TotalEnergies SE benefited from a rebound in commodity prices in the second quarter as earnings came in above pre-Covid 19 levels during the same period in 2019.

The French supermajor said international oil and natural gas markets climbed 13% and 28%, respectively, sequentially in 2Q2021.

The integrated gas, renewables and power segment also continued to grow. Liquefied natural gas (LNG) sales were 10.5 million tons in the second quarter, up 8.5% from the year-ago period and a 1% gain from the first quarter.

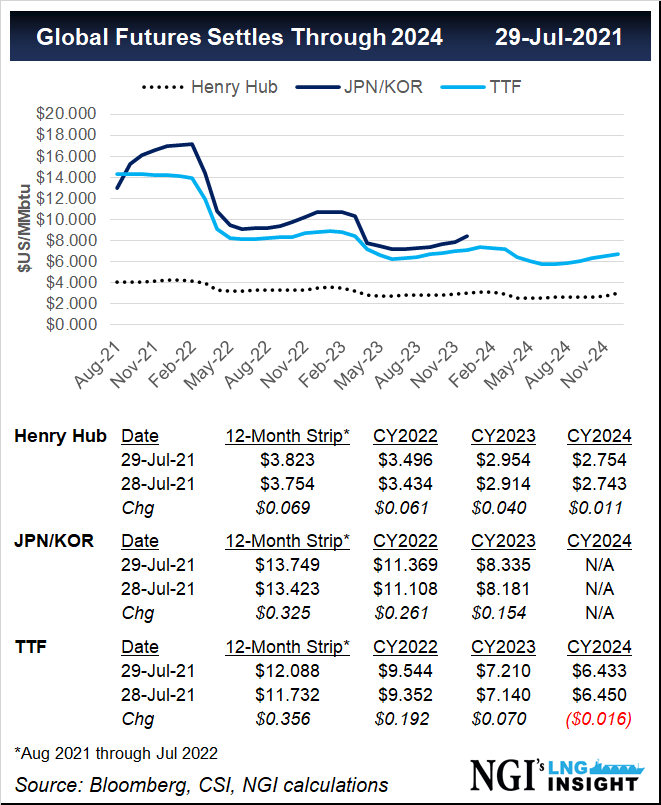

Average LNG prices were up 50% year/year in the second quarter to $6.60/MMBtu. Prices were lifted by the lag effect of rising crude prices on long-term oil-linked LNG contracts, as well as the increase in gas prices for spot LNG contracts. Oil-indexed LNG contracts are...