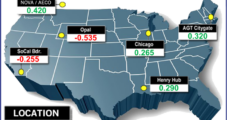

Natural gas prices dived lower in April bidweek trading as markets mulled waning weather demand for the month ahead. NGI’s April Bidweek National Avg. fell 51.5 cents month/month to $2.380/MMBtu, led lower by declines across the Midwest, Midcontinent and Northeast regions. The April average marked a substantial increase from NGI’s April 2020 Bidweek National Average…

Bidweek

Articles from Bidweek

Gains for Texas, Midcon in March Natural Gas Bidweek as Analysts Ponder Mild Temps, Supply Tightness

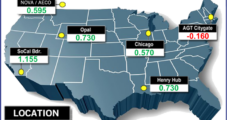

As natural gas bidweek traders weighed moderating temperatures against possible lingering impacts from a historic cold blast, March prices finished slightly higher month/month. NGI’s March Bidweek National Avg. climbed 7.0 cents to $2.895/MMBtu, a reflection of both fading winter premiums for demand areas in the Northeast and double-digit gains for points throughout producing areas of…

Updated Notice of Proposed Change to NGI’s Bidweek Survey

* Please see the amendment in blue font below to the original Notice of Proposed Change to NGI’s Bidweek Survey, which was posted Feb. 1. Dear NGI Subscribers, Price Reporters and Market Participants, In response to a public request for comment published by S&P Global Platts, Natural Gas Intelligence (NGI) is requesting feedback on whether…

February Natural Gas Bidweek Prices Jump as Weather Drives Up Demand in Midwest, Northeast

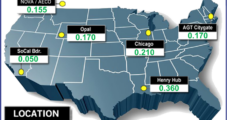

Natural gas prices advanced in February bidweek trading as markets absorbed the demand impacts of cold winter blasts that permeated the nation’s midsection and parts of the East. Anticipation of a massive snowstorm smacking the East Coast early this week and extending the winter freeze added to the momentum. NGI’s February Bidweek National Avg. climbed…

Weather Volatility Dominates January Bidweek Natural Gas Trading, but Export Demand Strong

Major fluctuations in the latest weather models resulted in big swings in natural gas bidweek prices, with solid gains on the East Coast and out West. However, much of the country’s midsection posted hefty losses amid healthy storage levels, leaving NGI’s January Bidweek National Avg. down 2.5 cents from December 2020 bidweek to $2.695/MMBtu. While…

December Natural Gas Bidweek Prices Slip Lower Amid Mild Temperatures, Dubious Outlook

Natural gas prices dipped slightly lower in December bidweek trading as markets mulled modest weather-driven demand in November against the prospect of increased domestic heating needs this month and continued robust liquefied natural gas (LNG) export volumes. NGI’s December Bidweek National Avg. declined 2.5 cents month/month to $2.720/MMBtu, which also represents a 10.5-cent discount from…

November Natural Gas Bidweek Prices Post Massive Gains as LNG Demand Roars Back

With some early-season cold in tow, a big recovery in natural gas export demand led to extensive gains for November bidweek prices. Led by $1.00-plus increases in the Northeast, thanks to a fast-moving cold front, NGI’s November Bidweek National Avg. jumped 88.0 cents month/month to $2.745. The November 2020 bidweek average also was considerably higher…

October Bidweek Prices Slump as Weather Demand Fades, LNG Potential Still Uncertain

Natural gas prices moved lower in October bidweek trading as markets mulled prospects for waning weather-driven demand and the uncertain potential for a sustained recovery in liquefied natural gas (LNG) volumes. NGI’s October Bidweek National Avg. declined 33.0 cents month/month to $1.865/MMBtu and was well below the $2.005 average recorded during October 2019 bidweek. The…

September Bidweek Prices Rally as Natural Gas Traders Look Ahead to Rising LNG, Bullish Winter

While weathering a tumultuous stretch in the natural gas market headlined by a Category 4 hurricane crashing into the Gulf Coast, bidweek traders throughout much of the North American market locked in premiums for the month of September. Strengthening futures prices bolstered by expectations for rising liquefied natural gas (LNG) demand in the month ahead…

August Natural Gas Bidweek Prices Jump on Late Summer Heat

Natural gas prices climbed higher in August bidweek trading as markets mulled prospects for ongoing seasonal cooling demand, strong power burns and robust Mexican export levels. NGI’s August Bidweek National Avg. rose 23.0 cents month/month to $1.680/MMBtu. The August Nymex natural gas futures contract rolled off the board last Wednesday at $1.854, up 5.4 cents…