The state of Alaska and Pantheon Resources plc are negotiating a deal to boost in-state natural gas inventories using a proposed LNG feed gas pipeline to transport associated volumes from the North Slope. London-based Pantheon has been advancing development plans for an additional 66,000 acres in Alaska’s Ahpun and Kodiak fields since submitting the top…

E&P

Articles from E&P

SLB Jumping into Merger Game with ChampionX, Aker Carbon Deals to Accelerate E&P Efficiencies, CCUS

In its second transaction in less than a week, SLB Ltd. agreed Tuesday to buy ChampionX Corp., considered a leader in oilfield reservoir optimization. The all-stock merger with ChampionX, headquartered in The Woodlands north of Houston, was valued at nearly $8 billion. Once the transaction is completed, now expected by year’s end, ChampionX shareholders would…

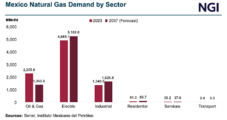

Mexico’s Sener Sees Natural Gas Demand Growing in Power, Industrial Sectors, but Flat Overall Through 2037

Mexico’s natural gas demand will be driven by its power and industrial sectors through 2037, according to a report from Mexico’s energy ministry Sener. The report, Prospectiva de Gas Natural 2023-2037, is a planning instrument to help with “the design of the integral national strategy around natural gas,” Sener said. It would be part of…

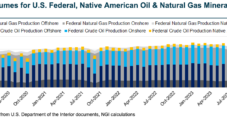

BLM Finalizes Methane Waste Rule for Federal Onshore Oil, Natural Gas Production

The U.S. Department of the Interior’s Bureau of Land Management (BLM) has finalized a rule designed to curb methane pollution from oil and natural gas production on federal and Tribal lands, in part by collecting royalty payments on flared gas. The Waste Prevention, Production Subject to Royalties, and Resource Conservation rule, which was proposed in…

E&Ps Urge Expanding Gulf of Mexico Oil and Gas Leasing, Continuing Wind Sales

Natural gas and oil lease sales in the Gulf of Mexico (GOM) should continue, but there’s room for wind development, as well as carbon capture and sequestration (CCS), according to exploration and production (E&P) companies. Both supporters and opponents of federal leasing in the offshore made their comments on the national leasing program, published late…

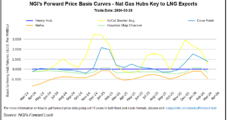

Will Summer Temps Move U.S. Natural Gas Demand? Wind, Solar May Have a Word

Natural gas production cuts have stabilized the fuel’s prices by countering weak Lower 48 winter demand, turning the market’s attention to the next big levers for fundamentals: the upcoming summer and added wind and solar capacity. Prompt-month New York Mercantile Exchange futures, trading above the $1.800 level at the start of April, had settled as…

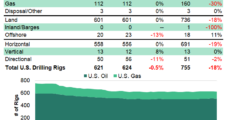

U.S. Natural Gas Drilling Rig Count Flat Week/Week, but Oil Count Down, BKR Data Show

The domestic natural gas rig count held steady at 112 for the week ended Thursday (March 28), while a decline in oil activity lowered the combined domestic drilling tally by three to 621, the latest Baker Hughes Co. (BKR) data show. The combined oil and gas U.S. rig count for the week, which was 621,…

Tudor Champions Houston to Lead Charge for Decarbonizing Oil, Natural Gas

Houston, the nation’s fourth largest city and one that built its fortune in oil, natural gas and petrochemicals, is now a mecca for entrepreneurs out to make the next great no-carbon technology. The city remains the place to forge oil and gas deals, as thousands of energy companies, large and small, have their headquarters in…

E&Ps ‘Keeping Powder Dry’ Amid Low Natural Gas Prices, LNG Uncertainty, Says Dallas Fed

Weak natural gas prices are weighing on the minds of oil and gas executives, but the outlook is not all bearish, according to a new survey by the Federal Reserve Bank of Dallas, aka the Dallas Fed. “Natural gas is currently pricing at or below costs of production,” said one respondent from an exploration and…

Mexico Presidential Frontrunner Sheinbaum Promises Dominant CFE, Pemex if Elected

Claudia Sheinbaum, Mexico’s presidential candidate for the ruling Morena Party, seeks continuity for the national energy sector. In a March 18 speech to commemorate the anniversary of state oil company Petróleos Mexicanos (Pemex), Sheinbaum said her administration would follow the path of the Andrés Manuel López Obrador government and continue to prioritize the dominant role…