After experiencing a lull in the first half of this year, mergers and acquisitions (M&A) throughout the energy sector are going to pick up dramatically to the end of 2018, according to Austin, TX-based Drillinginfo.

M&A

Articles from M&A

Powerhouse LNG Buyers Jera, EDF Combining Trading Activities

Two of the leading natural gas buyers in the world, EDF Trading Ltd. (EDFT) and Jera Co. Inc., on Tuesday agreed to combine their worldwide trading activities to optimize liquefied natural gas (LNG) marketing.

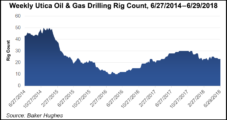

Utica Shale Further Consolidated With Ascent’s $1B-Plus Acquisition

Ascent Resources LLC announced on Friday that it would acquire 113,400 net Utica Shale acres for $1.5 billion in a package of deals with multiple sellers, ballooning the company’s position in the play to more than 300,000 net acres and becoming one of the country’s largest private exploration and production (E&P) companies in the process.

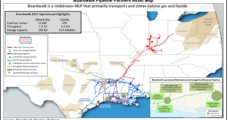

Loews Taking Over Boardwalk, in Line with Peers After FERC MLP Ruling

Following the lead of other pipeline operators that have brought into the fold their master limited partnerships (MLP) because of changes to federal law, Loews Corp. said it plans to take over subsidiary Boardwalk Pipeline Partners LP for an estimated $1.5 billion.

Cox Oil Snaps Up Energy XXI for $322M

Energy XXI Gulf Coast Inc., whose predecessor company spent billions to establish a foothold in the U.S. offshore only to collapse into scandal and bankruptcy, on Monday agreed to be acquired by Cox Oil Offshore LLC for $322 million.

Jaguar, Vista JV Could Unlock Increased Mexico Natural Gas Development

A relatively modest joint venture (JV) by two Mexican companies, both with huge financial and technical resources, could lead to a revitalized natural gas industry in a nation that now is dependent on massive imports from the United States.

Brief — Avista, Hydro One Settlement

Spokane, WA-based Avista Corp. and Toronto-based Hydro One Ltd. have settled regarding their proposed merger in Oregon and filed an all-parties, all-issues agreement with the Oregon Public Utility Commission. Customers in Oregon would receive rate credits effective at the close of the merger. The Oregon settlement and agreements in Washington, Idaho, Alaska and Montana would collectively provide $78.6 million in benefits to utility customers, according to Avista. No merger costs are to be recovered from customers in any of the states.

Majority of Oil, Gas Executives Ready to Make Deals, Says EY

With record-level transactions in the first quarter, 90% of oil and gas executives expect global dealmaking to only improve in the coming months, up from only 43% in April 2017 that expressed confidence in more dealmaking.

Total Takes Majority Stake in Clean Energy, Pushes Heavy Duty NGV Trucks

French oil major Total SA on Thursday agreed to accelerate the push to convert more heavy-duty trucking fleets to run on natural gas in partnership with Clean Energy Fuels Corp., a pioneer in advancing the North American natural gas vehicle (NGV) fueling network.

Black Hills Sells Last of Oil/Gas Assets, Eyes Colorado Regulatory Tussle

Newly freed of its upstream business unit, Rapid City, SD-based Black Hills Corp. finds itself in a dispute with Colorado regulators over a high-profile state law that encourages new gas-fired generation and the retirement of coal plants.