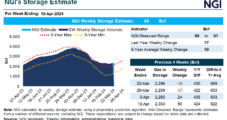

More operational wobbles at the Freeport LNG terminal and worries of an expected bearish government storage print Thursday triggered another bout of selling in natural gas futures Wednesday. At A Glance: Freeport LNG Train 3 trips EQT sees curtailments through May Analysts expect above-average build The May Nymex contract dove around 10.0 cents in the…

Topic / Shale Daily

SubscribeShale Daily

Articles from Shale Daily

Gulf Coast LNG Construction Milestones Mount, Foreshadowing Growing U.S. Natural Gas Demand

The outlook for added feed gas demand in the coming months is beginning to firm, portending a possible tight supply balance next year. Earlier in the week, Cheniere Energy Inc. asked FERC for permission to connect the first train of its Stage 3 expansion at Corpus Christi to power and gave an update of its…

Mexico’s Sheinbaum Promises Energy Continuity Amid Sector Challenges

With only weeks remaining until Mexico’s June 2 presidential election, members of the energy industry are weighing in on what the sector might look like during an administration led by Claudia Sheinbaum of the Morena coalition, who has a commanding lead in national polls. On the campaign trail, Sheinbaum has explained that she would continue…

Natural Gas Futures Flop as Market Eyes LNG Weakness — MidDay Market Snapshot

Amid signs of ongoing issues at a major U.S. LNG export terminal, and with physical market prices pointing to weak near-term fundamentals, natural gas futures were headed for heavy losses as of midday trading Wednesday. Here’s the latest: May Nymex futures down 13.2 cents to $1.680/MMBtu as of 2:11 p.m. ET Day-ahead Henry Hub prices…

EQT Plans MVP Expansion to Serve Data Center Boom in Southeast

EQT Corp. said it would continue cutting 1 Bcf/d of production as U.S. natural gas prices remain near four-year lows, but management anticipates strong power generation demand in the coming years that has it planning an expansion of the Mountain Valley Pipeline (MVP). After a seven-year battle and a congressional mandate rescued the system from…

EU Energy Watchdog Says LNG Demand Could Peak This Year

The European Union’s (EU) LNG demand is likely to peak this year and buyers on the continent are likely to be over-contracted by 2030 as efforts to displace Russian natural gas over the last two years have been successful, according to the bloc’s energy watchdog. Since 2022, when Russia invaded Ukraine and cut off gas…

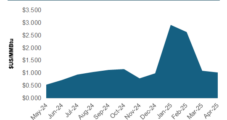

Scorching Summer Forecast Sets Stage for Strong Natural Gas Demand, Price Recovery

From Texas to both corners of the North, the National Weather Service (NWS) now expects above-average summer heat across the vast majority of the country this summer – a welcome development for natural gas bulls. If the outlook proved accurate, it would drive sustained elevated gas demand for the first time in 2024, helping to…

Eagle Ford, SCOOP/STACK Said Ripe for Consolidation While Natural Gas Prices Low

Privately held exploration and production (E&P) firms in the Eagle Ford Shale and Midcontinent regions could prove attractive targets for public producers seeking exposure to future strengthening of natural gas prices, according to Enverus Intelligence Research (EIR). EIR’s Andrew Dittmar, principal analyst, highlighted the Eagle Ford, the South Central Oklahoma Oil Province (SCOOP) and the…

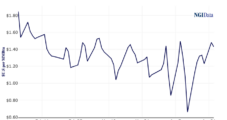

Natural Gas Futures Pull Back Early as Market Continues to Mull Mild Temps, Weak Production

After advancing over the previous two sessions, natural gas futures pulled back in early trading Wednesday as mild shoulder season weather continued to dampen the outlook despite continued production restraint. The May Nymex contract, set to expire later this week, was down 5.3 cents to $1.759/MMBtu at around 8:45 a.m. ET. June was down to…

Natural Gas Futures Climb for Second Day as Maintenance Sends Output Lower

Natural gas futures finished higher Tuesday after a choppy session that began in the red, supported by a rebound in U.S. LNG exports and a blitz of pipeline maintenance that sent gas production estimates lower. At A Glance: West Texas prices flip positive MVP pipeline ready to start in May Production falls below 97 Bcf/d…