Markets | Infrastructure | LNG | NGI All News Access | NGI The Weekly Gas Market Report

U.S. LNG: A Growing Slice of A Growing Pie

The global liquefied natural gas (LNG) market, which was about 270 million tonnes last year, will grow to 360-370 million tonnes in three years time, and the U.S. Gulf Coast will serve 25-30% of that market, LNG pioneer Charif Souki said Thursday in Houston.

Speaking at CERAWeek by IHS Markit, Souki, a cofounder of Cheniere Energy Inc. and later of Tellurian LNG, said anywhere from 12 to 15 LNG cargos will be for sale daily in the global market, controlled by a group of 30-40 players in the industry. There will be 200 tankers moving on the seas with LNG on them at any given time, Souki said. “That’s equivalent to 40 Bcf/d,” he said. “It’s a very, very significant physical market.”

While suppliers in the U.S. Gulf Coast stand to capture 25-30% of the market, about one-third of the market will be served by LNG producers in Qatar and another one-third by LNG from Australia, he said. The rest of the demand will be met by smaller LNG suppliers around the globe.

Buyers will source LNG from the closest market and when in a pinch will be willing to pay a premium to snag a cargo on the water, he said. A robust spot market for LNG is coming. “It’s just a matter of time until we get there,” Souki said.

Seeing a market that is oversupplied for the time being, LNG buyers have sought more flexible contract terms and more favorable prices for LNG. While once mainly concerned with security of supply and long-term contracts, buyers now are thinking more opportunistically and seeking better deals, said Datuk Wan Zulkiflee Wan Ariffin, CEO of Malaysian producer PETRONAS.

Japan’s JERA Co. Inc. is one such buyer. LNG has two weaknesses, JERA President Yuji Kakimi said at CERAWeek. One of them is price and the other is liquidity — and they’re intertwined. “If the price isn’t so high and we can increase its liquidity, and then I think demand will come along with that and I think we will get that LNG golden age,” he said through an interpreter.

Souki and other LNG developers take a long view on commodity trends. Oversupply situations have a way of working out. Predictions of stranded cargos in an oversupplied market have not come to fruition, he said. “All the LNG was sold.” As with natural gas on land, weather drives demand for LNG on the seas.

“We live in a very, very seasonal industry, very volatile industry where weather has more impact on demand than anything else,” Souki said. “So in the same year you found low prices globally, and then you found premium prices in Asia, and then two months later you find premium prices in southern Europe, and then premium prices move, at a lower level, to the Middle East…You have prices that vary on a regional basis from $5, $5.50 to $9, $10 and then back to $5 [per MMBtu] and another area of the world goes up…[T]he gas is finding its way to market…”

Testament to the growing LNG market, and the growing role of the United States in that market, is what is going on at Cheniere Energy’s first liquefaction and export terminal in Louisiana, Sabine Pass.

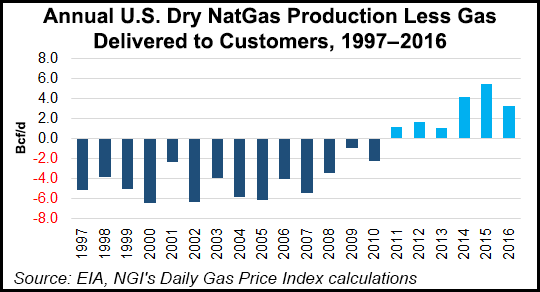

Corey Grindal, Cheniere senior vice president for gas supply, told a CERAWeek audience that LNG exports are likely to be the largest growth market for U.S. natural gas over the next 10 years, if not over the next five.

Last year, Cheniere bought and consumed 235 Bcf of gas to feed its export operation. In the first two months of this year, the company consumed 109 Bcf. “I would have to say that [gas] going abroad is starting to happen and starting to happen in earnest, Grindal said.

It’s not just U.S. natural gas leaving in liquid form from Sabine Pass. Cheniere recently struck a deal to source gas from a Canadian producer.

“The North American continent is available for us to source gas from,” said Cheniere Chief Commercial Officer Anatol Feygin, also speaking at CERAWeek. “We are the largest physical gas buyer in the country. We really think that the trade prospects for U.S. LNG are very attractive…”

Cheniere’s Sabine Pass and Corpus Christi terminals combined are among the largest pipeline capacity holders in the country with more than 5 Bcf/d of firm capacity on eight pipeline systems, Feygin said recently. “This capacity represents an annual expenditure of approximately $400 million in capacity payments between our two project companies but will ensure our ability to effectively manage intraday volume variances, price volatility and effectively operate as one of the largest gas buyers in the U.S.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |