Occidental Petroleum Corp. (Oxy) has agreed to acquire privately held Permian Basin oil and natural gas producer CrownRock L.P. in a deal valued at roughly $12 billion. Oxy plans to finance the acquisition by incurring $9.1 billion in new debt, issuing about $1.7 billion of common equity and assuming CrownRock’s $1.2 billion of existing debt,…

M&A

Articles from M&A

Woodside and Santos Confirm Merger Talks, but Say No Deal Close

Australia’s two largest energy companies confirmed Thursday that they’re in preliminary discussions to explore merging in a deal that could create one of the world’s leading LNG exporters. Woodside Energy Group Ltd. and Santos Ltd. cautioned, however, that the discussions are in very advanced stages, but no deal is close to being reached. Both companies…

SilverBow Now ‘Largest Public Pure-Play’ in Eagle Ford, Eyeing $565M Capex in 2024

Eagle Ford Shale operator SilverBow Resources Inc. is targeting capital expenditures of $550-$580 million to support a three-rig drilling program in 2024, management said Thursday. The Houston-based operator said it has closed its $700 million acquisition of Chesapeake Energy Corp.’s South Texas oil and gas assets, clearing the way to advance natural gas-weighted development in…

Williams Cements Top DJ Natural Gas Gathering Spot with $1.27B Cureton, RMM Acquisitions

Williams has secured its spot as the largest natural gas gatherer in the Denver-Julesburg (DJ) Basin by closing two previously announced midstream acquisitions valued at a combined $1.27 billion. Williams acquired Cureton Front Range LLC, whose assets include gas gathering pipelines and two processing plants serving producers across 225,000 dedicated acres. Williams also purchased private…

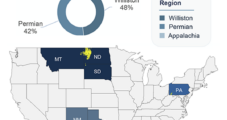

NOG Expanding Natural Gas, Oil Foothold with Permian, Utica Acquisitions

Northern Oil and Gas Inc. (NOG) has entered two deals to acquire interests in upstream assets in the Permian Basin’s Delaware formation and Utica Shale for a combined $170 million in cash. Minneapolis-based NOG specializes in acquiring non-operated minority working and mineral interests in Lower 48 basins. In the Permian Delaware, NOG entered a deal…

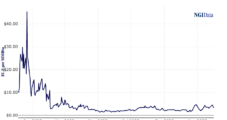

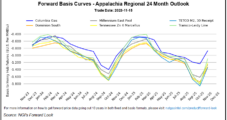

WhiteHawk Energy Gobbles Up More Natural Gas Assets in Marcellus Shale

WhiteHawk Energy LLC said it acquired additional Marcellus Shale natural gas mineral and royalty assets from an undisclosed seller for $54 million. The acquisition increases the Philadelphia-based company’s mineral and royalty ownership in its existing 475,000 gross acre position in the Marcellus by 100%. The assets are mostly in Washington and Greene counties of Pennsylvania.…

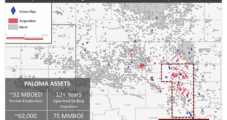

Oklahoma-Based Mach Adding to Anadarko Footprint with Paloma Deal

Mach Natural Resources LP is looking to expand its footprint in the Anadarko Basin of Oklahoma with the $815 million purchase of about 62,000 net acres from private equity-backed Paloma Partners IV LLC. Under the deal announced Monday, which is expected to close by the end of December, Oklahoma City-based Mach would acquire the acreage…

Pieridae Seeking Buyer for Goldboro LNG Site in Pivot to Western Canada

Nearly 300 undeveloped industrial acres at the former Goldboro LNG facility are for sale in Nova Scotia as owner Pieridae Energy Ltd. focuses on oil and gas production and processing in Alberta. The Calgary-based firm set a mid-2024 target for completing the sale as a “strategic pivot” to Western Canada legacy wells and field plants…

Enbridge Expands U.S. RNG Footprint with Acquisitions

Enbridge Inc. further expanded its presence in the Lower 48 by acquiring a string of renewable natural gas (RNG) facilities. The Calgary-based company said that, as part of ongoing efforts to build a U.S. RNG manufacturing and transportation business, it purchased seven operating landfill gas-to-RNG facilities from Morrow Renewables. The portfolio, valued at $1.2 billion,…

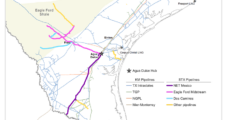

Kinder Morgan Adding Nearly 5 Bcf/d of South Texas Natural Gas Capacity in $1.8B Deal with NextEra

Kinder Morgan Inc. (KMI) has agreed to acquire NextEra Energy Partners LP’s South Texas natural gas business, South Texas Midstream LLC (STX Midstream), for $1.8 billion. The STX Midstream system comprises 462 miles of natural gas pipelines with 4.9 Bcf/d of transport capacity connecting the Eagle Ford Shale with growing demand in Mexico and along…