Infrastructure | E&P | NGI All News Access

U.S. Adds One Oil, One Natural Gas Rig; Canadian Count Ticks Up to 112, BHI Says

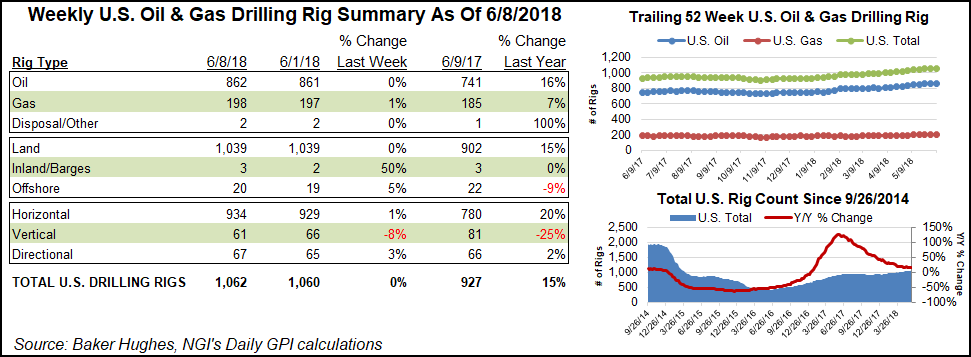

The number of rigs in the United States climbed by two in the week ended Friday, with net gains of one rig in oil-directed drilling and another in natural gas-directed drilling, according to data from Baker Hughes Inc. (BHI).

The United States ended the week at a combined 1,062 rigs, two more than in the previous week and an impressive 135 (14.6%) more than the 927 running a year ago.

Five horizontal and two directional units were added, while five vertical units packed up for the week, according to BHI. One rig each returned in the Gulf of Mexico and inland waters. The number of land rigs remained unchanged week/week (w/w) at 1,039.

Canada saw 13 rigs return to the patch for the week, with all of the increase coming from oil rigs. Canada finished at 112 rigs, down 20 (15.2%) compared with its year-ago total of 132.

The combined North American rig count as of June 8 stood at 1,174, up from 1,059 rigs a year ago, according to BHI.

Among major basins, the biggest weekly increase came in the oil-focused Permian, which added three rigs to grow its count to 480, a whopping 30% increase from 368 a year ago. According to a more detailed breakdown of BHI data by NGI’s Shale Daily, four rigs were added in the Delaware Basin, while one was lost in the Midland Basin.

The only other gainer among basins was the Granite Wash, which added one rig for the week.

BHI data shows the Cana Woodford losing 3 rigs for the week, and another rig lost in the Williston.

Among states, Texas led with a w/w increase of three rigs to finish at 538 units, while Colorado saw two rigs return to the patch. Oklahoma and Wyoming each dropped two rigs w/w, while North Dakota had one unit exit the field.

The Permian may be facing oil and natural gas pipeline bottlenecks, as well as a dearth of supplies and labor, but that has not stopped activity levels and investments from increasing, particularly by private operators, according to analysts. Data indicate a strong expansion recently by private E&Ps in an area called the Midland North, which would be in West Texas, where activity has moved into the development phase.

As of June 1, about 89% of the wells drilled in the Permian were horizontals, according to Energent Group. Of those, 81.4% were drilling for oil, the rest for natural gas. Most of the wells had laterals that were 10,000-15,000 feet long.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |