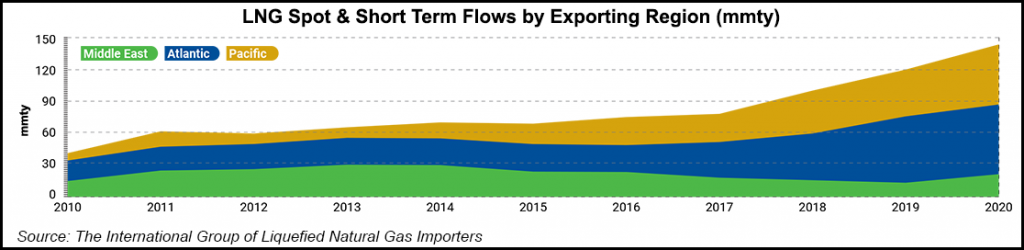

Despite the Covid-19 pandemic’s impact on energy markets, global liquefied natural gas (LNG) imports increased by 0.4% last year to 356.1 million tons (Mt), driven in part by supply additions from the United States, according to the International Group of LNG Importers (GIIGNL).

While the pandemic cut into demand across commodities, GIIGNL said the “LNG trade has proven resilient, increasingly diverse and global.”

The United States again accounted for most of the world’s new volumes, exporting 44.8 Mt last year, compared to 33.75 Mt in 2019, according to GIIGNL. The 11 Mt growth was driven by the commissioning of U.S. projects in both 2019 and 2020, including Cameron LNG trains 2 and 3, Corpus Christi train 3, and Freeport trains 2 and 3.

Not only did U.S. LNG...