NGI The Weekly Gas Market Report | E&P | Infrastructure | NGI All News Access

Two Rigs Exit Natural Gas Patch as BHGE’s U.S. Count Posts Small Annual Decline

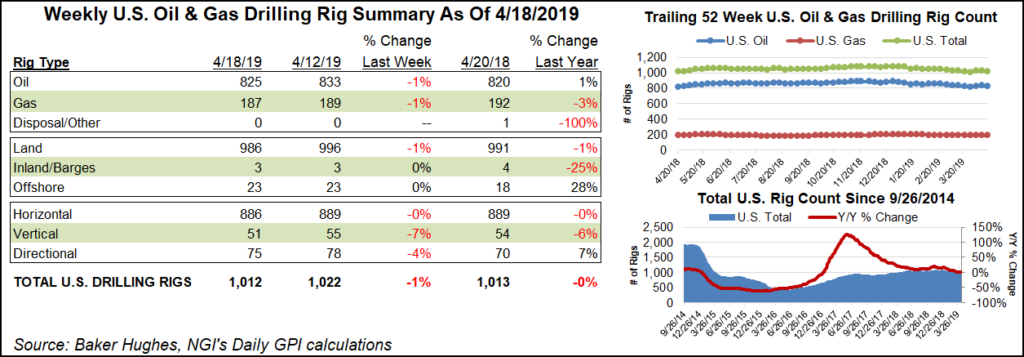

The U.S. natural gas rig count fell two units to 187 for the holiday-shortened week ended April 18, while a pullback in oil activity dropped the overall domestic count below year-ago levels, according to data from Baker Hughes, a GE Company (BHGE).

The U.S. rig count fell 10 units to 1,012, including the departure of eight oil-directed units. Total U.S. drilling activity is now officially down year/year, according to BHGE’s tally, as 1,013 rigs were running in the year-ago period.

The domestic rig count bottomed out in the low 400s in May 2016 amid the fallout from the collapse in commodity prices that began in 2014. From that point until last year, domestic drilling entered a period of ascendancy. After eclipsing the 1,000 rig mark last April, U.S. activity stabilized, with the latest numbers from BHGE illustrating a lack of significant growth or decline over the past year.

BHGE’s latest report, released a day early ahead of the Good Friday holiday, showed the week’s declines focused on land, as Gulf of Mexico activity held at 23 rigs. Four vertical units exited the patch, along with three directional units and three horizontal units.

In Canada, the addition of one oil-directed rig offset the departure of one gas-directed, and the Canadian count finished flat at 66, lagging the 93 rigs active in the year-ago period. The combined North American count finished at 1,078, down from 1,106 a year ago.

Despite the large week/week drop in the U.S. count, BHGE’s breakout of major basins showed activity holding steady in some of the most active plays in the U.S. onshore.

The Haynesville Shale saw two rigs exit for the week, dropping its count to 54, up from 52 a year ago. The Permian Basin, Mississippian Lime and Denver Julesburg-Niobrara each dropped one rig from their respective totals.

Among states, Louisiana, Oklahoma, Texas and Wyoming each dropped two rigs from their totals for the week, while Alaska and Colorado each dropped one, according to BHGE.

The United States’ seven most prolific onshore unconventional plays will churn out nearly 80 Bcf/d of natural gas in May, which is expected to be their 29th consecutive month-to-month increase, according to the U.S. Energy Information Administration (EIA).

Total production from the seven plays is expected to reach 79.84 Bcf/d next month, compared with an estimated 78.93 Bcf/d in April, according to EIA’s latest Drilling Productivity Report, which was released earlier in the week.

Meanwhile, U.S. crude oil exports nearly doubled in 2018, rising to 2.0 million b/d versus 1.2 million b/d in 2017 as domestic volumes reached 42 destinations across the globe, according to EIA.

Along with the sharp growth in exports — driven by higher domestic crude production and infrastructure changes — the agency also noted significant shifts in export volumes by destination in 2018, including a drop in exports to China and growth in exports to South Korea, Taiwan and Canada.

U.S. crude oil production rose 17% to 10.9 million b/d in 2018, including 7.1 million b/d produced in the Gulf Coast, the departure point for 90% of U.S. crude oil exports, EIA said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |