New ways to drill old basins in North America is piquing the interest of energy analysts, who will be looking for insight into capital spending plans through the rest of 2014, and whether more mergers and public offerings are coming during 2Q2014 earnings presentations.

Topic / Eagle Ford Shale

SubscribeEagle Ford Shale

Articles from Eagle Ford Shale

Industry Brief

Houston-based Swift Energy Co. and PT Saka Energi Indonesia have closed on an agreement to develop 8,300 acres of Fasken area Eagle Ford Shale properties owned by Swift in Webb County, TX. Swift sold a 36% full interest in the properties to Saka for $175 million cash, with $125 million (subject to adjustments) paid at closing and $50 million to be paid over time to carry a portion of Swift’s field development costs. Swift’s net proceeds will be used initially to reduce debt and ultimately to fund accelerated development of its Eagle Ford properties. “This arrangement marks the beginning of a strategic partnership to grow production in the Eagle Ford dry gas window of South Texas,” said Swift CEO Terry Swift. Saka is the upstream oil and gas subsidiary of PT Perusahaan Gas Negara (Persero) Tbk (PGN), Indonesia’s largest natural gas transportation and distribution company.

Baker Hughes: Well, Rig Counts Both Increased in 2Q2014

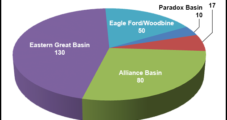

The well count and rig count in the U.S. onshore both increased slightly during the second quarter of 2014. The former was boosted by strong gains in the Permian Basin, Marcellus Shale and Granite Wash formation, while the latter reflected a slight improvement in drilling efficiencies, Baker Hughes Inc. (BHI) said Friday.

New Pipeline Would Feed Gas-Hungry Mexico With Eagle Ford Output

More natural gas from energy-rich Texas’ Eagle Ford Shale would travel to Mexico to fuel growing power generation and industrial demand there if another proposed border-crossing pipeline is constructed.

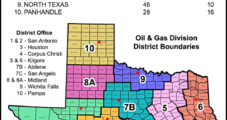

Denver-Based Hawkwood Enters East Texas Plays

In two separate deals, Denver-based Hawkwood Energy LLC has made its entry into the emerging East Texas Eagle Ford and Woodbine plays, acquiring producing and nonproducing assets in Brazos, Leon, Madison, and Robertson counties, TX.

Texas April Oil, Gas Production Up From Year-Ago Levels

Texas oil and gas production during April was up from year-ago levels, according to preliminary figures compiled by the Railroad Commission of Texas (RRC).

Industry Brief

Sanchez Energy Corp.plans to begin an underwritten public offering of 5 million shares of the company’s common stock, with the proceeds going in part to fund its pending “Catarina” acquisition in the Eagle Ford Shale (seeShale Daily,May 22). Meanwhile,Moody’s Investors Service assigned a B3 rating to Sanchez’s proposal to issue $700 million in unsecured notes due in 2023, the proceeds from which would also be used to finance the $639 million deal with twoRoyal Dutch Shell plcsubsidiaries for Catarina acreage and associated production.

Eagle Ford to Rival North Slope Output at its Peak, Says Wood Mackenzie

Eagle Ford Shale crude and condensate production in 2020 will rival Alaska’s entire North Slope field at its peak, hitting an estimated 2 million b/d, according to an analysis by Wood Mackenzie Ltd.

March Texas Oil, Gas Production Up From Year Ago

Texas preliminary March crude oil production averaged 2.01 million b/d, up from the 1.62 million b/d average of March 2013. Cumulative March production was 62.45 million bbl, up from 50.09 million bbl reported during March 2013, according to the Railroad Commission of Texas (RRC).

Sundance Adds to Eagle Ford Acreage as It Exits DJ Basin

Sundance Energy Australia Ltd. is picking up Texas acreage prospective for the Eagle Ford Shale and for the Georgetown Formation and has sold its acreage in the Denver-Julesburg (DJ) Basin in order to refocus capital on core areas, the company said.