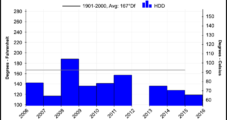

A string of cold snaps, which could be the last of the season, and signs of slowing production kicked natural gas forwards up a few notches between April 1 and 7, NGI Forward Look data shows.

Markets

Articles from Markets

Short Position Questioned; May Called Unchanged

May natural gas is set to open unchanged Friday morning at $2.02 as holders of short positions weigh the merits of continued market exposure. Overnight oil markets rose.

Firm East, Rockies Lift NatGas Cash Into Positive Territory; Futures Ease

Physical natural gas for weekend and Monday delivery moved little in trading Friday as gains in the East and Rockies were able to overcome a weak Texas market and flat Gulf Coast pricing.

NatGas Forwards Prices Rise on Slowing Production Potential, Winter Relapse

A string of cold snaps, which could be the last of the season, and signs of slowing production kicked natural gas forwards up a few notches between April 1 and 7, NGI Forward Look data shows.

Firm East, Rockies Lift NatGas Cash Into Positive Territory; Futures Ease

Physical natural gas for weekend and Monday delivery moved little in trading Friday as gains in the East and Rockies were able to overcome a weak Texas market and flat Gulf Coast pricing.

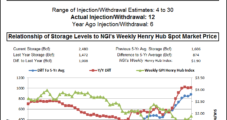

Traders Mull Cooler Temps, Plump Storage; May Called 2 Cents Higher

May natural gas is expected to open 2 cents higher Thursday morning at $1.93 as traders juggle a mix of short-term cooler weather along with a government report that is expected to show storage reaching an all-time high on a seasonal basis. Overnight oil markets were mixed.

Puzzling Market Response to Plump Storage Data

Natural gas futures worked higher Thursday morning and had traders scratching their heads after the Energy Information Administration (EIA) reported a storage build that was somewhat greater than what the market was expecting.

Bullish on NatGas Prices? Not Until 2017, Says TPH

U.S. natural gas prices are going to be sluggish this year as the oversupply slowly is whittled down, but analysts said falling rigs and delayed pipeline projects should lead to a bullish recovery in 2017.

MDA Expects Hotter-Than-Normal Temperatures This Summer

The probability of a transition from a Pacific El Nino to a La Nina event later this year, which many forecasters believe could pump up tropical storm activity in the Atlantic Basin, could also lead to a hotter-than-normal summer, according to MDA Weather Services.

Bullish Weather Secures First $2-Plus NatGas Futures Close in Two Months

Physical natural gas and futures both staged hefty advances Thursday. Outside of a few points in the Rockies, nearly all market locations gained by a few pennies to a nickel or more.