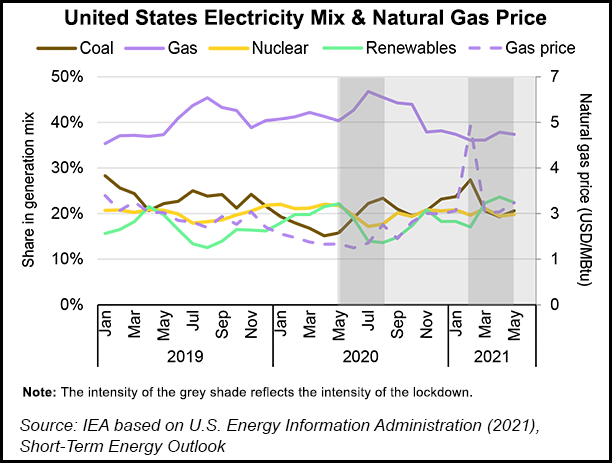

The coal market is witnessing a resurgence in the United States as natural gas prices skyrocket and utilities turn to coal-powered generation, according to Alliance Resource Partners LP (ARLP) CEO Joseph Craft.

“Commodity prices for each of our business segments have skyrocketed to levels not experienced in several years,” Craft said as second quarter earnings results were issued. “Looking ahead, coal market fundamentals are extremely strong both domestically and internationally.”

ARLP is a diversified natural resource company with 1.7 billion tons of coal reserves in Illinois, Indiana, Kentucky, Maryland, Pennsylvania and West Virginia. The company also has oil and gas mineral interests in the Permian, Anadarko and Williston basins.

“In our primary U.S. markets,...