Traders Mull Demand Destruction, LNG Exports; October Gains 6 Cents

Physical natural gas continued its trek higher Wednesday as temperature forecasts called for above-normal levels. Gains of about a nickel to a dime were widespread, with strength noted in Louisiana, Texas, the Midcontinent and Midwest. The NGI National Spot Gas Average added a stout 4 cents to $2.69.

Futures prices continued their upward trajectory as well, but still within widely acknowledged trading parameters. At the close, October had gained 5.7 cents to $3.058, and November was up 5.1 cents to $3.118. October crude oil jumped $1.07 to $49.30/bbl.

Traders on Tuesday had acknowledged that much of the concern over demand destruction may have been overestimated when October futures plunged 9 cents on Friday. Power burn in the Southeast has taken a bit of a hit from the recent hurricane damage, according to PointLogic Energy.

“Over the period of Sept. 5-13, Southeast power burn has dropped 22%, or 2.06 Bcf/d,” said NGI Market Analyst Nathan Harrison. “However, it looks like some of this recent demand loss may have been offset, to some extent, by a perfectly timed resurgence in liquefied natural gas exports, which climbed 2.18 Bcf/d over the same period.”

Northeast gains occurred as temperatures were forecast nearly 9 degrees above normal for Thursday. Wunderground.com predicted Boston’s high on Wednesday of 77 would reach 83 Thursday before settling down to 76 on Friday, 2 degrees above normal.

Gas at the Algonquin Citygate rose 6 cents to $2.13, and deliveries to New York City on Transco Zone 6 gained 14 cents to $2.43. Packages on Tetco M-3 Delivery added 8 cents to $1.22, while gas priced at Dominion South rose a dime to $1.16.

Chicago’s high of 76 on Wednesday was forecast to increase to 81 by Thursday and 85 by Friday, 9 degrees above normal.

Gas at the Chicago Citygate gained 6 cents to $2.95, and deliveries to the Henry Hub tacked on 10 cents to $2.99. On El Paso Permian deliveries Thursday came in 2 cents higher at $2.73, and gas priced at Northern Natural Demarcation was quoted 3 cents higher at $2.87.

The National Weather Service (NWS) in Chicago said a range in temperatures and dewpoints was observed across the area, with northwestern areas seeing sunshine, highs around 80 and dewpoints in the upper 40s, while the Southeast was cloudy, with temperatures and dewpoints in the 60s.

Winds were expected to drop off Wednesday night, allowing for radiational cooling in the Northwest. Based on current temperature/dewpoint trends and Wednesday morning observations, the Northwest could see temperatures in the upper 40s, according to NWS.

Elsewhere, Kern Receipts added 3 cents to $2.76, and Kern Delivery changed hands 2 cents higher at $2.89. Gas at the SoCal Citygate fell 2 cents to $3.15, and gas at the SoCal Border Average rose a penny to $2.87.

Futures bulls had a supportive weather forecast at their backs.

Wednesday’s demand gains were estimated to run higher than Tuesday’s and lower than Monday’s “as this new warm pattern for the Midwest, East, South appears to hold longer and stronger well into the 11-15 day range,” said Commodity Weather Group President Matt Rogers in a Wednesday morning report to clients.

“Some slightly cooler South and warmer West changes are noted in the short term one-to-five day, but then the main six-15 day, themes are warmer Midwest, East, South with cooler western adjustments. The warmest anomalies continue to be in the Midwest, where cooling demand is weaker this time of year, but warm to hot gains in the South and East easily help drive more last-minute demand increases for this cooling season.”

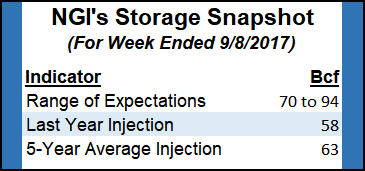

Natural gas storage currently stands at 3,220 Bcf, and traders Thursday will be looking for another plump addition in line with last week’s hefty build. Estimates are coming in in the 90 Bcf range. Last year 58 Bcf was injected and the five-year pace stands at 63 Bcf.

Ritterbusch and Associates is looking for an increase of 77 Bcf, and ION Energy calculated a 90 Bcf injection. A Reuters poll of 23 traders and analysts revealed an average 85 Bcf with a range of +70 Bcf to +94 Bcf.

Stout storage builds or not market technicians versed in Elliott Wave and Retracement don’t see any reason for the bears or bulls to get enthused, at least not yet.

Progress is higher “but still no breakout,” said United ICAP analyst Brian LaRose in closing comments Tuesday. He was “sticking to a neutral stance for now. What would get us to assume a more bullish posture? A close above the dense band of resistance straddling the $3.100 level.”

LaRose is not about to jump on any weather-driven or otherwise bullish bandwagon “until the bulls prove they are gaining the upper hand.” He is prepared to test a low in the $2.80s, “if the bulls cannot get the job done.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |