E&P | Markets | NGI All News Access | NGI The Weekly Gas Market Report

U.S. E&Ps, OFS Operators Finding Usual Playbooks Upended

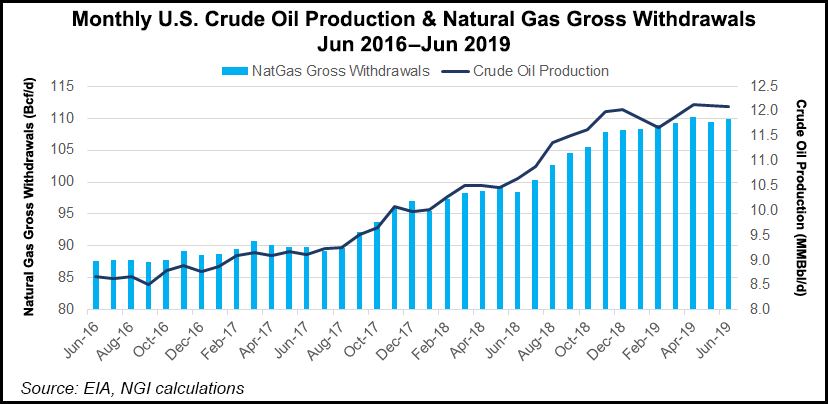

Efficiencies improved U.S. oil and gas production even on lower spending during the second quarter, but operators still are treading cautiously on erratic commodity prices and a dearth of capacity that is dogging development in some regions (see: Permian Basin).

The 2Q2019 earnings season is in the rearview mirror, but messages were mixed on plans going forward. Lower 48 exploration and production (E&P) companies and the oilfield services (OFS) operators appeared ready to hunker down and wait it out.

Relatively few surprises emerged during the conference calls but there were some notable trends. The bottom line: capital expenditures (capex) are more likely to be reduced than increased. For oil or natural gas production, gains may be modest.

“Producers are doing a good job staying within their previously announced capital budgets, yet many increased their 2019 production guidance, thanks to efficiency gains,” said NGI’s Patrick Rau, director of strategy and research. “Some of those gains are simply the result of lower OFS pricing, but sustainable efficiency improvements are no small part of that, either.

“None seem to be too worried about their ability to achieve further non-OFS price related efficiency gains in 2020 either.”

For the OFS sector, “most telling to me was Halliburton Co.’s decision to stack equipment,” Rau said. “That is a marked change in strategy for them and portends slower capex activity among the E&Ps going forward.”

Halliburton expects U.S. activity to soften through September and potentially bottom out by the end of the year or early next. The largest pressure pumping operator in the Lower 48 “always used to seek to maintain or grow their U.S. market share in downcycles, but now they are stacking pressure pumping equipment and admitted their playbook has changed,” Rau said. “To me, this means operators do indeed plan to slow their U.S. spending going forward.”

The OFS and midstream sectors “work closely and coordinate with their customers, and that is a fairly long lead-time process. Maintaining market share and growing capex in a down market means the super-charged production growth mentality would continue after the downturn. Maybe not so much now.”

Nabors Industries Ltd., which owns and operates the world’s largest land-based drilling rig fleet, has seen its future drilling plans continue to decline, CEO Tony Petrello said during the second quarter call. Nabors conducts regular customer surveys of its top 20 customers, mostly major independents and integrated operators, which account for around 39% of the total Lower 48 rig count.

“The customer survey indicated that a further decline of about 20 rigs or 6% is planned for the remainder of 2019,” Petrello said. “Clearly, the total number of rigs dropped for the year has significantly worsened in the last three months,” but it’s not been even across the board. Some customers that weren’t expected to drop rigs have sharply reduced their activity, while some with deeper pockets continue to expand activity.

The stronger activity is within the oil plays and weighted to the Permian. It’s better for the oil patch. However, for natural gas operators, particularly in Appalachia, the writing is on the wall.

Domestic E&Ps are putting the brakes on natural gas growth this year and beyond, even with more outlets for U.S. capacity.

The E&Ps covered by Jefferies LLC analysts produced around 30% (24.3 Bcf/d) of 2018 domestic output, adding an estimated 3.4 Bcf/d more than in 2017. However, that same group now is forecast to generate only 1.4 Bcf/d of growth in 2019 and 1.1 Bcf/d in 2020.

“The majority of the gas supply growth from our coverage group in 2019-plus will be from associated gas from oil drilling, as growth from our gassy E&P coverage will slow substantially from 2018 levels,” Jefferies analysts said.

Last year the gassy explorers added an estimated 2.3 Bcf/d of supply, “which we estimate will fall to just 0.5 Bcf/d in 2019 and only 0.4 Bcf/d in 2020.”

The second quarter reports highlighted how many Permian operators suffered through negative gas realizations.

“We’ve heard that negative $2.00-$2.50/MMBtu is the price where natural gas liquids recovery no longer offsets negative gas pricing (and would incentivize flaring gross gas),” analysts said.

In Appalachia, the heart of U.S gas production, volumes have been at record levels. In early August, according to Jefferies, gas output was averaging 31.1 Bcf/d, or around 200 MMcf/d more than in July, which set a daily record late in the month of 31.4 Bcf/d.

However, the Appalachian rig count appears to be responding to lower gas prices, and several of the biggest operators signaled they would drop rigs in the second half of the year.

“We continue to see Appalachia gas growth slowing substantially in 2019, as we estimate our coverage group (roughly half of Appalachia gas production) will add just 0.5 Bcf/d of exit to exit production in 2019 (vs 2.3 Bcf/d in 2018),” Jefferies analysts said.

It was a seesaw battle for E&Ps during the second quarter, as positive results were “handsomely rewarded, while names that disappointed were sent through the shredder,” said Raymond James & Associates Inc. analyst John Freeman. Raymond James had four companies outperform the E&P index by more than 10%, while four names underperformed by 10%-plus.

“In a typical quarter, we’d have maybe two or three break-out (or break-down) performances of this magnitude and rarely, if ever, do we see E&P stocks move 20% above/below the group post-release, which happened three times this earnings season,” Freeman said. The jarring results “created a dichotomy of haves and have-nots that is consistent with what we’ve seen all year.”

There were some positive signs for the E&P industry during the quarter, Rystad Energy analysts said the second quarter was the first three-month period on record for Lower 48 explorers overall to achieve positive cash flow from operations after accounting for capital spending. In a study of the financial performance of 40 U.S. onshore E&Ps, 35% were found to have balanced spending with cash flow from operations, accumulating an estimated $110 million surplus in operating cash flow versus capex.

The Raymond James team pegged themes that appeared to have an outsized impact on its E&P coverage universe: downspacing, capital efficiency/restraint and natural gas flaring.

“The name of the game now is finding the right balance between level of inter-well inference and field recovery,” Freeman said. Operators have moved away from a net asset value approach and toward returns/free cash flow models.

While most E&Ps toed the line on capital spending during 2Q2019, those that did not were pummeled.

“Given the current sentiment toward energy (not good), we expect to see a similar reaction to any announced budget increases regardless of the rationale provided,” Freeman said.

In its analysis of second quarter results of around 50 Lower 48 E&Ps, Rystad Energy said most reported unchanged or reduced capex expectations, with most spending reductions by the Permian-focused operators.

Capex guidance for the selected onshore E&Ps decreased in 2Q2019 by $150 million, or 0.2% relative to initial guidance. What that said, according to Rystad, is “the ability of U.S. shale operators to deliver on production guidance expectations and to further raise production targets while staying within capital budgets.

“Even accounting for infrastructure constraints and production downtime experienced by some operators during the quarter, the majority of companies…are on track to deliver on cash flow and capital discipline goals set for 2019.”

Overall, second quarter earnings season for the Lower 48 E&Ps covered by Williams Capital Group LP was mixed, said analyst Gabriele Sorbara. Some names outperformed, but the group overall drifted lower on a “few disappointing results” that plagued the sector.

Still, Williams Capital analysts “are in the camp that believes Permian Basin oil production growth will fall short of expectations in coming quarters and years, providing a pricing tailwind…

“Assuming the sector can execute on several critical points, including maintaining spending discipline, improving capital efficiencies and hitting production targets; achieving a model of sustainable free cash flow with some level of production growth; and returning cash to shareholders, current valuation levels offer an attractive risk/return profile.”

At a recent roundtable with key energy executives in Aspen, CO, Raymond James analysts said industry players were “coming around to our view” that global oil supply looks like it is weakening.”

The slowdown in capital for U.S. unconventional and large-scale international projects “will become more apparent in 2020,” said Raymond James analyst Marshall Adkins. There also is “greater consensus than expected” that the Saudi-led Organization of the Petroleum Exporting Countries is incentivized to push Brent prices higher.

On U.S. well productivity, executives were bullish but Raymond James is less optimistic about long-term gains, as the “bigger hammer” approach by E&Ps “is reaching its limits and the industry is gaining more negative evidence around down-spacing and multi-bench drilling,” while the core inventory also could be more limited than consensus realizes.

The Raymond James global oil demand forecast has been under consensus, but “arguments suggest we may still be too high,” Adkins said. Demand in the second quarter was weak, but the executives in Aspen had differing opinions about whether it was transitory or structural.

The second quarter proved again to be a challenge for North American onshore-levered oilfield services (OFS) providers, according to Evercore ISI.

“Visibility in the second half of the year remains poor, rig counts continue to decline, drilling and completion spending is moving lower, and E&P operators continue to focus on keeping spending within cash flows,” said Evercore’s team led by James West.

“The OFS companies are not sitting still and instead have focused on things they can control. This was a common theme on the earnings calls as companies stack equipment, close unprofitable yards, reduce headcount and try to high grade their customer base,” he said.

For example, National Oilwell Varco Inc. CEO Clay Williams during the quarterly conference call said the company was facing “challenging cross-currents as it navigates a generational oilfield downturn. International and offshore markets are exhibiting growth, while North America land markets are declining as customers slash spending.” The combination of a “severe capital austerity and lower activity in North America” has resulted “in a rapid change in our business mix.”

With limited near-term catalysts for the OFS subsector, Evercore is awaiting how operators may respond when E&P budgets are reset early next year.

“It does seem increasingly likely that the U.S. land rig count peak for 2019 occurred in the first quarter of the year, actually in the first two weeks,” West said.

The outlook for fracture activity in the second half of this year “is quite thorny,” according to Tudor, Pickering, Holt & Co. (TPH). U.S. fracture activity declines accelerated in August, down by more than 4% from July, as operators “remain quite budget conscious and both natural gas and natural gas liquids prices stink,” analysts noted. Declines were most pronounced in the Permian, the Northeast and in the gassy Haynesville Shale.

TPH also reviewed month/month (m/m) changes in U.S. fracture activity in 2018 and compared them to the changes to date this year.

“Should the second half of 2019 play out similarly to the second half of 2018, we could end the year at 300 active fracture spreads,” from around 325-330 active today. “If we don’t get the same m/m pop this year that we saw in September 2018, we could end the year notably below 300 active fracture spreads.”

Average OFS sector returns produced their fourth consecutive quarter of negative results, Evercore noted.

“Do we think there are risks to 2020?” analysts asked rhetorically. “You bet, although we’ve sharpened up the knives aplenty as we cut estimates following this latest round of quarterly earnings.” The OFS sector is making positive changes to align with the “capital austerity narrative” but “the investor community could not care any less.”

Rumors of additional bankruptcies among the small-cap E&Ps also “have continued their crescendo while investors likely size up service companies and regional banks with material exposure to increasingly probable worst-case scenarios,” the Evercore analysts said.

Year-to-date in mid-August, 26 North American E&Ps had filed for bankruptcy, according to Haynes & Boone LLC. That compares to 28 total last year and 24 total in 2017.

“We continue to make a call for industry consolidation in both the upstream and in OFS, although recent transactions have made executives wary given the sharp sell-off in the equities following merger announcements.”

Some companies have taken advantage of the “temporary market dislocation” for personal or company-mandated share buybacks, “which is a prescient strategy although it requires for general investor apathy toward the sector to eventually dissipate. After these counter-intuitive market rallies and sell-offs it seems like that assumption requires an ever greater leap of faith.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |