Oil and natural gas activity in Louisiana, New Mexico and Texas continued to grow in the final three months of the year but at a slower pace, according to the Federal Reserve Bank of Dallas.

The quarterly survey of energy trends by the Dallas Fed, as it is known, showed the business activity index, the broadest measure of conditions facing Eleventh District firms, rose for the ninth straight quarter. However, it stood at 30.3 versus 46 in 3Q2022.

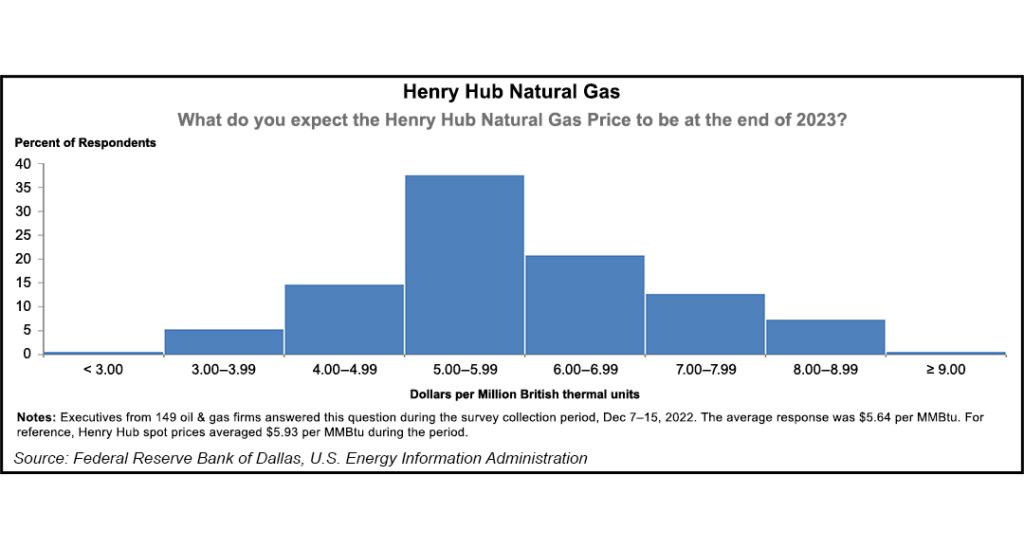

Dallas Fed surveys executives of exploration and production (E&P) and oilfield services (OFS) firms. Data were collected Dec. 7–15, with 152 firms responding. Of the respondents, 97 were from E&P firms and 55 were OFS executives.

“The oil and gas sector experienced another quarter of strong growth, but the pace of expansion...