U.S. Drops Three Natural Gas Rigs But Adds 11 Oil Units

Rig counts are up handsomely from year-ago levels, and the Permian Basin has been no slouch in contributing to gains. But the Eagle Ford Shale has made a comeback, too.

The “Eagle Ford took a backseat to the Permian during the crash,” analysts at Wunderlich Securities Inc. said in a note Thursday. “While we are big fans of the Permian and appreciate the attractiveness of the stacked pays, we believe that the Eagle Ford is still a solid and prolific trend.

“The available infrastructure, its proximity to the Gulf Coast petrochemical complex and export facilities for multiple products give the trend a competitive advantage.”

It’s also near Mexico, which is increasingly relying on natural gas to fuel power generation. While the Eagle Ford has primarily been seen as an oil play, its dry gas window is attractive to producers wanting to serve Mexico and the Gulf Coast markets as well.

According to the latest Baker Hughes Inc. (BHI) rig count, released Friday, the Eagle Ford stood pat at 86 rigs running during the week. But that’s up by a handsome 197% from the year-ago level of 29 rigs active. By contrast, the Permian Basin added two rigs during the week to end at 364 active, up 156% from the year-ago level of 142.

Increased Lone Star State drilling activity has been lifting Texas and Houston economic indicators. Texas oil and gas companies added 2,300 upstream jobs in April, building on of the 3,500 jobs added in March, the Texas Oil & Gas Association (TXOGA) said recently, citing Texas Workforce Commission (TWC) figures. “This increase marks the seventh straight month of job growth as the tentative recovery of the Texas oil and natural gas industry continues,” TXOGA said.

The upstream sector includes oil and gas extraction and supporting activities and does not include other sectors in the oil and natural gas industry such as refining, petrochemicals, fuels wholesaling, oilfield equipment manufacturing, pipelines and gas utilities.

And in Houston, after surging in 2015 and last year, layoffs filed with TWC are returning to historical average for Houston, according to the Federal Reserve Bank of Dallas. “Current figures are still higher than those observed between 2009 and 2015 but are consistent with a market that is putting the oil bust behind it.” the Dallas Fed said Tuesday.

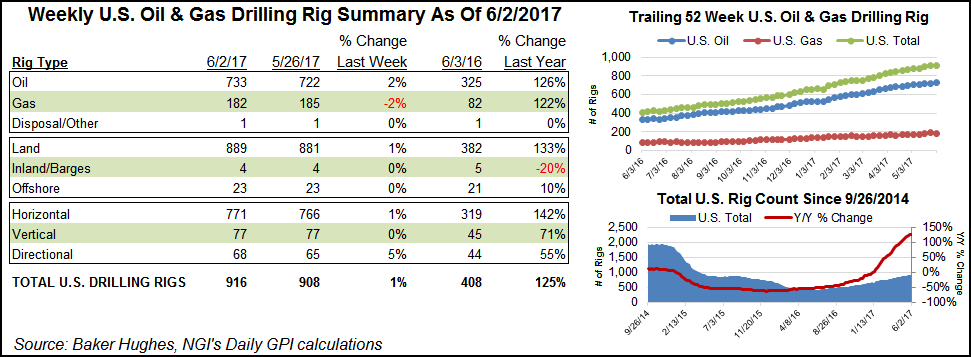

For the week, the BHI U.S. land-based rig count added eight units to end at 889 active. Nothing changed in the inland waters or offshore. Eleven oil rigs came back while three natural gas rigs exited. Three directionals and five horizontals came back. The U.S. count ended at 916 total.

In Canada, six rigs returned: 11 oil units offset by the departure of five natural gas rigs. Canada ended the week with 99 rigs active, and the North America count ended at 1,015, more than double the year-ago level of 449.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |