Infrastructure | LNG | NGI All News Access | NGI The Weekly Gas Market Report

Total, Tellurian Boost Partnership in Louisiana LNG Export Project Ahead of FID

Total SA’s stake in Tellurian Inc.’s planned Louisiana liquefied natural gas (LNG) export project is nearing the $1 billion mark after the French major agreed to invest another $500 million in the facility.

In a signed heads of agreement (HOA) with Tellurian, Total management said Wednesday it agreed to purchase 1 million metric tons/year (mmty) from the Driftwood LNG export terminal, to be sited on the west bank of the Calcasieu River, south of Lake Charles.

The HOA specifies that Tellurian and Total would enter into a sales and purchase agreement (SPA) for a further 1.5 mmty from Tellurian Marketing’s offtake volumes from Driftwood. The production would be purchased on a free-on-board basis for at least 15 years, at a price linked to the Japan Korea Marker.

“Our partnership with Total began before the inception of Tellurian, when Total endorsed a new business model for U.S. LNG,” Tellurian CEO Meg Gentle said. The developer’s unique strategy centers around eliminating Henry Hub gas price volatility by owning the volumes. “We look forward to consistently delivering on our development plan for Driftwood LNG and the integrated network, beginning construction on the largest privately funded infrastructure project in the U.S., and producing low-cost, reliable natural gas as we dedicate LNG to reduce urban pollution and transition to a low-carbon economy.”

Total also has agreed to buy around 19.87 million shares of Tellurian common stock for $200 million, including a positive final investment decision (FID) on the Driftwood project, which is expected by mid-year. Including Total’s original $207 million investment in 2016, the aggregate investment would equal $907 million.

The common stock purchase agreement specifies that Tellurian Marketing would purchase equity interests in Driftwood, which Tellurian intends to fund with private equity financing. Tellurian expects the equity interest would represent 2 mmty of purchases and after the roughly 27.6 mmty Driftwood terminal is completed, the marketing arm would receive about half, or 13.6 mmty.

“The cost to produce natural gas in the U.S. continues to fall, as the engine of American innovation finds more efficient ways to apply technology to producing its vast energy resources,” Total CEO Patrick Pouyanne said. “The Tellurian team has an established track record of developing and constructing energy infrastructure on time and at the lowest cost.”

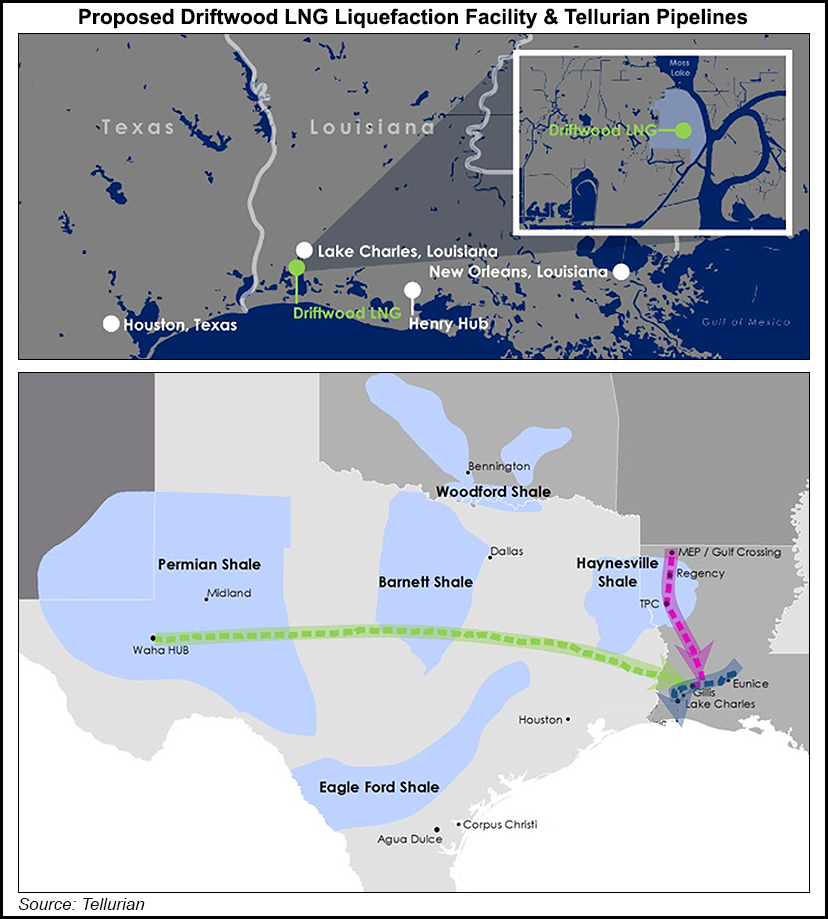

Tellurian also has gas production, gathering, processing and transportation projects in the works. The Driftwood Pipeline is a 96-mile, 48-inch diameter gas pipeline that would transport up to 4 Bcf/d from near Gillis, LA, and terminate at the LNG export terminal. Two additional pipeline systems would bring in supplies from the Permian Basin and the Haynesville Shale.

The proposed Permian Global Access Pipeline (PGAP) is a 42-inch diameter system running 625 miles that would be able to transport up to 2 Bcf/d. PGAP would originate at the Waha Hub in West Texas and connect to the Permian and associated unconventional plays around Midland, then terminate near Gillis, with proposed deliveries from various gas pipeline systems in the region.

The third proposed gas system, Haynesville Global Access Pipeline, also would be a 42-inch diameter pipeline that could carry up to 2 Bcf/d. The 200-mile-long system is also proposing to terminate near Gillis.

Driftwood LNG and Driftwood Pipeline have permits in hand, and in January received a final environmental impact statement from the Federal Energy Regulatory Commission. If it is sanctioned, first LNG is anticipated in 2023 with full operations in 2026.

The deal, announced in Shanghai during the 19th International Conference & Exhibition on LNG, added to the positive momentum for the Driftwood project, according to Raymond James & Associates Inc. While the HOA is nonbinding, the agreements “outline progress in negotiations” for the Driftwood project, which likely brings Tellurian closer to sanctioning

“While the equity funding isn’t necessary in our model from a cash flow standpoint, Total adding (subject to deal close) to its existing $207 million equity stake in Tellurian screens as a positive headline to us — even if the valuation is roughly 10% below Tuesday night’s closing price,” Raymond James analysts said.

Tellurian in February reached a memorandum of understanding (MOU) with India’s Petronet LNG Ltd. India (PLL) for a potential investment in the Driftwood project. It also secured an MOU with Vitol Inc. in December to supply 1.5 mmty of LNG for at least 15 years from Driftwood.

Meanwhile, Total also on Wednesday signed a 10-year SPA for the supply of 0.7 mmty to a subsidiary of Guanghui Energy Co. Ltd. The gas would be delivered to Guanghui’s regasification terminal in Qidong, Jiangsu Province, from Total’s global LNG portfolio.

Total became the second-largest private global LNG player when it purchased Engie’s portfolio, which included a 16.6% stake in Sempra Energy’s Cameron LNG export facility, also in Louisiana. Total’s position is behind only Royal Dutch Shell plc, which on Tuesday signed a long-term deal for the proposed Rio Grande LNG export project.

Total has an overall LNG portfolio of around 40 mmty by 2020 and a worldwide market share of 10%.

“We are delighted to start a long-term relationship with Guanghui, an increasingly successful LNG market player in China with clear ambitions for growth,” Total Senior Vice President of Gas Laurent Vivier said. “This new supply contract is in line with Total’s strategy to expand its presence in the Chinese LNG market, which grew by over 41% in 2018 and will continue to be a key driver of the LNG markets growth in the future.”

While the slew of contract signings this week point to a new wave of potential LNG exports in the next decade, some recent federal approvals signal more U.S. cargoes could be setting sail in a matter of weeks.

FERC on Wednesday gave Sempra Energy’s Cameron LNG the green light to introduce hazardous fluids and commission the inside battery limits (ISBL) for the dry flare system, the low-pressure dry flare systems and the propane system for Train 1. It was OK’d by the Commission to introduce feed gas in late March. The Federal Energy Regulatory Commission’s approval did not grant Cameron authority to introduce hazardous fluids or commission other project facilities.

Cameron would be the fifth export project to come online this year after Cheniere Energy Inc. received federal approval earlier in March to start commercial operations at its Corpus Christi facility in South Texas. The fifth train at Cheniere’s Sabine Pass export project in Louisiana also started service this month.

Also on Wednesday, Kinder Morgan Inc. (KMI) received FERC approval to introduce hazardous fluids to the LNG rundown line, refrigerant and condensate storage and distribution systems at its Elba Island export project near Savannah, GA. It also was approved last month to introduce feed gas. The approval also did not authorize introducing hazardous fluids to other project facilities.

KMI management has indicated the first unit would start service by the end of April, a month later than its most recent projections. Construction was halted twice because of hurricanes Florence and Michael last year. The in-service date of the remaining nine units is expected to follow sequentially, with one each month after the other.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |