Privately held Summit Utilities is doubling its customer base and expanding into Arkansas and Oklahoma with the acquisition of family owned A.O.G. Corp. and its subsidiary Arkansas Oklahoma Gas Corp. (AOG), a company that has deep roots in Arkansas and the early days of the natural gas industry.

M&A

Articles from M&A

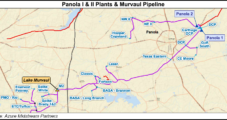

Azure Midstream Posts Loss, Sells East Texas Assets

Azure Midstream Partners LP is selling a processing plant and gathering pipeline in East Texas as it posts an $8.4 million net loss for the second quarter. In early June, partnership units were delisted from the New York Stock Exchange.

NGI The Weekly Gas Market Report

Williams Selling Canadian Business For US$1.03 Billion

Williams and Williams Partners said late Monday that they have agreed to sell the companies’ Canadian businesses to Inter Pipeline Ltd. for combined cash proceeds of C$1.35 billion (about US$1.03 billion). Proceeds are to be used to reduce debt at the companies.

Constellation Expanding Retail Gas, Power Business in ConEd Deal

Exelon Corp. unit Constellation has agreed to acquire the retail power and natural gas business of ConEdison Solutions, which is a subsidiary of Consolidated Edison Inc.

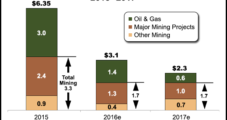

Freeport-McMoRan Continues Scaling Back Oil, Gas Ops in Favor of Mining Business

Freeport-McMoRan Inc. (FCX) continues to pull back on oil and gas activity and focus on its core mining business, selling assets and canceling $1.1 billion in drilling contracts in the second quarter.

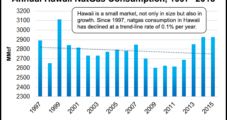

With Merger Scrapped, Hawaiian Electric Drops LNG Plans

Hawaiian Electric Industries Inc. (HEI) has scrapped plans for a liquefied natural gas (LNG) contract with Fortis Hawaii Energy Inc. as well as plans to convert an existing power plant to natural gas following the termination of its proposed merger with NextEra Energy Inc.

ValueAct to Pay Record $11M Penalty For Attempting to Influence Halliburton, Baker Merger

Activist investment firm ValueAct on Tuesday agreed to pay a record $11 million to the U.S. Justice Department to settle allegations that it attempted to influence the Baker Hughes Inc. and Halliburton Co. merger, which has since been canceled.

Brief — Sempra Energy/IEnova

Sempra EnergyMexico unit IEnova said it has restructured its deal to acquire the 50% stake in Gasoductos de Chihuahua that is held by Petroleos Mexicanos (Pemex). Last December, Mexico’s Federal Economic Competition Commission objected to the deal (see Daily GPI,Dec. 22, 2015). IEnova said it has reached an agreement with Pemex to restructure the deal in order to satisfy the regulator. According to IEnova, the price to be paid for the pipeline stake would be a minimum of US$1.108 billion. The deal is expected to close during the third quarter, assuming that regulatory conditions are satisfied by Pemex and regulatory approvals obtained, IEnova said.

NGI The Weekly Gas Market Report

Southern Company Buying Half of Southern Natural Gas System From Kinder

Southern Company is acquiring a 50% equity interest in the Southern Natural Gas (SNG) pipeline system from Kinder Morgan Inc. (KMI). The joint venture (JV) partners plan to “pursue specific growth opportunities” to develop natural gas infrastructure.

Southern-AGL, TransCanada-Columbia Tie-Ups Completed

As the fallout from the messy break-up of Williams Companies Inc. and Energy Transfer Equity LP continues (see Daily GPI, July 1), two other major natural gas industry mergers have been finalized.