Shale Daily | Markets | NGI All News Access

U.S. Imports of Canadian Heavy Oil to Increase, IHS Says

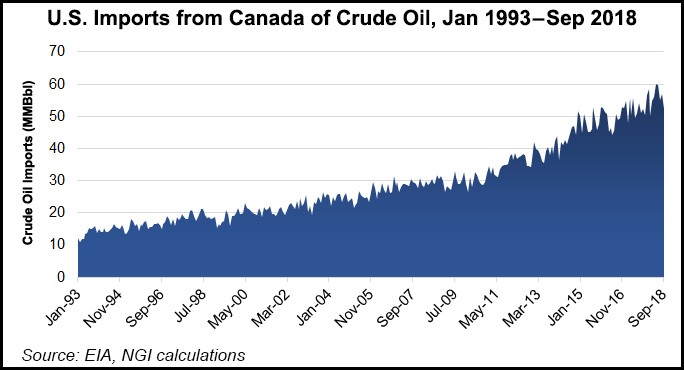

U.S. imports of Canadian heavy crude oil are expected to increase over the next two years, but the pace of oilsands growth in Canada is also expected to slow because the declining number of projects under active development, according to IHS Markit.

In the consultancy’s 15-page report, “Looking North: A U.S. Perspective on Canadian Heavy Oil,” Director Vijay Muralidharan and Vice President Kevin Birn projected that domestic imports of Canadian heavy oil would increase to more than 3.0 million b/d by 2020 from 2.5 million b/d in 2017.

IHS also expects several new oilsands projects to advance over the next few years.

“Yet with oilsands projects taking two years or more before production can be brought online, a slower period of growth at least to the early part of the next decade is almost assured,” Muralidharan and Birn wrote. Meanwhile, the Organization of the Petroleum Exporting Countries (OPEC) “could help moderate the heavy oil market, but there are quality differences between Middle Eastern heavy oil and the much heavier grades found in the Americas.

“If this trend continues, it could set the stage for a protracted period of a tighter heavy oil market in the world and a greater importance for Canadian output to U.S. refiners — at least in the medium term.”

Muralidharan said “the effect of Canada’s expanding market share has been to shore up the U.S. heavy oil market. Absent Canadian supply, heavy oil may otherwise be more scarce and expensive.” Canada’s expanded market share in the United States, the world’s largest heavy oil market, has offset or displaced offshore imports from Latin America and elsewhere, IHS found.

The authors added that logistical issues have impaired the ability of meaningful volumes of Canadian supply to access U.S. West Coast and East Coast markets.

“Although some limited rail has made its way from Canada to the U.S. East Coast, this market traditionally processes lighter crudes and lacks the complexity for heavier grades of oil. On the U.S. West Coast, the majority of heavy demand has been met by domestic Californian or Alaskan output. However, as Californian and Alaskan production has slowly declined, offshore imports have crept up, which could provide future opportunities for Canadian heavy oil.”

According to IHS, about 90% of heavy oil processing in the United States occurs on the Gulf Coast, followed by the Midwest and the West Coast. The Gulf processed more than half of all U.S. heavy oil demand in 2018 (2.7 million b/d), followed by the Midwest (1.3 million b/d) and the West Coast (just under 700,000 b/d).

Canada is currently the world’s largest producer of heavy oil, and over the past few years has been the only source of material heavy growth globally, IHS said. Canada’s rising profile comes as Russia has expanded heavy oil refining capacity, Mexico cut heavy oil production and Venezuela’s oil sector has collapsed. OPEC and other non-OPEC countries also temporarily cut heavy oil production.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |