* Part two of two. This series looks at the potential impact a Green New Deal could have on the oil and gas industry. This installment examines the oil and gas industry’s current posture toward the proposal, as well the reaction from lawmakers on both sides of the aisle. In part one, an environmental activist and a conservative economist revealed the merits and drawbacks of the sweeping proposal.

Markets

Articles from Markets

Nuclear Power Subsidies Inch Forward in Pennsylvania As Natural Gas Industry Digs In

A bipartisan group of Pennsylvania lawmakers has advanced recommendations for supporting five nuclear power plants in the state that face stiff competition in wholesale electricity markets, setting the stage for a continued battle with the natural gas industry and other interests opposed to any kind of government intervention.

Unusual Transition to Mild Winter Sends January NatGas Bidweek Prices Sharply Lower

A glance at January bidweek natural gas prices failed to reflect a market entering the peak of winter; dramatic losses of more than $1 were common as early-season cold made way for a far milder December, with long-range outlooks not yet conclusive as to when frigid conditions would return. The NGI Bidweek National Avg. tumbled 82.5 cents to $4.315/MMBtu.

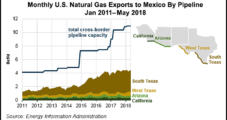

What to Watch for in 2019 in Mexico’s Natural Gas Market

Although Mexican president Andrés Manuel López Obrador has said relatively little about natural gas policy, he has made clear his opposition to the 2013 constitutional energy reform of his predecessor, Enrique Peña Nieto.

NatGas Markets Ring in New Year With Return to Sub-$3 as January Forecasts Seen Bearish

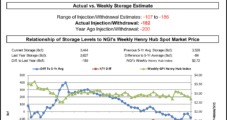

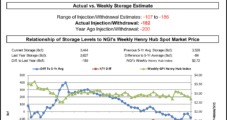

A new year brought a new outlook for natural gas markets Wednesday, with a mild forecast for the first half of January bringing a return to sub-$3 prices as the storage concerns that drove up risk premiums earlier in the heating season appear largely assuaged. Influenced by sagging futures, spot markets struggled through a post-New Year’s hangover, though a few locations in the West gained ahead of cold temperatures and precipitation expected this weekend; the NGI Spot Gas National Avg. tumbled 26.5 cents to $2.915/MMBtu.

Bearish January Forecasts Sink Natural Gas Below $3 to Start 2019

A new year brought a new outlook for natural gas markets Wednesday, with a mild forecast for the first half of January bringing a return to sub-$3 prices as the storage concerns that drove up risk premiums earlier in the heating season appear largely assuaged. Influenced by sagging futures, spot markets struggled through a post-New Year’s hangover, though a few locations in the West gained ahead of cold temperatures and precipitation expected this weekend; the NGI Spot Gas National Avg. tumbled 26.5 cents to $2.915/MMBtu.

February Natural Gas Nosedives as Weather Data Back Off Cold; Spot Gas Rebounds

As expected, February natural gas shed some serious holiday weight on Friday as weather data backed off some of the cold that was seen in early January and failed to show with certainty just when truly bone-chilling conditions would return. The Nymex February gas futures contract plunged 24.3 cents to settle at $3.303. March lost 20.5 cents to hit $3.148.

February Natural Gas Fizzles Ahead of New Year as Spot Gas Rebounds on Brief Cold

As expected, February natural gas shed some serious holiday weight on Friday as weather data backed off some of the cold that was seen in early January and failed to show with certainty just when truly bone-chilling conditions would return. The Nymex February gas futures contract plunged 24.3 cents to settle at $3.303. March lost 20.5 cents to hit $3.148.

Mild Christmas Week Temperatures Weigh Down Weekly Prices

Mild weather and light holiday demand combined to send weekly natural gas prices crashing down for the short Dec. 26-27 trading week, with some of the steepest losses occurring in the usually high-priced Northeast. The NGI weekly National Avg. plunged 42.5 cents to $3.07 for gas flowing through New Year’s Eve.

February Natural Gas Plunges Early as Timing of Returning Cold Not Clear

In its first day in the prompt-month position, the Nymex February gas futures contract was set to open nearly 20 cents lower Friday as frigid air continues to struggle to develop in long-range weather models.