E&P | Marcellus | NGI All News Access | Permian Basin

U.S. Adds One Natural Gas Rig as Drilling Total Surges on Oil Gains

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

Markets

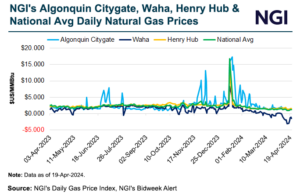

Natural gas futures struggled to find direction on Friday, trading in a narrow range of gains and losses throughout the session. Favorable near-term weather forecasts and continued light production estimates were countered by export weakness and only modest improvement in supply/demand balances evidenced in the latest government inventory data. At A Glance: Output near 98…

April 19, 2024Natural Gas Prices

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.