E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Land Recovery Still ‘Has Legs,’ But Pace Slips, Says H&P Chief

The recovery in the U.S. onshore should continue to improve, but at a more moderate pace, according to the CEO of one of the largest land drilling contractors, Helmerich & Payne Inc. (H&P).

During a conference call to discuss fiscal 2Q2017 results, CEO John Lindsay said the frenetic burst by U.S. exploration and production companies beginning last fall has settled into a slower rhythm.

“We see encouraging signs indicating that the recovery in the U.S. land market has legs and could continue to build momentum, even though the rate of increase in activity may slow to a more modest pace,” Lindsay said.

The Tulsa-based driller, one of the leading North American onshore drillers, has had “less inquiries on rigs. We’re still receiving inquiries but not to the same level, not to the same pace that we were previously.”

The market for high-tech rigs has not reversed, it’s merely calmed down, he said.

“This has been, at least for us…an increase in activity that we’ve never seen before. So it’s not really surprising that we’re seeing it pull back a little bit. That was our expectation. Quite frankly, my expectation would have been it would have pulled back a little sooner than what it has.

“So again we’re still getting requests, we still see the fleet growing through the rest of the quarter…It’s very challenging to see much past a month or two…We’re going to be effectively growing based on what our customers are seeing in the future. Obviously, oil prices, the softness that we’ve experienced over the last month or so has not helped matters any.

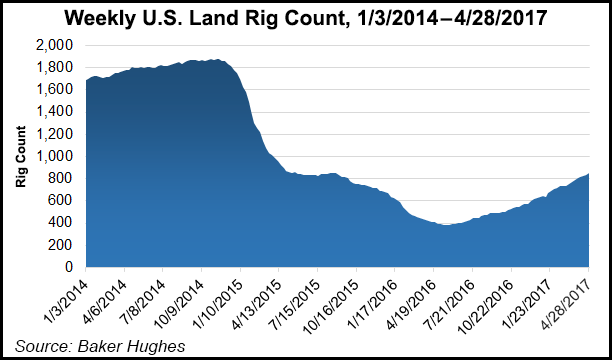

“But again I think in general, if you see the rig count where it is right now, depending on the rig count that you look at between 830 to 900 rigs has really far exceeded anybody’s expectation, I think. So I don’t think any of this should be really a surprise it slowed down just a little bit.”

Unfortunately, “we expect international and offshore markets to remain challenging for the foreseeable future.”

H&P, whose forte is its high-specification alternating-current (AC) FlexRigs line, experienced some spot pricing improvements in its U.S. onshore during the latest quarter as it put some of idled equipment back to work.

The U.S. land operations’ contracted rig count increased by 41 rigs from the end of 2016 to March 31 and by 73 rigs from last Sept. 30. As of last Thursday, the rig count stood at 177. U.S. land market spot pricing since late January has increased by about 9%.

Rates Too Low for Newbuilds?

As operators go back to work, some oilfield service companies have been talking up newbuild activity during quarterly calls. But many simply won’t be able to do it, Lindsay said. One of the “obvious barriers to rapidly expanding newbuilds is economics,” i.e. rates still are too low to support investing in new rigs, he explained.

“While many of our peers may be forced to build new rigs at questionable economics to grow their AC-drive fleets, we have been able and expect to continue to be able to maintain an industry-leading cadence by upgrading and reactivating FlexRigs.”

Halliburton Co. hinted during its 1Q2017 conference call that there was customer interest in newbuilds, but management said it was in no hurry to oblige.

Since last September, H&P’s active fleet has increased by 89 rigs, including about 60 with super-spec upgrades. At the same time, the operator has grown its U.S. land market share, which now stands at around 18%, versus 15% at the peak in early 2014.

Meanwhile, rig specs increased as producers drilled deeper laterals and used more proppant. Rigs that aren’t already AC-equipped “are mostly redundant today,” Lindsay said.

“If we were to assume — and we realize that’s maybe a big if — but if the market continues to improve over the coming years, we could very feasibly exceed H&P’s 2014 peak level of quarterly activity of approximately 300 active rigs in the U.S. with our existing FlexRig fleet, including the upgrades required for the rigs drilling more complex wells.”

Many of H&P’s large land drilling competitors are experiencing activity levels “of less than or close to half of their 2014 peak levels and are reportedly already constrained to grow using their existing idled rigs, many of which are not suitable for upgrades,” Lindsay said.

H&P’s strategy, while the competition is working on new equipment, is to pick up market share.

“We don’t foresee investing in new rigs at this stage of the cycle, especially as we continue to demonstrate we can upgrade our fleet to meet the needs in the market and deliver best-in-class performance with our FlexRig fleet,” the CEO said.

Permian Still Market Leader

Since the last quarterly conference call in January, H&P has put 42 FlexRigs back to work in the U.s. onshore, “which is the equivalent to delivering a FlexRig to active status every 52 hours. Of those rigs, 37 are in the spot market and five on term contract.”

The Permian Basin has led the way with 21 rigs. Another 10 rigs have been raised in the Eagle Ford Shale, three have gone up in Oklahoma’s stacked reservoirs and two each have been added in the Bakken and Haynesville shales. One rig each also has been raised since January in the Barnett and Utica shales, Piceance Basin and Woodbine formation.

“The Permian remains our most active operations, and we have 80 rigs contracted coming off below the 38 contracted rigs, and at one point last summer, we only had 23 actively operating rigs,” CFO Juan Pablo Tardio said. “We have 50 idle FlexRigs in the area, 31 of which are 1,500-hp, and we expect to continue to have opportunities to grow our active fleet in the Permian.

“For perspective, we had 85 rigs contracted in the Permian during the 2014 peak.”

In the Eagle Ford, 30 rigs are contracted, coming off a low of 16 contracts, with another 29 contracted in Oklahoma’s STACK and SCOOP, i.e., the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties, and the South Central Oklahoma Oil Province. The Oklahoma plays had only 15 contracted rigs when business was booming in 2014.

H&P exited fiscal 2Q2017 with 168 U.S. land rigs with contracts, “driving a remarkable increase of approximately 35% in total quarterly revenue days,” Tardio said.

The increasing proportion of rigs priced under recent market conditions drove a 7% decline in adjusted average rig revenue/day to $22,201 in the quarter. The average rig expense/day increased by about 4% to $15,612, mostly driven by upfront expenses on a larger-than-expected number of rigs returning to work.

In fiscal 3Q2017, H&P expects to see continued improvements in activity levels and revenue days, which are forecast to rise by about 25% sequentially. The adjusted average rig revenue/day is forecast to decline to around $21,000, while the average rig expense/day is forecast to fall sharply to around $14,300 because the sequential start-up costs should have a lower impact on the average rate.

H&P suffered a net loss of $49 million (minus 45 cents/share) in fiscal 2Q2017, versus profits of $21 million (19 cents) in the year-ago period. Operating revenues totaled 405 million, with net operating cash of $76 million. U.S. land drilling operating revenue fell year/year to $331 million from $349 million but climbed from $264 million sequentially. International land revenue fell from a year ago to $35 million from $51 million, while offshore revenue increased to $36 million from $34 million.

Supreme Loss

In related news, H&P, which owns and operates land rigs across North America, South America, the Middle East and Africa, and an offshore rig fleet in the Gulf of Mexico, suffered a loss at the U.S. Supreme Court on Monday, which ruled against the driller after it had claimed that Venezuela unlawfully seized 11 rigs in 2010. The high court ruled in favor of Venezuela by an 8-0 vote, tossing a 2015 decision by the U.S. Court of Appeals for the District of Columbia Circuit. Justice Neil Gorsuch did not participate.

Justice Stephen Breyer in writing for the court said the appeals court had used the wrong standard in denying Venezuela immunity from the lawsuit. H&P had sued the Venezuelan government and state-owned oil companies under the U.S. Foreign Sovereign Immunities Act, claiming that the property seizure violated international law. The Act allows foreign governments to be sued in U.S. courts in certain circumstances, including when private property is seized.

For years H&P had provided drilling services for the Venezuelan government, but after the country failed to pay $100 million it owed, H&P disassembled its rigs in 2009. In response, President Hugo Chavez’s government, assisted by the military, ordered the property be seized in 2010.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |