Infrastructure | E&P | NGI All News Access

Two Natural Gas Rigs Exit the Patch as Slowdown in U.S. Onshore Continues

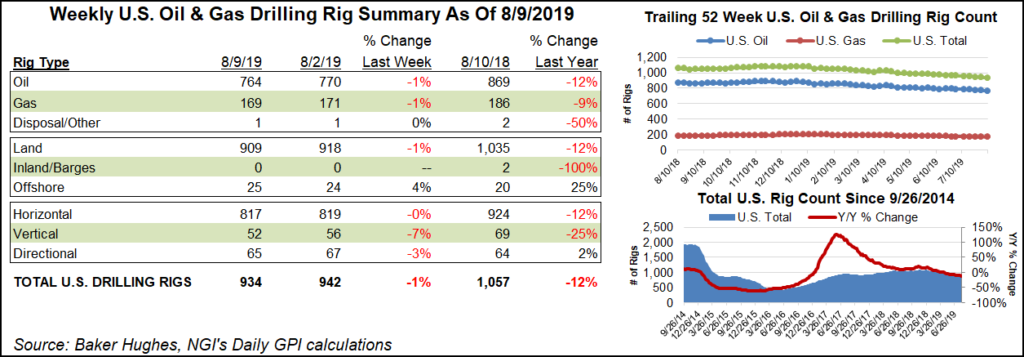

The U.S. natural gas rig count fell two units to 169 for the week ended Friday (Aug. 9), another week that saw overall domestic drilling activity contract, according to the latest data from Baker Hughes, a GE Company (BHGE).

Six oil-directed rigs exited the patch for the week, dropping the combined U.S. count to 934, 123 units behind its year-ago total of 1,057. The number of active U.S. rigs has declined steadily since late last year, when the rig count topped 1,080, BHGE data show.

Nine rigs departed on land for the week, offsetting the addition of one rig in the Gulf of Mexico. Four vertical units packed up shop, along with two directional units and two horizontal units.

The Canadian rig count added three rigs — all oil-directed — to end the week at 140, lagging its year-ago total of 209. The combined North American rig count finished at 1,074, down from 1,266 a year ago.

Among the major plays, Oklahoma’s Cana Woodford saw the largest week/week decline in BHGE’s latest tally, falling three rigs to 45, down from 68 in the year-ago period. The Haynesville Shale also saw two rigs exit for the week, dropping its total to 50, roughly flat with the 49 rigs running there at this time last year.

Also among plays, the Permian Basin added two rigs to reach 444 for the week, down from 485 a year ago. The Granite Wash also added two rigs to its total.

Among states, Alaska dropped four rigs on the week, while Louisiana and Oklahoma each dropped two from their respective totals. Kansas and Texas each saw one rig depart for the week.

New Mexico, meanwhile, saw a net gain of two rigs, growing its total to 109, up slightly from 107 a year ago.

The latest financial results from industry players continue to show exploration and production companies shifting their focus to living within cash flow amid a challenging commodity price environment.

Comstock Resources Inc., which this year became the No. 1 operator in the natural gas-heavy Haynesville, said second quarter output from the play was 88% higher than a year ago and 19% higher sequentially, but confronted with continued low prices, the company is playing defense.

Comstock’s average realized gas price, including hedging gains, decreased 13% from a year ago to $2.29/Mcf, while oil prices fell 9% to average $52.12/bbl.

Meanwhile, Devon Energy Corp., which has continued to build a more oil-targeted Lower 48 arsenal, said during the week it plans to take capital reserved for Oklahoma and move it to the Permian Delaware and Powder River basins.

For Devon, realized quarterly oil prices without hedges averaged $57.09/bbl, versus $65.41 in 2Q2018. Natural gas liquids fetched $14.79/bbl from $24.10. For natural gas, the realized price was $1.61/Mcf, compared with $2.03 a year earlier.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |