweltering Europe, but it might not be enough to rescue oversupplied natural gas markets, either at home or abroad.

Stateside, New York Mercantile Exchange Henry Hub futures rallied to start the week, but by and large natural gas prices have taken it on the chin as of late amid a run of larger-than-normal inventory injections reported by the U.S. Energy Information Administration.

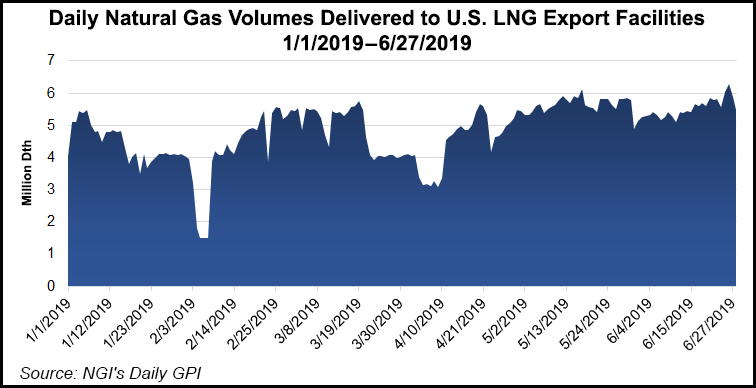

With U.S. liquefied natural gas (LNG) exports reaching record highs, making the domestic and European gas markets more interconnected than ever, and with a heat wave spreading across Europe this week, bulls might be tempted to look abroad for potential upside.

“The optimists in the U.S. market have been putting a lot of their hopes on U.S. LNG export growth expectations” as mild weather has exacerbated domestic oversupply conditions, Flux Paradox LLC CEO Gabe Harris, a former Wood Mackenzie gas analyst, told NGI. Coming off the bearish sentiment that pervaded the market last week, “it would take a whole lot to start moving things back in the other direction.”

Part of the bearish sentiment domestically stems from concerns over possible delays to LNG exports, concerns that have been made worse by weak prices in Europe in the United Kingdom, Harris said, describing the UK NBP (aka National Balancing Point) and Dutch TTF (Title Transfer Facility) benchmarks as “in freefall” over the last six months.

Extreme heat arriving this week could lend support to European gas markets.

Forecaster Maxar Earth Intelligence Solutions said it expects a “powerful” heat wave in Europe this week, with a broad area of high pressure creating dry and hot conditions for most of the continent. Temperatures should climb to well above normal levels and set record-highs in some cases, according to Maxar.

“The large ridge of high pressure is not just influencing high population centers in central Europe but extends into the Iberian Peninsula as well,” Maxar European meteorologist Matthew Dross said.

Maxar called for Berlin, Germany, to see temperatures peak at 98 F on Wednesday afternoon, with Madrid, Spain, potentially seeing temperatures reach 105 late this week. Frankfurt, Germany was on track to break a June record that dates back to 1947.

Maxar said it expects the extreme temperatures to drive up power demand across various utility grids.

After this week, “the extended forecast has the ridge continuing in place, albeit a bit weaker with the temperature extremes but still above normal readings continuing to be observed,” Dross said.

Depending on the duration of the heat wave in Europe, there could be some uplift for gas prices, according to Harris.

“If the heat wave lasts an unusual amount of time I would expect a price reaction, and yes, I would expect that to have a positive impact on the Henry Hub contract as optimism on U.S. LNG export growth will cycle back into the U.S. market (perhaps just in time for U.S. heat in August),” Harris said. But the initial impact on prices has been “almost zero.”

Late last week, on the deadline for Cheniere Energy Inc. offtakers to alert the company whether or not they plan to lift cargoes, the arbitrage (arb) window for domestic LNG exports to Europe was held “narrowly open” for August thanks to the weakness in Henry Hub futures, according to Energy Aspects.

“The arb for September is open by nearly 50 cents/MMBtu, but there remains a risk that the arb could close once more,” the firm said. “For Spain, given lower transport costs from Sabine Pass, the arb remains open in August by nearly 40 cents. To be fair, even if that arb shuts we still expect that U.S. gas will find a home in either Europe or Asia.

“The paper arb, which includes costs for tanker transport and regasification, might not be factored into every offtaker’s calculation, as many of these costs would be considered fixed/sunk. In addition, these cargoes would likely already have been hedged. Nevertheless, the closing and opening of the arb window on paper does illustrate just how loose global balances are.”

This comes as Europe has been dealing with a “massive” year/year storage overhang, which it would need to reduce from 865 Bcf as of last week down to 410 Bcf by the end of October, according to Energy Aspects.

“Europe has been the focus of discussion for potential arb windows closing, given just how congested storage in Europe could potentially be,” the firm said. “We envision European inventories filling by end-September. The widening differential in East of Suez and West of Suez shipping rates now means a narrower” Japan Korea Marker to TTF differential “is necessary to entice U.S. volumes to Asia. We expect Asian autumn restocking ahead of winter to support LNG shipments as well.”

Given recent strength in LNG feed gas demand flowing to U.S. facilities, upside for LNG volumes could be limited heading into July, according to Energy Aspects. “Higher sustained flows into Cameron LNG or steady volumes into Freeport LNG could move the needle slightly.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |