Infrastructure | E&P | NGI All News Access

U.S. Adds Three Rigs, Including Two in Marcellus, BHI Count Shows

The United States added three rigs for the week ended Friday, helped by gains in Oklahoma and in the Marcellus Shale, according to data from Baker Hughes Inc. (BHI).

U.S. producers added two natural gas-directed rigs and one oil-directed rig to end the week at 981 active units, up from 756 rigs running a year ago. Six directional units and five horizontal units were added, with eight vertical units exiting the patch.

The week’s changes also included four rigs added on land and two to inland waters. Three rigs packed up in the Gulf of Mexico, according to BHI.

Canadian drillers dropped six gas-directed rigs while adding two oil-directed to end at 302 active units, down from 335 in the year-ago period. The combined North American rig count finished the week down one to 1,283, up from 1,091 a year ago.

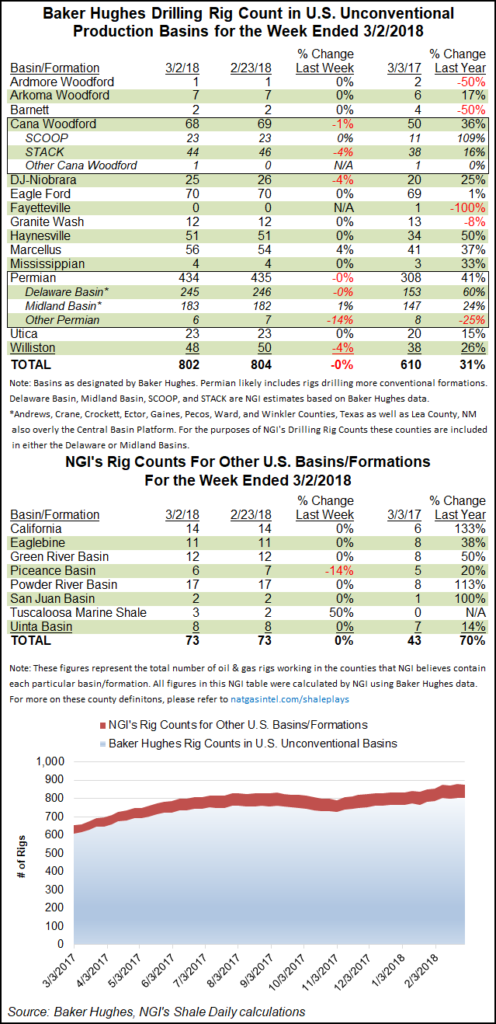

Among the major basins BHI tracks, the Marcellus was the week’s only gainer, adding two units to finish at 56 (41 a year ago). Meanwhile, the Williston Basin dropped two rigs, and the Cana Woodford, Denver Julesburg-Niobrara and Permian Basin each dropped one rig.

Among states, Oklahoma led the way with three units added for the week to end at 124, followed by Pennsylvania and Alaska, which each added two rigs. Texas and New Mexico netted one rig each for the week, according to BHI.

Colorado dropped three rigs week/week, while North Dakota dropped two and Louisiana dropped one.

NGI’s more detailed breakdown of BHI data showed a relatively flat week in the Permian, the U.S. onshore’s most active play by a wide margin. The Permian’s Delaware sub-basin dropped one rig to 245 for the week, with the Midland sub-basin gaining a rig to 183, NGI’s breakdown shows. In the “Other Permian” category, one rig exited to leave the running tally at six.

Pipeline constraints remain a major concern for Permian operators facing the prospect of depressed natural gas spot prices until infrastructure catches up to production.

Centennial Resource Development Inc. CEO Mark Papa recently discussed the company’s plans to spend more on its Permian operations in West Texas to prevent constraints in moving its natural gas to markets.

Papa specifically cited Apache Corp.’s gassy Alpine High development in the Delaware as potentially putting the hurt on other producer volumes.

Alpine High is a “very gassy play,” said Papa, and it “obviously is going to move a lot of gas into that Waha Hub. And then, you’ve got certainly a lot of the casinghead gas coming from the oil development in Reeves County.”

Centennial has “some concerns for 2018, 2019, 2020…In that timeframe you could have some issues on No. 1, getting our gas to Waha, and then No. 2, getting our gas away from Waha.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |