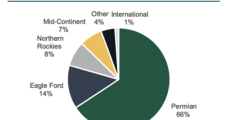

Houston’s APA Corp., which in recent years has pursued overseas oil and gas prospects, is storming back to the Permian Basin with a $4.5 billion all-stock takeover of Callon Petroleum Co. APA, long a Permian exploration and production (E&P) stalwart, already has a broad portfolio in the Midland and Delaware formations. In the Delaware, where…

M&A

Articles from M&A

KMI Cements Eagle Ford Natural Gas Midstream Deal with NextEra

Kinder Morgan Inc. (KMI) has finalized the $1.8 billion acquisition of NextEra Energy Partners LP’s South Texas Midstream LLC, securing natural gas pipeline and storage assets serving Mexico and the Gulf Coast. “These assets integrate well with our existing South Texas footprint and extend our direct connectivity in the lean area of the Eagle Ford…

Williams Acquires Hartree’s Gulf Coast Storage Assets For $2B

Midstream giant Williams said Wednesday that it has reached a deal to acquire a portfolio of Gulf Coast natural gas storage assets from an affiliate of Hartree Partners LP for $1.95 billion, capping a busy year for storage acquisitions and expansions. The deal includes six natural gas storage facilities with a total capacity of 115…

Kodiak, CSI Merger to Create Natural Gas Compression Giant, with Permian, Eagle Ford Prowess

The blitz of tie-ups in the U.S. oil and gas industry is continuing, with Kodiak Gas Services Inc. offering to buy CSI Compressco LP in a deal that would become the largest contract compression fleet in the industry with an estimated 4.3 million hp. The all-equity acquisition, valued at $854 million including debt, would deepen…

UK’s Harbour Buoying Up Global Natural Gas and Mexico Portfolio with Wintershall Upstream Takeover

Harbour Energy plc joined the dealmaking parade on Thursday, announcing a $11.2 billion “transformational acquisition” of the upstream assets of Germany’s largest natural gas and oil producer, Wintershall Dea AG. Wintershall has gas and oil prospects in Algeria, Argentina, Denmark, Egypt, Germany, Libya, Mexico’s onshore and offshore, and in Norway. Also included in the deal…

Billionaire Carlos Slim Accumulating Mexico Oil, Natural Gas Assets

Mexican conglomerate Grupo Carso SAB has bought into another Mexico oil and natural gas field in shallow waters offshore Campeche. Carso subsidiary Zamajal SA de CV would acquire PetroBal SAPI de CV and its 50% interest in the Ichalkil and Pokoch fields. PetroBal is the oil and gas subsidiary of Mexican conglomerate Grupo Bal. The…

Consolidation Wave Hits Haynesville with TGNR Acquiring Rockcliff for $2.7B

Natural gas producer TG Natural Resources LLC (TGNR) has entered a deal to acquire fellow Haynesville Shale heavyweight Rockcliff Energy II LLC for $2.7 billion. Rockcliff, which is backed by private equity firm Quantum Capital Group, operates in the East Texas portion of the Haynesville, which also straddles northwestern Louisiana. Rockcliff operates across more than…

Fury Resources Snapping Up Permian Delaware Producer Battalion for $450M

Privately held Fury Resources Inc. is acquiring publicly traded Permian Basin oil and gas producer Battalion Oil Corp. in a cash deal valued at about $450 million, the companies said Friday. The transaction, slated to close in early 2024, would see Fury acquire all outstanding shares of common stock in Battalion, which operates in the…

Oxy-CrownRock Deal Caps Record Permian M&A Year as Dealmaking Surpasses $100B

The aggregate value of mergers and acquisitions (M&A) in the Permian Basin has surpassed $100 billion this year with the recently announced $12 billion takeover by Occidental Petroleum Corp. (Oxy) of CrownRock LP, eclipsing the previous record of $65 billion set in 2019, according to new analysis by Wood Mackenzie. The Oxy-CrownRock deal followed ExxonMobil’s…

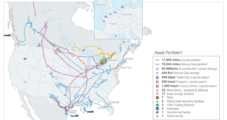

Pembina Agrees to Buy Enbridge’s Alliance Pipeline, Aux Sable Natural Gas Processing Facility

Enbridge Inc. said late Wednesday it planned to sell its stakes in the Alliance Pipeline and the Aux Sable natural gas liquids processing facility in the United States to Pembina Pipeline Corp. for more than US$2 billion. The deal would generate proceeds to help fund Enbridge’s efforts to acquire U.S.-based gas utilities. The Calgary-based midstream…