The U.S. natural gas market has lost more than 5 Bcf/d of demand from the industrial sector since the start of the year, Department of Energy data show, providing yet another metric by which to gauge the Covid-19 pandemic’s heavy economic toll.

U.S. natural gas demand from the industrial sector measured 20.1 Bcf/d in June, down nearly 1.0 Bcf/d compared to year-ago levels and down from 25.4 Bcf/d in January 2020, the U.S. Energy Information Administration (EIA) said in a research note published Monday.

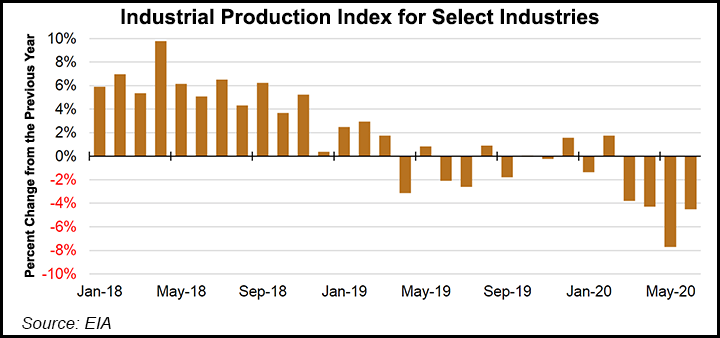

Monthly measurements of industrial sector demand began showing year/year declines in March 2020, coinciding with the start of Covid-19 containment measures that disrupted economic activity. By May 2020, industrial sector natural gas demand declined 8% compared to 2019 levels,...