Markets | LNG | NGI All News Access | NGI The Weekly Gas Market Report

U.S. LNG Exports Hit 1.94 Bcf/d in 2017, with More Projects in Queue, Says EIA

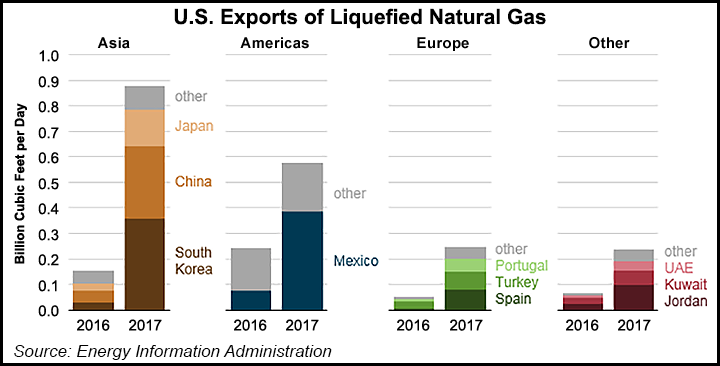

Domestic natural gas exports topped 1.94 Bcf/d last year, sharply higher than the 0.5 Bcf/d in 2016, with all of the shipments originating from Cheniere Energy Inc.’s Sabine Pass liquefaction terminal in Louisiana, the Energy Information Administration (EIA) said Tuesday.

Liquefied natural gas (LNG) exports reached 25 countries last year, EIA said in a note overseen by principal contributor Victoria Zaretskaya.

“More than half (53%) of U.S. LNG exports in 2017 were shipped to three countries: Mexico, South Korea, and China,” EIA researchers noted. “Mexico received the largest amount of U.S. LNG exports, at 20% of the 2017 total.”

Rising gas demand in Mexico, particularly from the power generation sector, coupled with delays in constructing pipelines to connect Lower 48 supply, led Mexico to rely more on LNG rather than pipeline imports.

“In Asia, the widening difference between the Henry Hub natural gas price — to which U.S. LNG contract prices are indexed — and crude oil — to which LNG prices are benchmarked in Asia — helped to drive increases in LNG imports from the United States,” EIA noted.

South Korea imports accounted for 18% of total U.S. exports last year, linked to long-term contracts by Cheniere and Royal Dutch Shell plc. The gas buyers included South Korea’s state-run Korea Gas Corp., aka Kogas, and Korea Electric Power Corp.

The South Korea exports “were sold mostly on a spot basis, with volumes in October, November and December increasing as record-high LNG demand prompted China to seek additional LNG on the global spot market to supplement contracted volumes,” researchers said.

Nearly 60% of domestic LNG last year was sold on a spot basis to more than 20 countries across Asia, North and South America, Europe, the Middle East and North Africa, as well as the Caribbean.

“Although liquefaction capacity at Sabine Pass is fully contracted under long-term contracts to various buyers, flexibility in those contracts’ destination clauses allows U.S. LNG to be shipped to any market in the world,” according to EIA.

Countries in Europe collectively accounted for the third-largest share of domestic gas exports.

Several European countries increased their imports last year primarily because of rising power generation demand, researchers said.

Meanwhile, South American LNG imports declined last year. “Demand for natural gas in that region is highly variable and is affected by the availability of competing lower-cost natural gas supply and hydro generation output.”

The increase in U.S. gas exports over the past two years has resulted from the continuing expansion of export capacity, EIA noted.

Between Sabine Pass and the Dominion Cove Point terminal in Maryland, EIA estimated U.S. LNG export capacity stands at around 3.6 Bcf/d. The Federal Energy Regulatory Commission earlier this month granted Dominion Energy permission to begin LNG commercial service from Cove Point.

EIA noted that four more projects are scheduled to come online in the next two years with Elba Island LNG in Georgia and Cameron LNG in Louisiana each slated for start up this year. In 2019, two Texas coastal projects, Freeport LNG and Corpus Christi LNG, are scheduled to begin commercial service.

“U.S. LNG export capacity is expected to reach 9.6 Bcf/d by the end of 2019,” according to EIA’s research. “As export capacity continues to increase, the United States is projected to become the third-largest LNG exporter in the world by 2020, surpassing Malaysia and remaining behind only Australia and Qatar.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |