Traders Scratching Their Heads Following Plump EIA Stats

October futures worked higher Thursday following a report by the Energy Information Administration (EIA) showing a storage injection that was greater than what traders were expecting.

The EIA reported a storage injection of 91 Bcf, about 6 Bcf above consensus estimates. At the time the report was issued Thursday, the market was hovering around $3.052. Following the release, October futures jumped to $3.093, and by 10:45 a.m. October was trading at $3.081, up 2.3 cents from Wednesday’s settlement.

Prior to the report traders were looking for a storage build somewhat lower than the actual number, but well above historical norms. Last year 58 Bcf was injected and the five-year average stands at 63 Bcf.

Kyle Cooper of ION Energy calculated a 90 Bcf injection and Ritterbusch and Associates was looking for a 77 Bcf build. A Reuters survey of 23 traders and analysts showed an average 85 Bcf with a range of +70 Bcf to +94 Bcf.

The market’s reaction to the number caught traders by surprise.

“The number should have been bearish, right?” a New York floor trader told NGI. “It took a brief downturn and then made new highs. The session’s low of $3.036 was not made after the number came out.

“I had heard 83 Bcf-85 Bcf and coming in at 91 Bcf, you would have thought it would have made a downturn. It seems to happen all the time. Within 15 minutes of the number coming out, we are trading at or above where it was or at or below where it was depending on the significance of the number. You’ve got to make your moves real quick and get out because you are going to lose money within the 15-minute time frame.

“It doesn’t make a lot of sense, but sometimes this market doesn’t. You can say that natural gas got a psychological boost from crude oil, which is trading over $50/bbl and made a new high at $50.50/bbl as well.

The trader said, “Above $3.10 should be a little bit of a resistance level, but the main one is going to be $3.25; $3 will be a little bit of support underneath and below that you will get something at the $2.85 to $2.90 level, but primarily $2.75. Right now I am not looking to see either one of those, $2.75 or $3.25.”

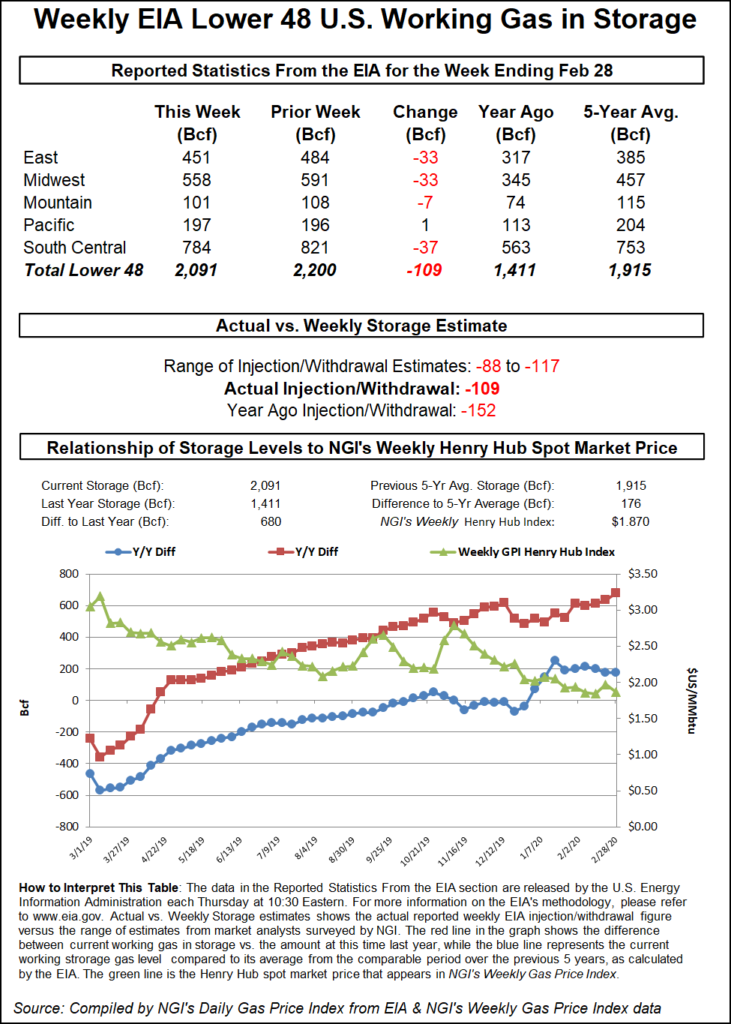

Inventories now stand at 3,311 Bcf and are 179 Bcf lower than last year and 43 Bcf above the five-year average. In the East Region 28 Bcf was injected, and the Midwest Region saw inventories rise by 34 Bcf. Stocks in the Mountain Region were 3 Bcf higher, and the Pacific Region was unchanged. The South Central Region added 26 Bcf.

Salt storage rose by 19 Bcf to 285 and nonsalt storage increased 7 Bcf to 807 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |