Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Midstream Answers to Regulatory, Legal Challenges in Focus as 2Q Results Unfold

The recent legal and regulatory setbacks for a handful of U.S. pipeline companies, as well as the uncertain outlook in oil and natural gas demand from Covid-19, may come more sharply into view as midstream second quarter earnings are unveiled.

“Earnings season is about much more than the quarterly results, and this go-round will be no different,” said Alerian’s Stacey Morris, director of research.

Analysts generally expect midstream companies to fare better than their exploration and production (E&P) counterparts when it comes to earnings. While no major revisions to 2020 guidance are expected, the lower end of expectations could be bumped higher, or at least assigned lower odds, according to Morgan Stanley Research.

More quarterly earnings coverage by NGI may be found here.

The Morgan Stanley team, led by equity analyst Stephen Byrd, said with oil prices back around $40/bbl, most of the previously curtailed volumes should be back online by the end of September. Noble Energy Inc. is the latest E&P that works in the Lower 48 to announce plans to bring back previously shuttered output.

Alerian also assumed shut-in volumes in the United States largely would be restored in the third quarter as long as oil prices do not backtrack significantly. The firm is looking to midstream companies for guidance about how the second half of 2020 may unfold.

Future oil production growth hinges on where prices go from here. West Texas Intermediate would need to be around $40-50/bbl in order for crude production to resume growth, Morgan Stanley analysts said.

With Covid-19 still impacting demand, and global supply set to increase in the coming months, that means the lower volumes moving through the vast network of U.S. pipelines are here to stay for the foreseeable future.

Devil In The Details

However, it’s not one size fits all when it comes to pipelines and how they manage through down periods.

“While pipeline contracts are intended to ensure throughput certainty, the differing nature of contracting terms between crude and natural gas pipelines can create very different outcomes for both shippers and pipeline operators,” said analysts with East Daley Capital Advisors Inc.

In periods of market distress and production declines, pipeline capacity tends to become abundantly available, according to the analysts, making pipelines highly dependent on existing contracted capacity. The combination of regulatory requirements and less flexible volume arrangements enable natural gas pipelines to be more fully protected from cash flow declines during low commodity price cycles, East Daley said.

Management for Kinder Morgan Inc., the largest independent transporter of petroleum products in North America, was set to issue its results late Wednesday. The Houston midstream giant has touted the take-or-pay structure of its contracts to insulate it from lower volumes. Nevertheless, the midstreamer reported that crude and condensate pipeline volumes were down 26% compared to the prior period and total refined product volumes were down 31% compared to the second quarter of 2019.

When it comes to liquids pipelines, understanding the specific contracting terms and historical shipments on the pipeline become necessary to determine whether a pipeline can preserve cash flows despite volume shortfalls, “when cash is king and cleaner balance sheets are highly coveted,” East Daley analysts said.

Quarterly results may not be as bad as some analysts fear.

Crestwood Equity Partners LP in early July reported that during the second quarter, average volumes flowing through the Arrow system exceeded initial forecasts estimated by its producers and exceeded the firm’s revised guidance. In May, Crestwood said 50% of the volumes would be shut-in through July.

Currently, about 90% of estimated available Arrow production is flowing, and based on producer plans for the second half of 2020, Crestwood expects the Arrow system to return to 100% flow rates. Larger producer customers were expected to bring back completion crews beginning this month.

More Dividend Cuts?

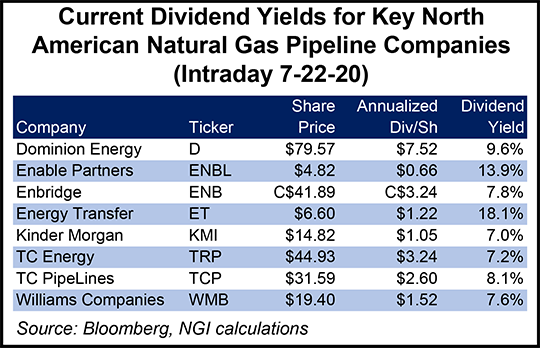

Many midstream companies responded to the Covid-19 and energy market headwinds by cutting 1Q2020 dividends to shore up their financial positioning, but the worst of the cuts may be in the rearview mirror, according to analysts.

Altogether, 21 of 48 dividend-paying midstream companies reduced their payouts for the first quarter, Alerian said. While the absolute number of cuts was high, the firm said the reductions were largely biased to smaller operators.

That said, the optics of cutting dividends were better in April against the backdrop of heightened counterparty risk from plummeting oil prices, demand destruction and shut-ins, “which made painful cuts more understandable and justifiable,” Morris said.

“If companies were in a position where a cut may have been needed, it was best to rip off the Band-Aid with the first quarter payout.”

Most companies likely recognized this dynamic and wanted to take proactive steps to enhance financial flexibility given market headwinds and uncertainty at the time, according to Morris. Additional cuts are possible for second quarter payouts, but overall are less likely.

Similar to the first quarter, Alerian is forecasting sequential dividend increases “to be few and far between.”

Regulatory Risks

Though the second quarter widely is seen as the bottom of the current energy market downturn, several risks continue to lurk over the industry.

Covid-19 has in recent weeks worsened, stifling economic recoveries that had started to take shape in May, when U.S. employment and consumer spending data improved.

“A much anticipated V-shaped recovery is but a pipe dream,” analysts with The Schork Report said. Shipments via air, rail, trucks and pipelines all dipped in July, signaling a slowdown in economic activity that could threaten fuel demand and overall energy needs.

While a return to lockdowns and a potential second wave of the coronavirus later this year are keeping investors wary, concerns over future pipeline development add “another dimension of headline risk” as the industry awaits resolution of Dakota Access pipeline’s (DAPL) ongoing legal battle.

DAPL, now in operation for three years, stands to be temporarily shut down and emptied while the U.S. Army Corps of Engineers completes an environmental impact statement (EIS). An appeals court last week granted an administrative stay of a lower court’s July 6 order vacating the water-crossing permits, but the court has yet to decide whether an emergency stay would be granted.

“Ultimately, if the appeals court effort fails, the next step for DAPL is likely for the case to be heard by the Supreme Court,” said analysts at Raymond James & Associates Inc. “The question at that point will be whether the pipeline is forced to halt operations before a Supreme Court ruling.”

If DAPL is forced to shut, roughly 300,000-500,000 b/d of production would need to be rerouted, according to Raymond James analysts, which would “meaningfully crimp” realized prices in the Williston Basin and increase price differentials to other regions.

The analyst team, led by Justin Jenkins, expects Bakken Shale crude differentials to widen to around $8-10 below Brent if rail to the West Coast satisfies takeaway needs. However, a differential would widen to around $11-13 if the incremental clearing point is the East Coast.

“While DAPL has long been one of the most hot-button issues in midstream, a full shutdown of the pipeline has large ramifications for the sector,” Raymond James analysts said.

Another crude pipe that serves Bakken operators, Tesoro High Plains, also was ordered shut earlier this month. Although in operation for 67 years, the Bureau of Indian Affairs determined the pipeline was trespassing on Native American land in the Fort Berthold Reservation in North Dakota.

An initial right-of-way was struck with landowners in 1953, but a renegotiation in 2013 regarding the pipeline’s route was never completed. The ruling at that time found that operator Marathon Petroleum Corp. (MPC) was responsible for $187 million in damages to landowners.

MPC spokesman Jamal Kheiry told NGI’s Shale Daily that the company recognizes indigenous groups as “partners who have a distinct relationship with the land, and we are committed to respecting the rights of the Mandan, Hidatsa and Arikara tribes members as we work with them to resolve this matter. Guided by our values of integrity, respect and collaboration, our hope is that we come to an agreement that benefits all parties.”

Tesoro flows crude to MPC’s 74,000 b/d Mandan refinery. According to Enverus, it did not appear to be running full, which means the interim shutdown may not have an impact on in-basin Bakken differentials.

Kinder Morgan has faced legal battles of its own.

Although it successfully brought online the highly anticipated Gulf Coast Express natural gas pipeline in September 2019, the midstreamer’s second planned conduit out of the Permian Basin — Permian Highway — has been met with strong opposition from landowners in the iconic Texas Hill Country, through which the pipeline would traverse. Interest in a third pipeline has fizzled.

“The permitting/legal/court process has been very disruptive to the broader sector’s growth and outlook and will remain so for the foreseeable future,” Raymond James analysts said.

Dominion Energy Inc. and Duke Energy Corp. cited the “unacceptable layer of uncertainty and anticipated delays” for the Atlantic Coast pipeline (ACP) when they bowed out of developing the project.

Meanwhile, the U.S. Supreme Court earlier this month reinstated the use of Nationwide Permit 12 for oil and gas pipelines, but not for the U.S. leg of the Keystone XL oil pipeline at the center of the debate. Refusal to restore the Keystone XL permit may delay most of the pipeline’s U.S. construction until 2021.

“DAPL/Keystone XL/ACP — this newsflow collectively has increased concerns that large-scale new midstream project development will be materially limited by legal and regulatory challenges,” Morgan Stanley analysts said.

Moreover, following the election in November, “a potential Biden administration could usher in a more stringent regulatory environment for new pipelines as well,” according to the analysts. “Coupled with an already challenged operating environment, investors could potentially need to recalibrate further sector growth investment downward.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |