E&P | NGI The Weekly Gas Market Report

U.S. Added NatGas Along With Oil Rigs in Latest Tally

When rigs return to the energy patch, it doesn’t just mean more oil and natural gas production, they bring with them increased economic activity to the regions where they operate, as the nation’s Federal Reserve banks have noted recently.

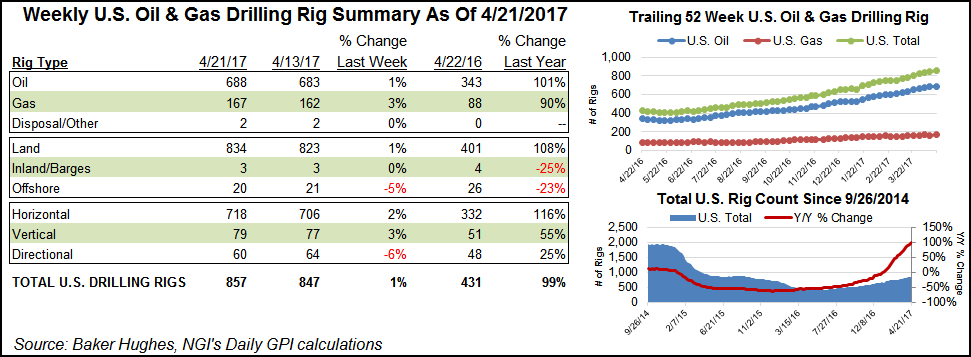

The United States saw a net gain of five oil and five natural gas rigs during the week just ended. More than twice as many oil rigs are operating as there were one year ago, and natural gas rigs are up by 90% from their year-ago tally.

The land-based rig tally climbed by 11 units to end at 834. One rig left the offshore, leaving 20, and there were three rigs running in the inland waters. Twelve horizontal and two vertical units came back as four directional rigs departed.

Texas surpassed the other producing states in rig additions, bringing back six units. The Eagle Ford Shale saw three rigs return, making it the biggest gainer among major plays tracked by Baker Hughes Inc.

Texas ended the week with 426 rigs running, up handsomely from 187 one year ago. The Texas Petro Index, a barometer of Lone Star State oil and natural gas industry health, recently charted its fourth consecutive monthly gain.

Rig Count gains are a component of increased economic activity monitored by the Federal Reserve. Hiring in the energy sector gathered pace in the Dallas, Kansas City and Minneapolis Federal Reserve districts, home to some of the nation’s shale plays, the Fed said recently.

In an April note the Dallas Fed, which is the Eleventh District and includes Texas, northern Louisiana and southern New Mexico, said business activity continued to rise during the first quarter, based on responses from 153 oil and gas executives responding to a Fed survey.

“The business activity index — the survey’s broadest measure of business conditions facing Eleventh District energy firms — was at 41.8, slightly higher than last quarter’s 40.1 reading,” the Fed said. “Business activity was particularly strong among oilfield services firms, with an index of 48.0 [out of a possible 50].”

The Kansas City Fed (Tenth District) includes the western third of Missouri, all of Kansas, Colorado, Nebraska, Oklahoma and Wyoming as well as the northern half of New Mexico. Firms responding to its energy survey said “oilfield service costs have increased slightly over the past year. Additionally, several firms expressed concerns about labor shortages limiting near-term growth.”

One respondent to the Kansas Fed bemoaned “the glut of gas from the Marcellus Shale” and its effect on prices. Another noted high levels of gas in storage and said it will take a while for demand to catch up, “…but when it does, it will be a big swing up in the price.”

In Canada 19 rigs departed (seven oil and 12 natural gas).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 1532-1266 |