Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

TransCanada Officially Dumps Energy East NatGas Mainline Conversion

TransCanada Corp. confirmed Thursday that a proposed partial conversion of its Energy East natural gas mainline to oil service is dead, blaming “changed circumstances” for loss of the C$15.7 billion ($12.6 billion) plan.

As a side effect, the Calgary pipeline and power conglomerate also scrapped its Eastern Mainline project, a C$2 billion ($1.6 billion) package that would have replaced central Canadian gas capacity cut by the oil switch.

TransCanada foreshadowed the decision in early September when it announced it would halt Energy East spending after the National Energy Board (NEB) added oilsands greenhouse gas emissions to the agenda for hotly contested cross-country public hearings.

TransCanada expects to record a C$1 billion ($800 million) loss on Energy East, said President Russ Girling.

“In light of the project’s inability to reach a regulatory decision, no recoveries of costs from third parties are expected.”

He did not specify the changed circumstances that ended the project, leaving an open stage for an instant Canadian political furor.

On the left, environmental and native opponents claimed victory. On the right, pro-industry factions blamed the Liberal government in Ottawa and Alberta’s New Democratic Party regime. In Canada’s regional politics arena, western and Atlantic provincial leaders of all partisan stripes blamed the federal government for the project loss.

Amid the partisan crossfire, the national voice of workers that would have built Energy East and the Eastern Mainline expressed widespread frustration with ever slower, less predictable Canadian industrial development approval processes.

“Canadians need to understand that at the end of the day project approvals are a political decision,” said Canada’s Building Trades Unions, a coalition of 15 labor groups with 500,000 members. “A political decision seems to have been made here and it is not one that is necessarily in the interests of Canadians particularly our members.”

Also outside the political arena, at a practical level industry analysts pointed to economic changes in the four years since TransCanada crafted the foiled plan to deliver 1.1 million b/d from Alberta to eastern refineries and a New Brunswick tanker dock.

Oil prices fell more than 50%. The project driver, Alberta oilsands production growth, slowed down. Other expanded and new routes, to markets in the United States and overseas, achieved approvals and are headed into construction.

A trio of pipeline projects is forging ahead with combined capacity for 1.8 million b/d: the 590,000 b/d Trans Mountain expansion to the Pacific coast, a 370,000 b/d addition to the Enbridge system, and 890,000 b/d in TransCanada’s own Keystone XL project revived by approval from the Trump administration.

The lines will be open to all production, but most traffic is forecast to flow from Alberta thermal oilsands extraction, which after a cost-cutting campaign continues to increase. As Canada’s largest industrial natural gas consumer, the sector’s growth drives additions to TransCanada’s gas pipeline network as well as its oil conduits.

In the corporate epitaph for Energy East and the Eastern Mainline, Girling emphasized that TransCanada growth is far from over.

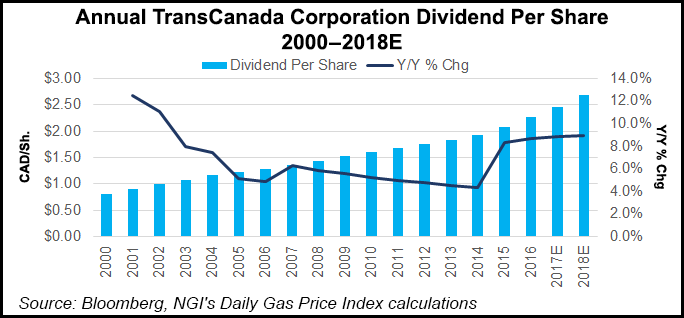

“We will continue to focus on our C$24 billion ($19.2 billion) near-term capital program which is expected…to support an annual dividend growth rate at the upper end of an 8-to-10% range through 2020.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |