Cooler temperatures and soft demand in the natural gas cash market, along with ongoing liquefied natural gas (LNG) woes, weighed down futures again Tuesday, with prices hitting a new daily low in June for a third consecutive trading day.

NGI Data

Articles from NGI Data

Natural Gas Futures Lose Steam Amid Jangle of Weather, Inventory and LNG Concerns

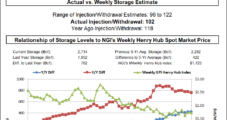

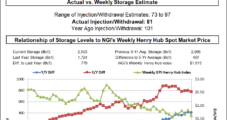

Natural gas futures tumbled Friday as markets absorbed forecasts for cooler weather, concerns about bloated inventories and declining liquefied natural gas (LNG) volumes. The July Nymex contract settled at $1.731/MMBtu, down 8.2 cents day/day. August fell 8.5 cents to $1.815.

NGI The Weekly Gas Market Report

Another Rough Road in 1Q2020 for Top U.S. Natural Gas Marketers

The year started as 2019 had ended for leading natural gas marketers, with 1Q2020 continuing the sales declines that have hampered the industry for four consecutive quarters, according to NGI’s Top North American Natural Gas Marketers rankings.

Natural Gas Futures Fall on Mixed Weather, Continued Weak LNG Outlook

Natural gas futures dipped into the red early Tuesday and remained there on demand concerns tied to mixed weather forecasts and diminished natural gas exports. The July Nymex contract settled at $1.767/MMBtu, down 2.2 cents day/day. August was down 2.9 cents to $1.863.

Natural Gas Futures Slide as Market Awaits Fresh Data; Cash Also Weakens

Natural gas futures were slightly lower but still range bound to finish the week as the July Nymex contract swung in a less than 10-cent band before settling Friday at $1.782, off 4.0 cents day/day. August was down 3.1 cents to $1.886.

Weekly Natural Gas Spot Prices Can’t Maintain Momentum as Summer Heat Builds

Hotter weather couldn’t prevent an ultimate fall in spot gas prices for the June 1-5 period, with markets across the Lower 48 falling week/week. Losses were fairly small, however, andNGI’s Weekly Spot GasNational Avg.was down only 5.0 cents to $1.610.

June Natural Gas Bidweek Prices Retreat as Demand Struggles to Gain Momentum

A mild start to the summer, combined with demand that continues to struggle amid the coronavirus pandemic, weighed down June natural gas bidweek prices. Although pockets of heat boosted prices in California, small losses were seen in most markets across the Lower 48, sending NGI’s June Bidweek National Avg. down 8.5 cents to $1.545/MMBtu.

Natural Gas Futures Firm as Demand Picture Slowly Improves; Cash Surges Post-Holiday

Natural gas futures strengthened Tuesday, with demand continuing to increase as economies reopen amid the coronavirus pandemic and as weather models boosted heat in the coming weeks. The June Nymex gas futures contract climbed 6.2 cents to settle at $1.793. July picked up 6.4 cents to $1.945.

Natural Gas Futures See Modest Bump Ahead of Holiday Weekend; Cash Mixed

Natural gas futures traded both sides of even on Friday as the market steadied a bit while continuing to weigh steep production cuts, seasonal weather and hefty liquefied natural gas (LNG) demand losses. The June Nymex gas futures contract ultimately closed the week at $1.731/MMBtu, up 2.1 cents from Thursday’s close. July picked up 2.9 cents to reach $1.881.

Strong Power Burns Boost Weekly Natural Gas Cash Prices

A popular mantra in the world of energy is that there’s no better cure for low prices than low prices, and that slogan rang true for the May 18-22 period as cheap natural gas incentivized power burns across the Lower 48, driving up weekly spot gas prices. Despite a generally mild weather pattern over most areas,NGI’s Weekly Spot GasNational Avg.jumped 9.5 cents to $1.615.