TotalEnergies Expanding North Field Investment with Qatar to Build LNG Capacity

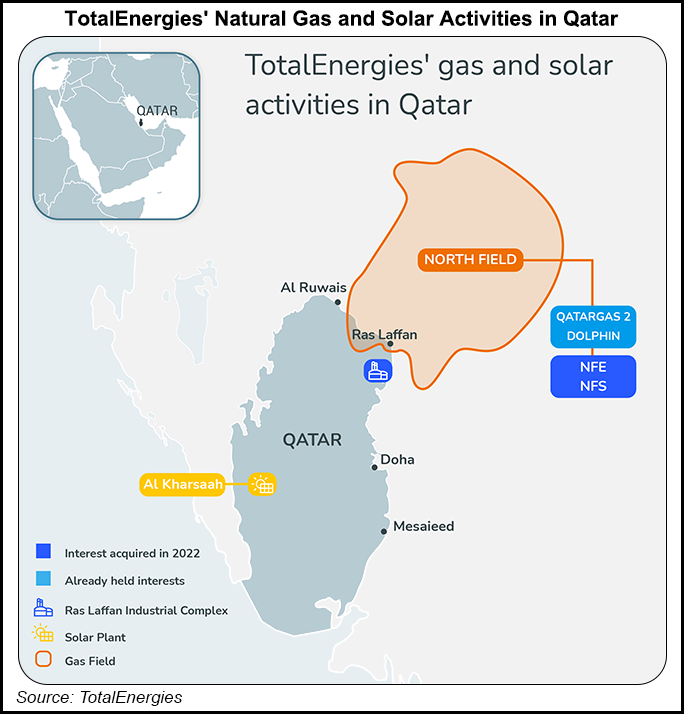

TotalEnergies is expanding its investment in Qatar’s next wave of natural gas and LNG development as the first international stakeholder in the North Field South (NFS) project.

The French major agreed to take a more than 9% stake in the 16 million metric ton/year (mmty) liquefied natural gas project planned for the waters off of Qatar’s northeastern coast. QatarEnergy is offering a 25% stake for foreign investment and retaining the majority.

North Field South is the second project in QatarEnergy’s North Field expansion. In June, TotalEnergies agreed to take a 6.25% interest in the 32 mmty North Field East (NFE) project. It was soon followed by ExxonMobil, ConocoPhillips and Eni SpA.

TotalEnergies CEO Patrick Pouyanné said capturing more interest “will make a major contribution to increasing LNG supply in the years to come” and support goals to secure more energy for Europe.

QatarEnergy sanctioned NFE last year and awarded a $2 billion engineering, procurement and construction (EPC) contract to Samsung C&T Corp. NFS is still unsanctioned. The NFE and NFS twin projects would increase LNG production from the North Field by 48 mmty by 2028. The expansion would give the state-controlled company 126 mmty in total export capacity from the field.

NFS could be supported by upstream development of five platforms, 50 wells and additional pipelines. The projects would incorporate greenhouse gas emission reduction designs, including carbon capture and sequestration (CCS) and electrification.

QatarEnergy is also a 70% stakeholder in the Golden Pass LNG terminal project on the Texas coast with ExxonMobil. The facility is expected to ramp in 2024.

TotalEnergies aims to increase the share of natural gas to 50% by 2030. It has investments in projects that could boost its global gas portfolio to 50 Mt/year by 2025. The company finalized equity partnerships with Sempra Infrastructure earlier this year to take a one-third ownership in the Vista Pacifico LNG terminal in Mexico and becoming a joint venture partner in the CCS project for Port Arthur LNG southeast of Houston.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |