NGI All News Access | E&P | Infrastructure

U.S. Drops 64 Rigs as Oil Patch in Freefall; Natural Gas Count Eases Lower

Coming off one of the largest down weeks in the past two decades, the pace of retrenchment in the U.S. onshore accelerated during the week ended Friday (April 3), although the natural gas rig count was mostly spared, according to the latest figures from Baker Hughes Co. (BKR).

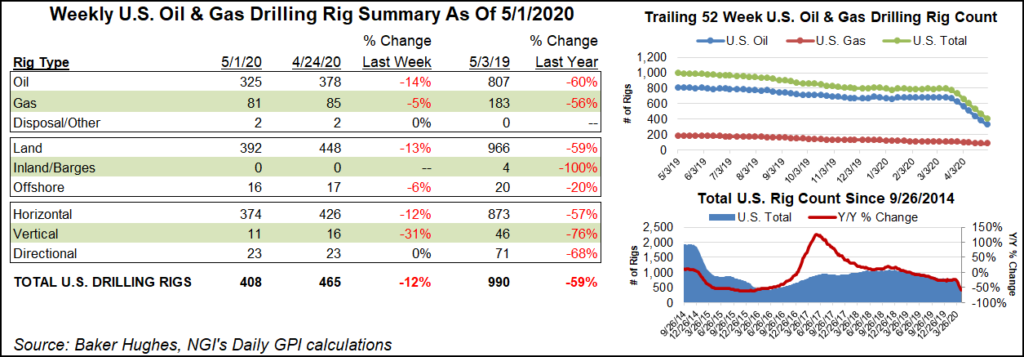

The unmistakable price signal of $20/bbl oil has prompted a swift response from upstream operators, with the slowdown in activity this week even more pronounced than the 44-rig drop BKR recorded in the week prior. Most of the recent week’s losses occurred in the oil patch, with 62 oil-directed rigs packing up. The U.S. natural gas rig count, meanwhile, shed two rigs to fall to 100. That dropped the combined domestic tally to 664, off from 1,025 rigs active in the year-ago period.

Land drilling accounted for the entirety of the drop-off, with the Gulf of Mexico maintaining 18 rigs, flat week/week.

Horizontal rigs saw a net 60-unit decrease week/week, with directional rigs down six units. Two vertical units were added.

In Canada, 13 rigs were sent packing, including nine oil-directed and four gas-directed. That dropped Canada’s count to 41, off from 68 in the year-ago period.

The combined North American rig count ended the week at 705, down from 1,093 at this time last year.

Among plays, once again the Permian Basin — by far the U.S. onshore’s most active — bore the brunt of the losses for the week. The Permian dropped 31 from its total to fall to 351, down more than 100 rigs from the 462 active a year ago.

Also among plays, the Eagle Ford Shale and Williston Basin each dropped six rigs, while the Cana Woodford saw a net decrease of two. The Denver Julesburg-Niobrara, the Haynesville Shale and the Mississippian Lime each dropped one.

Among states, Texas dropped 30 rigs during the week, while New Mexico dropped nine. Oklahoma saw 10 rigs pack up, North Dakota dropped six and Wyoming dropped five. California dropped two rigs, while Alaska and Colorado each dropped one, according to BKR.

The rapid slowdown in the U.S. onshore has coincided with a seemingly nonstop string of announcements from operators planning steep reductions in capital spending as the energy industry faces down the dual threats of the Covid-19 pandemic and an oil price war.

Meanwhile, the borrowing bases of U.S. oil and natural gas producers are likely to be reduced by at least 20% as the outlook for commodity prices remains grim, according to the results of an industry survey conducted by Haynes & Boone LLC.

“The rapid deterioration in market conditions that started on March 8, 2020, had an immediate and deep impact on predictions about future borrowing capacity,” Haynes and Boone’s Kraig Grahmann, head of the Energy Finance Practice Group, said. A “sizable majority of respondents expect borrowing bases to decrease by at least 20% in response to the recent freefall in commodity prices; 45% of respondents expect even deeper cuts, of 30% or more.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |