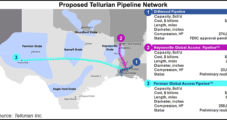

Houston-based Tellurian Inc., which is building a global natural gas business centered around Gulf Coast exports and onshore upstream development, has an estimated $29 billion in “near-term investments,” CEO Meg Gentle said Thursday.

Topic / Haynesville Shale

SubscribeHaynesville Shale

Articles from Haynesville Shale

QEP Seeking Permian Pure-Play Status, Selling Williston, Haynesville Assets

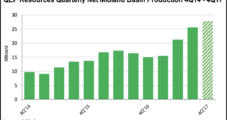

Doubling down on a goal to get more oily, Denver-based QEP Resources said last week it plans to become a Permian Basin pure-play by divesting its assets in the Williston Basin and Haynesville Shale.

Haynesville Natural Gas Infrastructure to Expand under Tellurian Proposal

Houston-based Tellurian Inc. is testing support to build a 42-inch diameter natural gas pipeline that would connect up to 2 Bcf/d of Haynesville and Bossier shale volumes to customers in southwestern Louisiana.

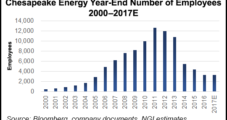

Both Oil, Natural Gas Assets Still on Table as Chesapeake Continues Divestments

Chesapeake Energy Corp. won’t discriminate between its oil and natural gas properties this year as it looks to keep unloading assets in an ongoing quest to get leaner and cut another $2-3 billion of debt from its balance sheet.

Chesapeake Cuts Another 400 Jobs in Cost Cutting Initiative

Chesapeake Energy Corp. has cut 13% of its workforce, or 400 employees, as part of ongoing belt tightening at the company, CEO Doug Lawler told staff in an email on Tuesday.

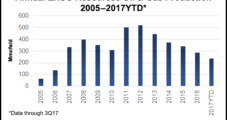

Haynesville Lifts Comstock’s Natural Gas Reserves in 2017

Onshore producer Comstock Resources Inc. replaced 387% of production and increased proved reserves by 27% during 2017, with natural gas output rising from the Haynesville Shale.

BHP Preparing Data Room to Divest Lower 48 Portfolio

Energy conglomerate BHP Billiton Ltd., no longer keen on the plethora of prospects it holds in the Lower 48 states, is preparing data rooms to give potential buyers a better view of its long-held projects in the Permian Basin and three big shale plays, the Eagle Ford, Haynesville and Fayetteville.

Exco Resources Files For Chapter 11 Protection

Exco Resources Inc. has voluntarily filed for bankruptcy protection as it looks to reorganize and strengthen its balance sheet.

Goodrich to Devote Entire ’18 Capex on Gas-Rich Haynesville Shale Core

Goodrich Petroleum Corp. plans to spend between $65 million and $75 million on capital expenditures (capex) in 2018, all devoted to its holdings in the gassy core area of the Haynesville Shale in North Louisiana.

Black Stone Entering East Texas Farmout, Buying Noble Assets for $340M

Black Stone Minerals LP, one of the largest owners of oil and natural gas mineral interests in the United States, has entered into a farmout agreement to develop assets in trending plays in East Texas, and plans to acquire a package of properties spread across 20 states from Noble Energy Inc. for $340 million.