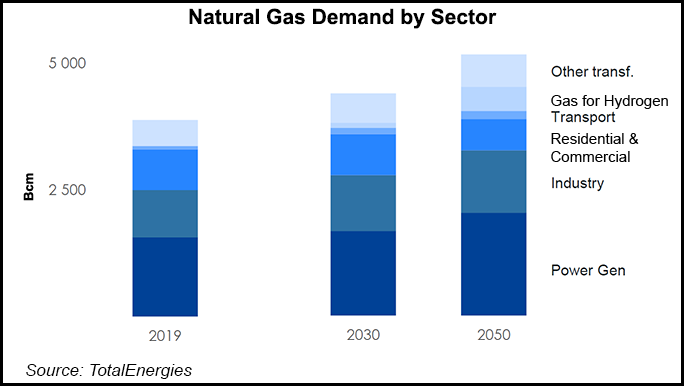

Global oil demand should plateau earlier than estimated, likely before 2030, but natural gas will continue to play a key role in the energy transition, TotalEnergies said Monday.

The Paris-based multi-energy major provided its third annual short-term forecast in the Energy Outlook (EO) 2021. Ahead of the upcoming United Nations (UN) Climate Change Conference, also known as COP26, the Energy Landscape report details the global pace of the transition toward net-zero carbon.

“Energy transition is a global debate, and there is consequently a necessity for society as a whole to participate,” CEO Patrick Pouyanné said. The two documents are “in line with our strategy to build a multi-energy company” as it moves toward net zero carbon by 2050.

Sustainability is “at the...