Additional natural gas storage capacity in the Pacific Northwest to serve electric generation plants is on track to be in service for the winter of 2018-2019, according to NW Natural CEO David Anderson, who updated the project during a 3Q2016 earnings conference call on Wednesday.

Markets

Articles from Markets

Next-Day NatGas Higher on Cooldown, But Futures Can’t Get A Break; December Eases 2 Cents

Physical natural gas for Friday delivery gained ground in Thursday’s trading as an abrupt cool-down was forecast to bring eastern points off their recent abnormal highs closer to seasonal norms.

Deja Vu All Over Again; December Called Down 9 Cents on Updated Weather

December natural gas is set to open 9 cents lower Wednesday morning at $2.81 as updated weather models show ongoing warmth with little likelihood of tapping into any cold air anytime soon. Overnight oil markets fell.

Still Waiting on Texas Petro Index Turnaround

September was the 22nd consecutive month that saw a decline in the Texas Petro Index (TPI), a barometer of upstream oil and natural gas activity in the Lone Star State. No one in the energy patch is going to call this recovery a quick one.

SoCalGas Seeks to Reinject NatGas into Aliso Canyon

Southern California Gas Co. (SoCalGas) on Tuesday formally asked California regulators for approval to reopen the Aliso Canyon underground natural gas storage field along the northern fringes of Los Angeles that has been closed since a leak occurred a year ago (see Daily GPI,Feb. 18).

Pioneer Energy Sees Producer Activity Increase in 3Q, Enters 4Q With Momentum

San Antonio-based Pioneer Energy Services reported modest rig count growth and a sequential uptick in production services activity during the third quarter, reinforcing management’s earlier view that the market hit bottom in 2Q2016.

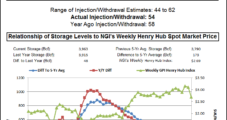

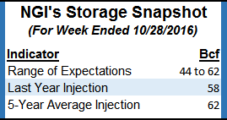

NatGas Traders Mulling Long, Short-Term Price Trends While Futures Probe Sub-$2.80

Both physical natural gas and futures continued their trek lower in Wednesday trading as the specter of mild weather prompting storage builds at record levels well into November had traders embracing the bearish argument for the near term.

Modest Weakness Seen Prior to Weather-Related Gains; December Called 4 Cents Lower

December natural gas is expected to open 4 cents lower Tuesday morning at $2.99 as traders factor in a modest decline into long-term support and weather models remain moderate. Overnight oil markets gained.

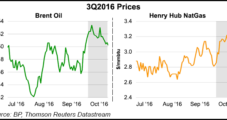

BP, Shell Surprise to Upside as Cost Cutting, Efficiencies Kick In

Battered by a two-year rout in oil prices, Royal Dutch Shell plc and BP plc fought back, posting surprising improvements to the bottom line in the third quarter by clobbering costs and honing efficiencies in a sustained period of lower commodity prices.

November Physical NatGas Bidweek Average, Buoyed By NE, Avoids Futures Slump

Overall November bidweek trading fared far better than the free-falling natural gas futures market as the NGI National Bidweek Average eased a modest 3 cents from October bidweek to $2.48, while the November futures settled at $2.764, down a stout 18.8 cents from the settle of the October contract.