LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

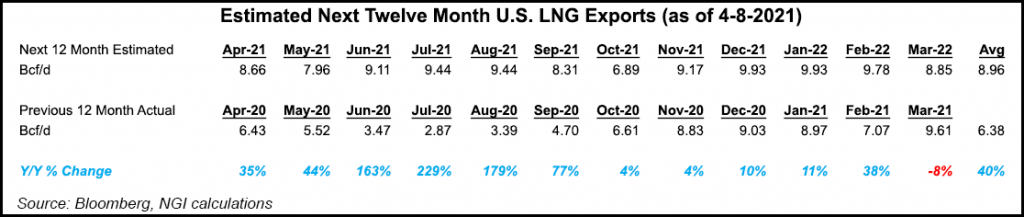

U.S. LNG Exports Hit Record High in March, with Strength Expected to Persist Through Summer

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |

all_out

all_out