TransCanada Rustling Up NatGas Utility Support For Energy East Project

A settlement on replacement capacity for natural gas distribution companies in central Canada and the northeastern United States may remove the economic obstacle delaying TransCanada Corp.’s mammoth Energy East project.

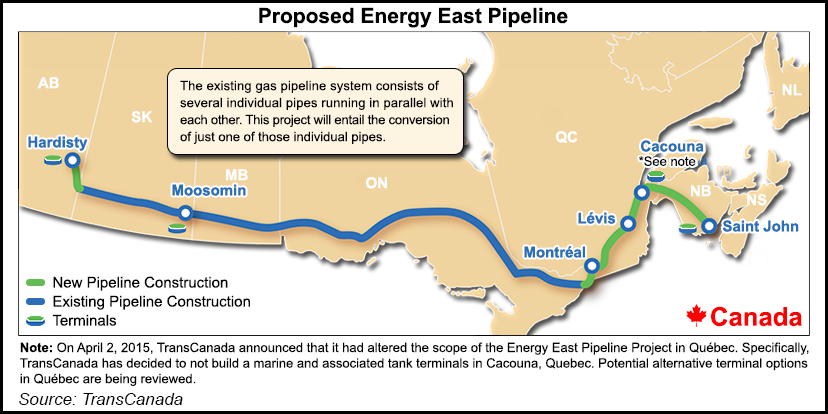

TransCanada has told the National Energy Board (NEB) to expect an amendment to the gas piece of the proposed partial conversion to oil service of its half century-old Mainline from Alberta to Ontario, Quebec and U.S. connections.

The notice cites “ongoing commercial processes that may impact the scope of the Eastern Mainline Project” (EMP), a C$1.5 billion (US$1.2 billion) plan to satisfy gas distributor needs with a new 245-kilometer (152-mile) line across southern Ontario.

While details are undisclosed, TransCanada says the processes include reviewing results of two open seasons for gas capacity bookings and negotiations that began last fall and will continue into May.

As a C$12 billion (US$10.7 billion) partial conversion and extension of the old cross-country conduit to take 1.1 million b/d of oil to the Atlantic Coast, Energy East has enthusiastic support on the western supply side of Canadian energy markets.

The scheme would cut costly excess capacity for natural gas in Alberta, Saskatchewan, Manitoba and northern Ontario. The production industry — and especially growing oilsands plants — would escape reliance on exports to the United States, where environmentalists persuaded the government to withhold approval of TransCanada’s proposed Keystone XL express line to refineries on the U.S. Gulf Coast.

But in central Canada and the northeastern United States, Energy East and its associated Eastern Mainline proposal ran into stiff environmental and economic opposition as soon as TransCanada filed more than 30,000 pages of applications for the projects last October.

TransCanada jumped the biggest green hurdle — apart from objections to support of oilsands development — by dropping plans for an eastern Quebec export tanker dock early this month. The location, at Cacouna on the St. Lawrence Seaway, was near a colony of beluga whales, which may soon be designated a threatened or endangered species.

The environmental move left TransCanada facing stiff resistance from its top gas service subscribers: distributors Union Gas (Spectra) in southwestern Ontario, Enbridge Gas in Toronto and the Ottawa region, and Gaz Metro in Quebec, as well as a dozen New York, New England and New Jersey counterparts in the Alberta Northeast Gas supply procurement consortium.

In the distributors’ service territories, which TransCanada calls its Eastern Triangle, the old gas Mainline has stayed full. Short-haul traffic and pipeline facilities are growing in the region, thanks to strong trade in U.S.-sourced supplies, chiefly from the Marcellus Shale. U.S. exports to central Canada more than doubled, nearly to 1 Tcf per year, since 2007.

Just how much gas replacement capacity would be made necessary by the Energy East conversion emerged as a hotly contested issue, along with complicated arguments about whether TransCanada or the distributors should pay for the facilities.

The original version of the proposed new Eastern Mainline was designed for initial traffic of about 550 MMcf/d. The distributors questioned the volume forecast, while also insisting that TransCanada and its prospective oil customers should cover all costs of replacing lost Eastern Triangle gas delivery capacity.

After disputes broke out with the distribution companies, the NEB effectively froze regulatory review of the blueprint for pipeline restructuring by deeming TransCanada’s application to have gaps.

A federally legislated mandate for efficient approvals sets a 15-month deadline for decisions on major projects, but the clock only starts running after proposals are formally accepted as complete.

The board has indicated that a completeness ruling could take the rest of 2015, prompting TransCanada to postpone its in-service target date for the package to 2019. Amendments to the applications, “including any financial impact on gas shippers,” will be made known sometime this year, the company said in its notice to the NEB.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |