Markets | NGI All News Access | NGI The Weekly Gas Market Report

Top North American Natural Gas Marketer Sales Leap 8% Higher in 1Q2018

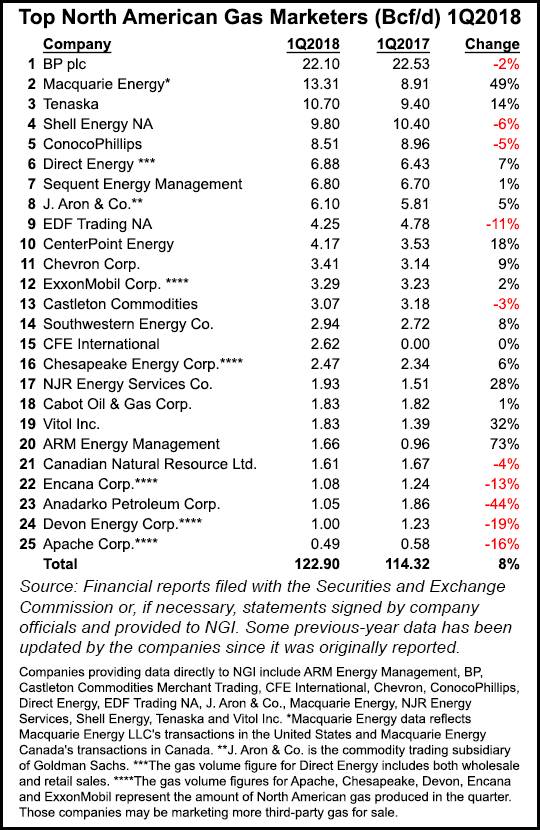

For the second consecutive quarter, natural gas sales by 25 leading marketers soared higher compared with the same period a year earlier, adding 8.58 Bcf/d (8%) to the companies’ total in the opening three months of the year, according to NGI‘s 1Q2018 Top North American Natural Gas Marketers rankings.

Participating gas marketers reported combined sales transactions of 122.90 Bcf/d in 1Q2018, compared with 114.32 in 1Q2017. Six of the survey’s top 10 marketers and 15 companies overall reported higher numbers in 1Q2018 than in the year-ago period. Marketers reported a 7% increase in sales of natural gas in 4Q2017 compared with 4Q2016, and the full-year 2017 total was 109.49 Bcf/d, only 1.73 Bcf/d less than in 2016.

Perennial No.1 BP plc kept a firm grip on the top spot, reporting 22.10 Bcf/d in 1Q2018, a 2% decline compared with 22.53 Bcf/d in 1Q2017. BP reported its strongest underlying profit in three years during 1Q2018, with earnings up 71% year/year and 23% sequentially. The supermajor recently said it would trim its global upstream workforce of about 18,000 by nearly 3%, mostly through “natural attrition,” as it simplifies the organization.

Macquarie Energy for a second consecutive quarter reported the largest increase in the survey, this time a 49% increase to 13.31 Bcf/d. The company’s sales have been boosted by its purchase last June of Cargill’s North American Power and Gas trading business. Macquarie was No. 5 in NGI‘s analysis of 2016 Form 552 buyer and seller filings with FERC; Cargill was No. 47 in NGI‘s analysis of 2015 Form 552 filings, buying and selling 669.8 Tbtu.

There was also good news for Tenaska, which moved up one spot to No. 3 with 10.70 Bcf/d, a 14% increase compared with the year-ago period. Tenaska Marketing Ventures and Enterprise Products Operating LLC finished out 2017 by receiving a temporary waiver of Federal Energy Regulatory Commission capacity release regulation and related Northern Border Pipeline Co. tariff provisions. The two companies had filed a petition with FERC requesting all necessary approvals and waivers to facilitate Enterprises’ sale to Tenaska of several transportation agreements and a related natural gas purchase agreement as part of an integrated transaction to allow Enterprise’s exit from the Midwest natural gas marketing business [RP18-183].

Rounding out the top 5 in the survey, Shell Energy NA reported 9.80 Bcf/d in 1Q2018, a 6% decline compared with 10.40 Bcf/d in 1Q2017, while No. 5 ConocoPhillips reported 8.51 Bcf/d, a 5% decline.

Other Top 10 companies reporting increases were Direct Energy (6.88 Bcf/d, up 7% from 6.43 Bcf/d), Sequent Energy Management (6.80 Bcf/d, up 1% from 6.70 Bcf/d), J. Aron & Co. (6.10 Bcf/d, up 5% from 5.81 Bcf/d), and CenterPoint Energy (4.17 Bcf/d, up 18% from 3.53 Bcf/d). CenterPoint, a natural gas and electric utility based in Houston, said in April it plans to acquire Vectren Corp. in a deal valued at $6 billion.

Looking ahead to summer market conditions, an analysis of weather forecasts, the economy, consumer demand, and production and storage of natural gas points to neutral price pressure, according to the Natural Gas Supply Association (NGSA). “Tremendous growth in demand” will be matched by even more impressive growth in production, resulting in flat price pressure, NGSA said.

Still, some analysts are bullish about U.S. natural gas prices this summer.

“Production growth was robust at the end of 2017, but winter weather caused temporary well freeze-offs in several basins in 1Q2018, negatively impacting supply growth trend,” Societe Generale (SocGen) analysts Michael Haigh and David Schenck said in a note to clients Thursday. “And while growth resumed in 2Q2018, the pace has been more contained than initially expected.

“Meanwhile, we expect total U.S. demand to rise by 6% y/y in 2018, driven by growing exports,” both to Mexico and via liquefied natural gas. “Summer power-generation demand will prove determining for U.S. natural gas prices.”

The SocGen analysts expect injection numbers through October to be significantly larger than during the same period last year, and forecast U.S. gas prices to average $3.03/MMBtu in 3Q2018.

Other highlights of NGI’s 1Q2018 survey include a 9% increase year/year for Chevron Corp. (3.41 Bcf/d), a 2% increase for ExxonMobil Corp. (3.29 Bcf/d) and an 8% increase for Southwestern Energy Co. (2.94 Bcf/d).

Chesapeake Energy Corp. reported 2.47 Bcf/d, a 6% increase from the year-ago period, and NJR Energy Services Co. reported 1.93 Bcf/d, a 28% increase. Cabot Oil & Gas Corp. and Vitol Inc. each reported 1.83 Bcf/d, an increase for each compared with 1Q2017.

CFE International, which wasn’t trading natural gas a year ago, reported 2.62 Bcf/d in 1Q2018. Mexico’s Comision Federal de Electricidad (CFE) has said much of its future lies in trading natural gas through marketing affiliates CFE International and CFEnergia.

The NGI survey ranks marketers on sales transactions only. FERC’s Form 552 tallies both purchases and sales.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |