Trading for Tuesday deliveries saw a greater number of physical natural gas points in the loss column on Monday, but outsize gains in New England, the Mid-Atlantic, and Marcellus shifted the overall average increase to 12 cents. Many points in the producing regions were down by a few pennies to 5 cents or more.

NGI Data

Articles from NGI Data

Physical Prices Hit Hard as Futures Fall a Fourth Time This Week

Gas for delivery over the weekend and Monday plummeted as a 1-2 combination of a weak screen and modest temperatures gave buyers little incentive to spring for a three-day package, especially when spot purchases can be made by instant electronic communications. The selling was broad and pervasive and no point made it to the positive side of the trading ledger.

Modest Gains Offset Steep Eastern Losses In Weekly Trading

With the exception of a few eastern points, weekly physical gas prices posted mostly moderate advances at all locations. For the week ended June 20 the NGI’sWeekly Spot Gas Averagerose just a penny to $4.43 with outsize losses at Northeast points pulling down broad, but thin gains elsewhere.

Physical, Futures Race Each Other Lower; July Off 7 Cents

Physical gas for Friday delivery fell hard and fell often as traders worked hard to accommodate a more normal weather environment and get deals done before the release of government storage figures.

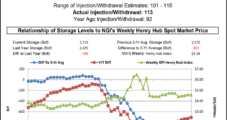

Futures Falter Following Plump Storage Build

Natural gas futures continued the recent trend of outsize market moves off of modest storage forecast misses by industry forecasters.

Dodd-Frank Reform a Mixed Bag, Industry Exec Says

The Dodd-Frank Wall Street Reform and Consumer Protection Act got some things right, and the industry has largely adapted to the new provisions, but there are still some parts of the new law that could use some tweaking, according to Matthew Picardi, vice president for regulatory affairs at Shell Energy North America.

Steady Physical Market Outshines Soft Futures; July Slides A Nickel

Next-day gas for Thursday delivery changed little overall in trading Wednesday, but far more points were in the black than in the red.

Firm Cash Market Unable to Lift Futures; July Up a Hair

Natural gas for delivery Wednesday posted steady gains at most locations in Tuesday’s trading. Locations impacted by high temperatures, such as the East Coast, saw the greatest gains, with some points advancing more than $1.

Northeast Leads Broad Weather-Driven Advance; Futures Falter

Physical gas for Tuesday delivery rose hard and often in Monday’s trading, with forecasts of pervasive heat and humidity along the Eastern Seaboard lifting quotes at some points more than a dollar, and only a handful of locations slipped into the loss column. The Northeast led the pack with the day’s biggest gains, but the Mid-Atlantic was a close second. Appalachian prices were firm as were quotes out of the Rockies. At the close of futures trading, July had retreated 3.2 cents to $4.707 after trading overnight as high as $4.886. August slipped 3.0 cents to $4.718 and July crude oil dropped a penny to $106.90/bbl.

Gas Export Authorization Could Bring on Haynesville Production; Export Pricing a Problem

It wouldn’t be a stretch for the United States to ramp up production to serve a 10 Bcf/d liquefied natural gas (LNG) export market by 2020, but whether the prospective exports would cause higher domestic natural gas prices could hinge on whether those exports are tied to Henry Hub gas or to or higher Brent crude equivalents, according to Patrick Rau, Natural Gas Intelligence (NGI) director of strategy and research.