International | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report | Oil | Shale Daily

TotalEnergies Vows to Withhold Capital in Russia Following ‘Military Aggression’ in Ukraine

The energy industry on Tuesday continued its condemnation of Russia’s unprovoked invasion of Ukraine, with TotalEnergies SE joining BP plc, Equinor ASA and Shell plc in withdrawing capital for new projects.

Shunning Russia has been nearly universal, with the western energy majors, some with large interests in the country, pulling back resources. ExxonMobil was one of the few supermajors that had not publicly stated Tuesday afternoon its go-forward plans in Russia, where it has several ventures underway. However, ExxonMobil was said to be evacuating employees from the country.

“TotalEnergies supports the scope and strength of the sanctions put in place by Europe and will implement them regardless of the consequences (currently being assessed) on its activities in Russia,” a spokesperson said. “TotalEnergies will no longer provide capital for new projects in Russia.”

The French supermajor, like its peers, blasted “Russia’s military aggression against Ukraine, which has tragic consequences for the population and threatens Europe.” The company also said it was standing in “solidarity with the Ukrainian people, who are suffering the consequences and with the Russian people who will also suffer the consequences.”

TotalEnergies said it is mobilized “to provide fuel to the Ukrainian authorities and aid to Ukrainian refugees in Europe.”

The actions by TotalEnergies followed the initial move by London-based BP plc on Sunday, which announced it would sell its stake in Russia’s state-owned Rosneft. London-based Shell and Norway’s Equinor followed suit on Monday, each announcing they would exit Russian joint ventures and end new investments. Among other things, Shell plans to sell its stake in Russian-controlled Gazprom, which is overseeing the delayed Nord Stream 2 natural gas pipeline that would move Russian supplies to Germany.

‘Devastating’ Human Impact

Scores of energy companies are shunning Russia’s actions.

Glencore, one of the world’s largest global commodities traders, also voiced its opposition.

“We have no operational footprint in Russia, and our trading exposure is not material for Glencore,” the executive team said. “We are reviewing all our business activities in the country,” which includes equity stakes in Rosneft and En+ Group plc. Anglo-Russian En+ has a controlling stake in Rusal, one of the largest producers of aluminum in the world.

“The human impact of this conflict is devastating,” a Glencore spokesperson said. “Glencore is looking to see how we can best support humanitarian efforts for the people of Ukraine.”

Chevron Corp. CEO Mike Wirth, who was helming the annual Investor Day on Tuesday, joined in the chorus of Russia’s condemnation. Wirth noted that the San Ramon, CA-based energy major has only a small presence in Russia.

“Obviously, it’s a tragic situation as you watch this unfold,” Wirth said. “We don’t have direct exposure in Ukraine. We don’t really have much exposure in Russia,” with the exception of a 15% stake in the Caspian Pipeline Consortium (CPC). The CPC pipeline transports oil from the Tengiz field to the Black Sea coast in Russia.

The pipeline is “the only asset that we have in Russia,” he said. “We don’t produce and sell out of Russia,” Wirth noted. “We really just transit through Russia with our production from Kazakhstan.”

In discussing the situation with analysts, Wirth said “the actions that have been taken thus far by governments in Europe, the U.S.…and others have been crafted in a way to try to create the desired outcomes and yet not impede energy flows.

“I think there’s a recognition that coming into this, energy inventories were low, supplies were tight, and there were very conscious efforts to not impose further energy cost pain on the global economy.”

Chevron is “relatively less affected…than most others in the industry,” he said. However, “secondary impacts” already are being seen.

“Shipping rates have gone up; insurance typically follows,” Wirth said. “Marine movements in the Black Sea now are becoming a little bit more carefully choreographed.

“We have not seen any interruption of physical flows of oil or gas, at least none that I’m aware of. But there are certainly a lot of people who are concerned Urals crude discounts have widened out…so we’re beginning to see the effect of these things show up in the marketplace.”

Urals is the most common export crude oil grade from Russia and considered a key benchmark for the medium sour crude market in Europe.

Will Energy Policies Evolve Following Conflict?

Regarding the potential impact to global gas markets into the future because of the Russian conflict, Wirth was hesitant to offer a near-term forecast.

“I think it’s early days to really have confidence in how energy policy is likely to evolve as a result of this,” he said. “My view is that many countries have had imbalanced approaches to energy policy in recent times…

“As you look at balancing out the needs of the economy for energy, the realities about diversity of supply and energy security, and then also environmental objectives, those need to be considered in a balanced frame,” the Chevron chief said. “I think the frame has been a little bit unbalanced in many instances.”

What’s happening now is the reality that “reliability matters, affordability matters, and of course, ‘ever cleaner’ matters,” Wirth said. “We talk a lot about affordable, reliable and ever cleaner.”

However, in many discussions he’s had, Wirth said the reliability and affordability factors “get brushed by pretty quickly in pursuit of the third. And I think it’s going to be important for policymakers to consider how we balance all of those as we go together.”

In any case, there’s a big need for more natural gas, Wirth told analysts.

“We do think there is a very important and growing role for gas in the mix, particularly as you see more wind and solar,” he said. “You need some sort of reliable generation capacity to deal with the intermittency that we’re gonna see increasingly…” It happens in California, where Chevron is headquartered, “pretty regularly when you need to have natural gas generation spin up to keep the grid balanced. So I think it was a good future for natural gas.”

Chevron has a “big position” in the Eastern Mediterranean (Med), where it has stakes in several gas projects and pipelines.

“We see a bigger role for gas in the future and Eastern Med, which is certainly an important asset for us in the portfolio.”

IEA Members Releasing Oil Reserves

Meanwhile, the 31 member countries of the International Energy Agency (IEA) governing board have agreed to release 60 million bbl of oil from their emergency reserves “to send a unified and strong message to global oil markets that there will be no shortfall in supplies as a result of Russia’s invasion of Ukraine.”

The IEA ministers also discussed Europe’s “significant reliance on Russian natural gas and the need to reduce this by looking to other suppliers,” including via liquefied natural gas. They said they would “continue to pursue a well-managed acceleration of clean energy transitions.

“On Thursday, the IEA Secretariat will release a 10-point plan for how European countries can reduce their reliance on Russian gas supplies by next winter.”

IEA’s extraordinary governing board meeting was chaired by U.S. Secretary of Energy Jennifer Granholm.

During Tuesday’s meeting, the ministers of the global energy watchdog “expressed solidarity with the people of Ukraine and their democratically elected government in the face of Russia’s appalling and unprovoked violation of Ukraine’s sovereignty and territorial integrity.”

The ministers noted “the energy security impacts of the egregious actions by Russia and voiced support for sanctions imposed by the international community in response.”

Russia’s invasion “comes against a backdrop of already tight global oil markets, heightened price volatility, commercial inventories that are at their lowest level since 2014 and a limited ability of producers to provide additional supply in the short term,” IEA noted.

“It is heartening to see how quickly the global community has united to condemn Russia’s actions and respond decisively,” said IEA executive director Fatih Birol. “The situation in energy markets is very serious and demands our full attention. Global energy security is under threat, putting the world economy at risk during a fragile stage of the recovery.”

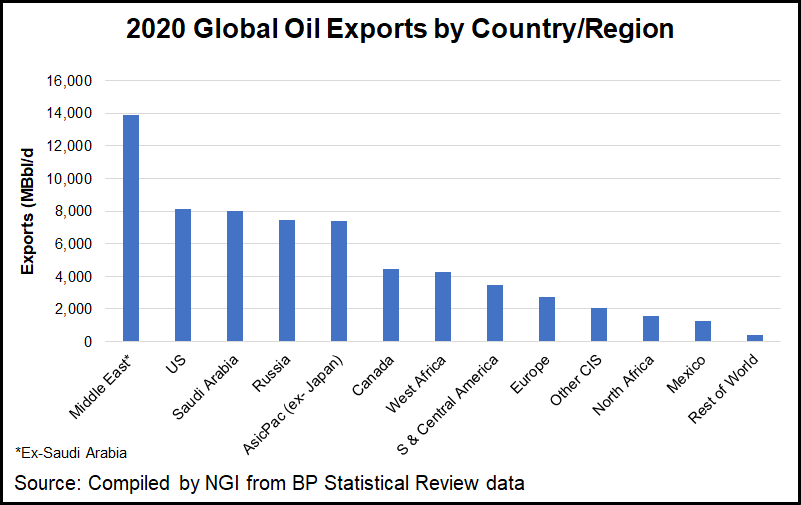

According to the IEA, “Russia plays an outsized role on global energy markets. It is the world’s third largest oil producer and the largest exporter. Its exports of about 5 million b/d of crude oil represent roughly 12% of global trade…” IEA also noted that Russia’s 2.85 million b/d of petroleum products “represent around 15% of global refined product trade. Around 60% of Russia’s oil exports go to Europe and another 20% to China.”

The IEA ministers said “energy supply should not be used as a means of political coercion nor as a threat to national and international security.” The governing board also encouraged each member country “to do its utmost to support Ukraine in the supply of oil products, recommending that governments and consumers maintain and intensify conservation efforts.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |