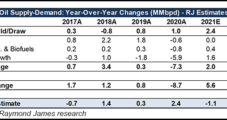

Despite fears about the Omicron variant of the coronavirus and rising global oil output, Raymond James Financial Inc. analysts are increasingly optimistic about strong crude prices through 2023. “Our bullish oil view over the next few years not only remains firm, but we’re actually increasing our long-term price forecast,” the analysts, John Freeman and Justin…

Oil

Articles from Oil

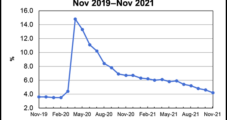

Oilfield Services and Equipment Job Growth Pauses in November, but Gains Solid for 2021

U.S. oilfield services and equipment sector employment took a step back in November after eight consecutive months of gains, according to a new Energy Workforce & Technology Council analysis of federal data. Using Bureau of Labor Statistics (BLS) data, the Council, along with researchers from the University of Houston, found that the sector shed 818…

Trans Mountain Resumes Service Following BC Floods

Oil and refined products flows resumed Sunday through Trans Mountain Pipeline after a three-week suspension of deliveries as a safety precaution during floods in southern British Columbia. “The restart comes following completion of all necessary assessments, repairs, and construction of protective earthworks needed for the pipeline to be returned to service,” said the Calgary firm.…

Oil, Gas Execs Looking to Texas, Oklahoma for Top Investments, Eschewing Canada

Policies and regulations in the U.S. oil and natural gas patch, led by Texas, are viewed as substantially more favorable to investment than in Canada, according to the latest survey by the Fraser Institute. The 2021 Canada-US Energy Sector Competitiveness Survey by the Vancouver-based think tank asked 71 senior executives in the petroleum sector to…

Alberta Enacts More Stringent Rules to Seal Backlog of Idle Oil, Natural Gas Wells

Alberta’s oil and natural gas firms are set to make a C$2.3 billion ($1.8 billion) start to seal a backlog of 95,524 inactive wells over the next five years under rules enacted Wednesday by the province’s production watchdog agency. The requirements translate the more stringent environmental legislation into “tools we need to begin to move…

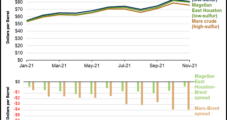

Divide Grows Between Sweet, Sour Oil Prices as OPEC-Plus, Natural Gas Play Key Roles

Mounting output from the Organization of the Petroleum Exporting Countries (OPEC) and its allies and lofty global natural gas prices are widening the spread between sweet and sour crude prices, the U.S. Energy Information Administration (EIA) said Friday. While crude prices have recently come off 2021 highs in large part because of coronavirus resurgence concerns,…

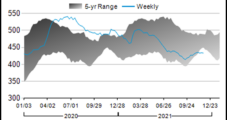

U.S. Crude Output Reaches ‘21 Peak; Focus Shifts to OPEC-Plus Production

Domestic oil production reached a 2021 high last week as demand waned in the face of lofty prices, the U.S. Energy Information Administration (EIA) said Wednesday. Production for the week ended Nov. 26 rose to 11.6 million b/d, up 100,000 b/d from the prior week and far ahead of the 11.1 million b/d a year…

What’s Ahead for Lower 48 Oil and Gas Players in 2022? Listen Now to NGI’s Hub & Flow

Click here to listen to the latest episode of NGI’s Hub & Flow podcast in which NGI’s Patrick Rau, director of Strategy & Research, shares takeaways from the third quarter energy company earnings results and insight into what’s ahead for operators in the Lower 48. In “Shale 4.0 — Natural Gas Earnings Takeaways from 3Q21,”…

Federal Oil, Natural Gas Auctions Facing Changes as Interior Proposes Higher Royalty Rates

The U.S. oil and natural gas industry need not fear a federal drilling ban — for now — but royalty rates may be hiked for the first time in a century and leasing terms could be tightened based on an analysis by the Department of Interior. After taking office in January, President Biden issued Executive…

Lower 48 Natural Gas-Focused E&Ps Potentially Eyeing ‘22 Hedging Losses on Early Price Bet

U.S. natural gas producers hedged most of their 2022 output before prices began to soar, setting the sector up for a slew of one-time losses on the wrong-way bets, according to Rystad Energy. When exploration and production (E&P) companies hedge their gas production, they typically take an opposite position in the forecast price. However, increasing…